Hi fellow options nerds, this is my first post on this sub regarding a trade idea – I'd love to get your feedback. I want to start posting more content like this in the future. Alright, lets get to the meat of it:

I am not a crypto guy, but I do find Bitcoin's price action interesting. And now that there are ways to trade liquid options on it via ETFs (without the nasty vol decay that occurs with futures), I've been watching for opportunities. Support and resistance levels seem to shape Bitcoin's price action more than they do with stocks, which I find interesting. Perhaps the inherent difficulty of valuing a novel currency causes people to psychologically cling to anchor points more than, say, an equity with a known revenue? I digress. But regardless of the reason, I think its fair to say that the 100K level (and 110 and 120K to a lesser degree) is quite a significant point in Bitcoin's history. The brief correction we've seen over the summer months could be a good opportunity to get into a long-ish term options bet.

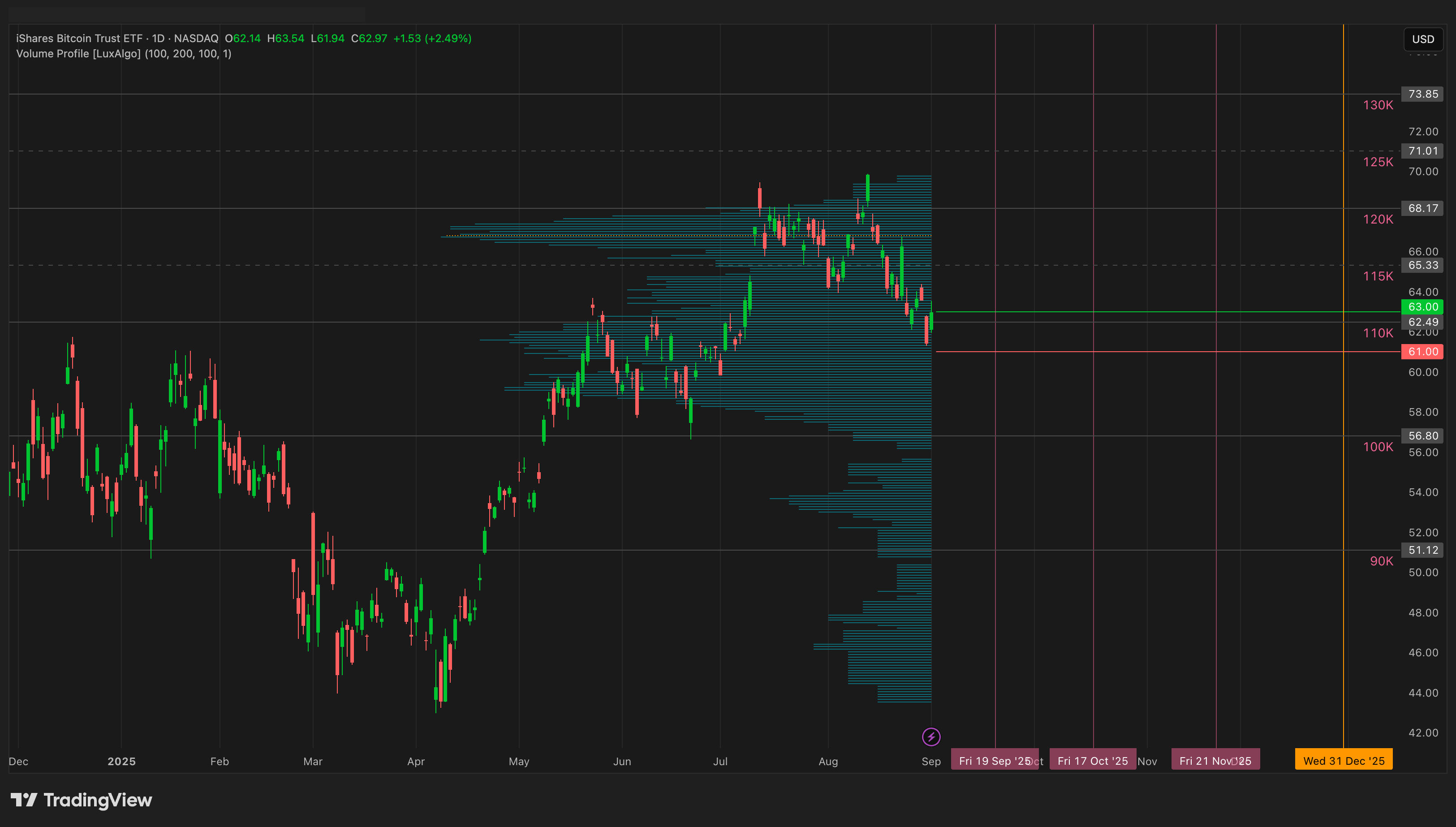

Above I have pasted my handy little chart of IBIT, with horizontal lines indicating levels that correspond to significant Bitcoin levels. I obtained these levels by taking multiple data points of IBIT / BTC and then averaging them. I found that IBIT does a pretty good job of tracking its underlying without much deviation, so we can trust these levels to hold in the future.

If we take a look at the roughly ATM spread I have outlined above, a vertical +63C -61C with December 31st expiry, it is the closest I can get to making a bet on the options market that reflects an outlook Bitcoin will be above 110,000 by the end of the year. This spread is currently going for a debit of $105, which gives us almost an exact 1:1 reward:risk ratio. If the market were efficiently priced, there would be exactly a 52.5% chance that this occurs. However I think this outcome is decidedly more likely than a coinflip. Hence my interest. If the actual probability is more like 65%, then the math of the kelly criterion dictates that we should A.) definitely take this opportunity and B.) bet about 26% of our total bankroll on this.

I am also considering other strikes. One consideration is a more probable bet – that Bitcoin will be above 100K by end of year. But the increased probability takes a lot off of the profit off the top. This bet, a +56 -57 ITM call spread (or put credit, but I prefer debit spreads), costs $137 with a max profit of $63. This gives us an implied probability of 69%. If the actual probability is, say, 75%, then kelly criterion dictates we should bet 21% of our bankroll on it.

The last consideration is the bet that Bitcoin will be above 120K by end of year. This spread on IBIT looks like a +66 -68 call spread, with each spread risking $75 and a max profit of $125. This gives us an implied prob of 38%. If the actual probability is 50%, kelly criterion dictates we should bet 20% of our bankroll.

Anyways, those are my thoughts. The main reason I am posting this idea is because I haven't really heard much talk about trading options on bitcoin ETFs. I also think that vertical spreads aren't talked about enough on this sub, and I wanted to shine some light on the advantages they provide in expressing a precise, time sensitive, and directional outlook with a known potential profit. This nuance allows us to use the kelly criterion to aid in understanding the probabilities that come into play. I want to add a **big** disclaimer though: the insights gleaned from the kelly criterion only apply **at expiration**. The kelly criterion is also extremely sensitive to the probability input. Any error in the estimate and you get a vastly incorrect bankroll percentage. This is why a lot of traders use "half-kelly" or "quarter-kelly". I personally do not actually use the exact kelly criterion for sizing these bets, but to give me a rough understanding of how good my odds have to be for a trade to be a good idea. Anyways, thanks for reading, sorry for the wall of text, and I'd love to hear this subreddit's thoughts!

https://i.redd.it/fnib12hb8umf1.png

Posted by bush_killed_epstein

1 Comment

Not all of us are Nerds ! I would fall into the geek category.