Hi everyone,

I’m 20 and started investing around 6 months back. I spread my money into:

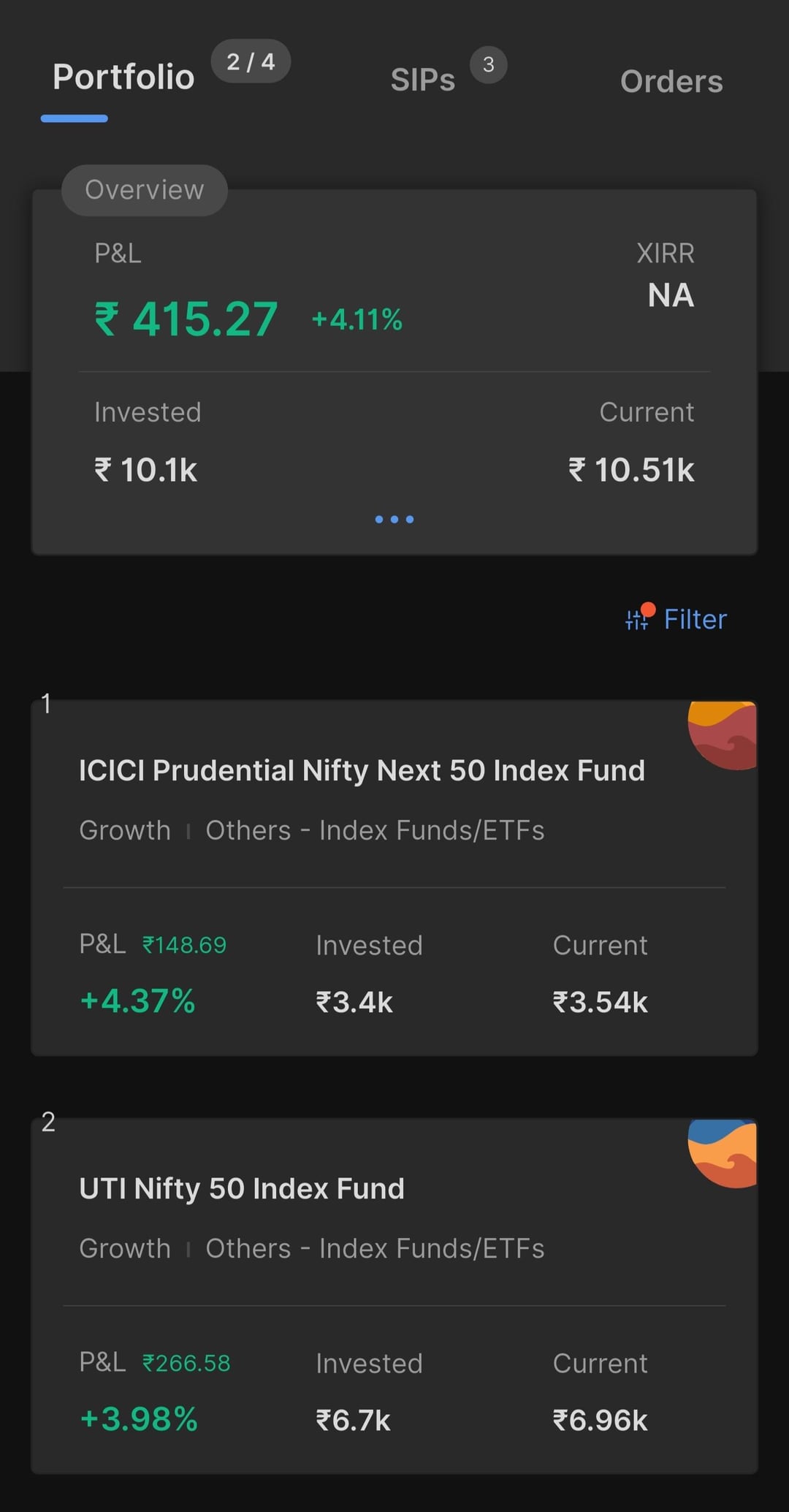

Indian index funds (Nifty 50 + Nifty Next 50)

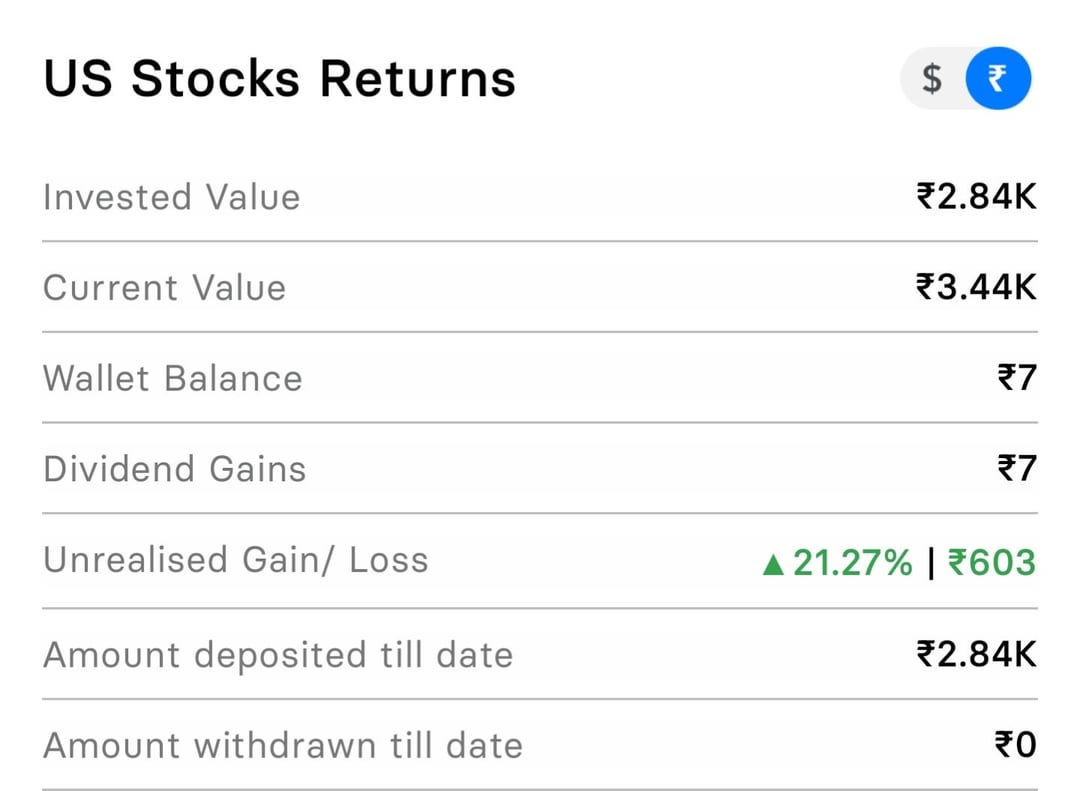

US stocks (S&P/Nasdaq exposure)

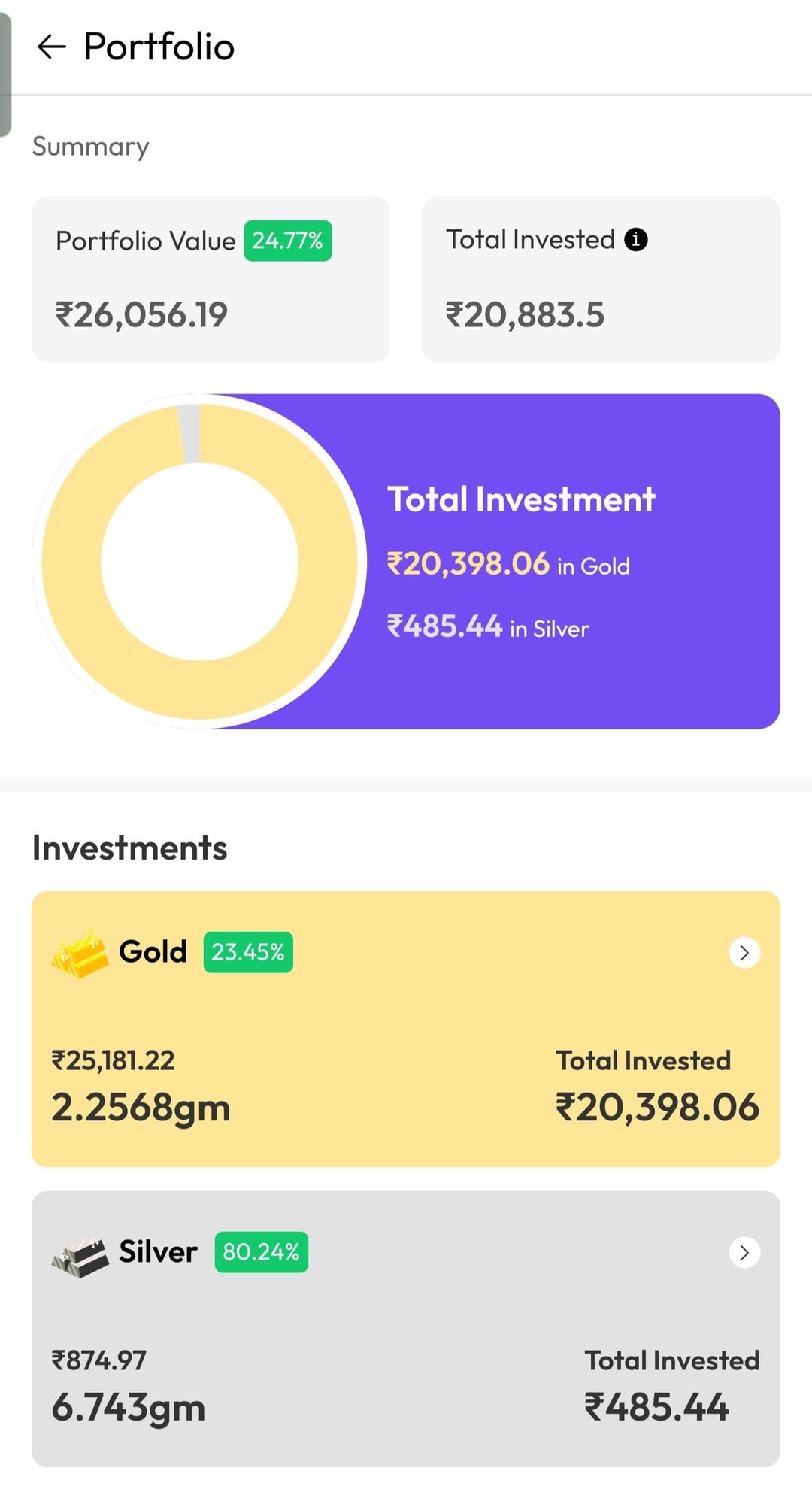

Gold & Silver

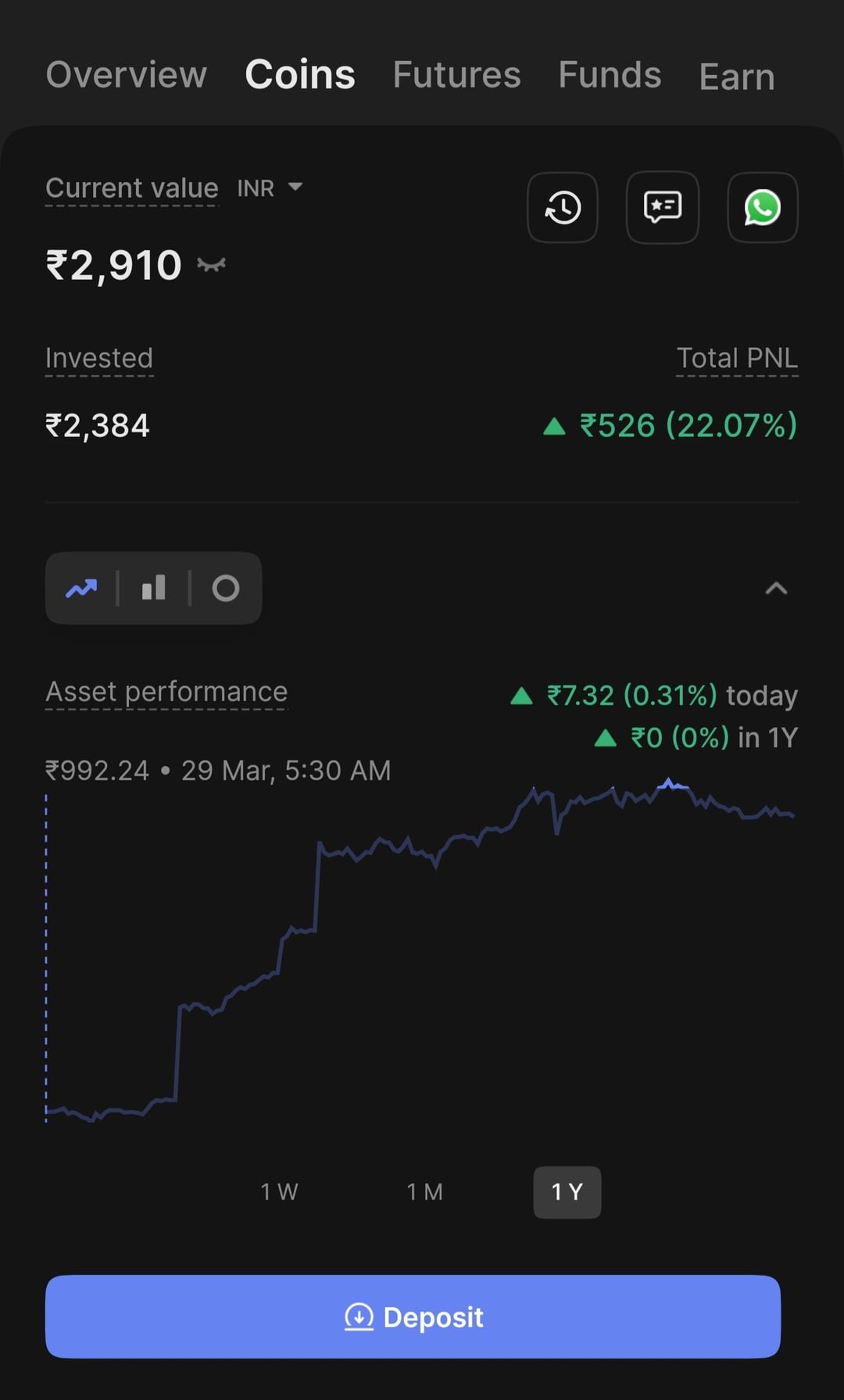

Bitcoin (small amount)

So far, these are my returns in 6 months:

Indian stocks: ~+6%

US stocks: ~+21%

Gold: ~+23%

Silver: ~+80%

Bitcoin: ~+22%

Overall portfolio is up around 20–25% in 6 months.

Is this kind of return normal? Or is it just lucky timing and not something I should expect regularly?

I’m planning for the long term (20 years+), just wanted to know how experienced investors see this.

https://www.reddit.com/gallery/1nd3r6e

Posted by TheNameIsHems

12 Comments

idk what squiggly dollars are, but I hope they are worth something!

You’ve definitely got good allocation for the future but have just gotten lucky in the short term with your timing. Don’t expect 20% every 6 months if you can hit 20% per year even that’d be amazing

No it isn’t good. 40% annualized returns is pathetic. But yes, it’s luck and timing, but a lot of investing is.

It is a nice and rational spread but still I would consider it luck. If you don’t actively adjust the portfolio, I would not expect the same returns all the time.

The problem is it’s a lot of hard work to keep up with all those assets.

If you just bough bitcoin and nothing else you would be up 100%+ in a year and don’t have to do anything.

Luck.

There. I said it.

Its Bitcoin

Really good timing. However, if you can keep adjusting your portfolio and follow volume rotations across sectors you’re onto something. If you can maintain relatively consistent profits in changing markets, not just a raging bull market, then you’ll know you have an edge.

These are not returns, these are unrealized gains, hopefully they will continue in the direction you prefer, but nothing is guaranteed. I think your timing might be serendipitous considering that they’re all gaining at the same time.

It’s called a Bull Market, a rising tide lifts all waters

20% in 6 months is definitely not the norm, but 20% can also happen in one month. You had good timing, but don’t get scared or worried if your account goes red for a bit and your unrealized gains are all gone. Don’t sell when this happens, just wait it out.

12% average annual return is generally expected from a balanced portfolio. You got in right when the markets were bottoming, so luck did play a hand.

At your age, because you have time on your side, rather than S&P index funds, you should go heavy nasdaq/tech exposure ie, QQQ.

Also, go to s/FIRE for general investment/early retirement questions. But stay here to learn more about Bitcoin.