The Oracle accounting scandal of 1990 involved the company overstating its revenues and profits by prematurely recognizing sales, particularly from aggressive "up-front" marketing tactics and unperformed consulting work

Oracle's sales teams were pressured to secure large upfront software sales, which contributed to the overstatement of revenue. The company recognized revenue for consulting work that had not yet been performed or was performed without a contract.

Oracle also failed to deduct sales of returned products and sometimes continued to bill customers for support services even after new software upgrades were purchased.

https://i.redd.it/iiy21xj72dof1.png

Posted by myironlung6

12 Comments

bullish and priced in

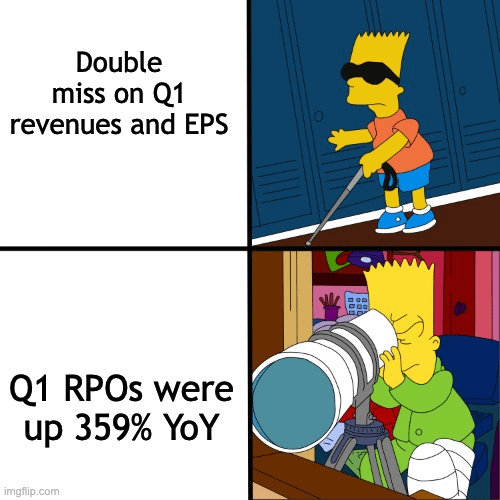

Bro, I pushed this stock back in may when the price was around $150. All my friends gave me shit about their RPO’s 🤣look at this shit today. smh wish I had committed. Oh well!

Definitely this. How people are falling for the oldest trick in the book is beyond me. The next earnings call will be very interesting.

AI tide lifting all boats. Even the shitty ones. You could argue that looking at Oracles’ customers that they are already totally locked in. It would be natural that Oracle would be the one to sell them AI services. That would entrench the lock in further.

wtf IS RPO??/?

Idk but calls it is!!

Since then they’ve had 35 years to pull some similar shit and haven’t so not sure why they’d start again now. Besides Larry already has a gazillion dollars.

I don’t think it’s an accounting scandal but it sure seems like concentration risk via Open AI and likely low margin.

OP must be old af

Did anyone go to jail? No? Then as you were…

Replace Oracle 1990 with any SaaS company in 2024. ‘Sure we’re bleeding cash and missing every target, but look at our ARR growth!’ 📈🤡

You can’t make money living in fear.

Seems like Put