When does wealth and income inequality move out of economic curiosity of soft data and move into policy focus? Sadly with our aged, aging and out of touch political leadership, many of whom are responsible for mindless passivity over the past two decades.

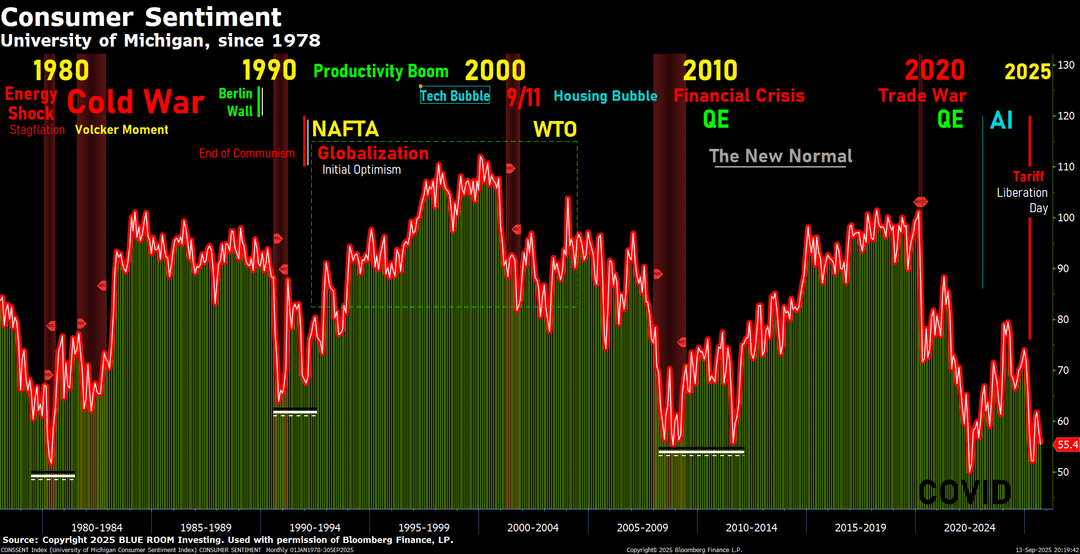

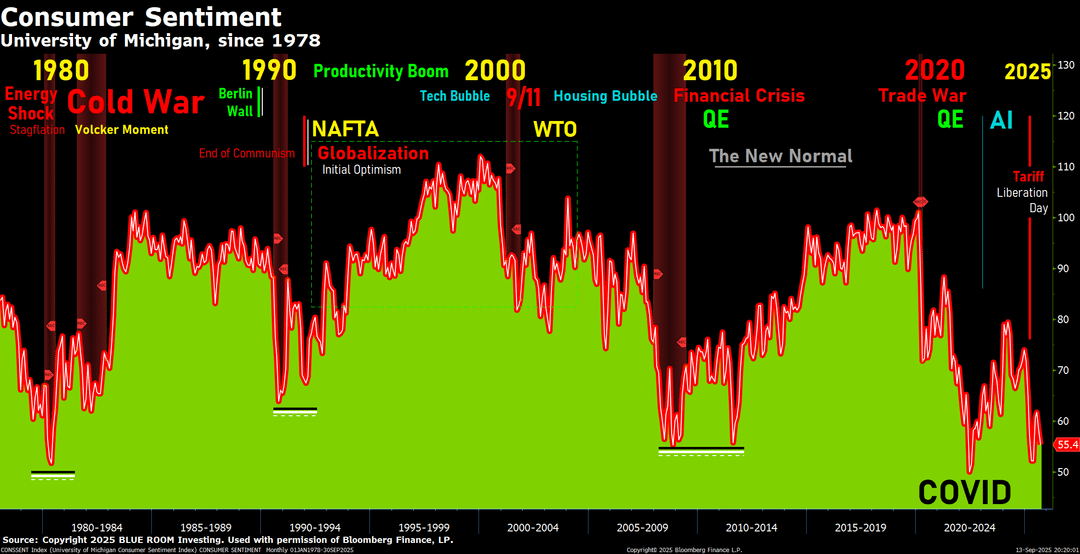

Looking back to the mid-1990s, consumer sentiment was at its highest with: (1) workers benefiting from a productivity boom with the emergence of Internet and software applications (2) housing was affordable and attainable (3) globalization, though new, was viewed with cautious optimism.

The preliminary reading for September 2025 registered at 55.4 with the index breaking down from the bounce following all time low reading of 50.0 in 2022.

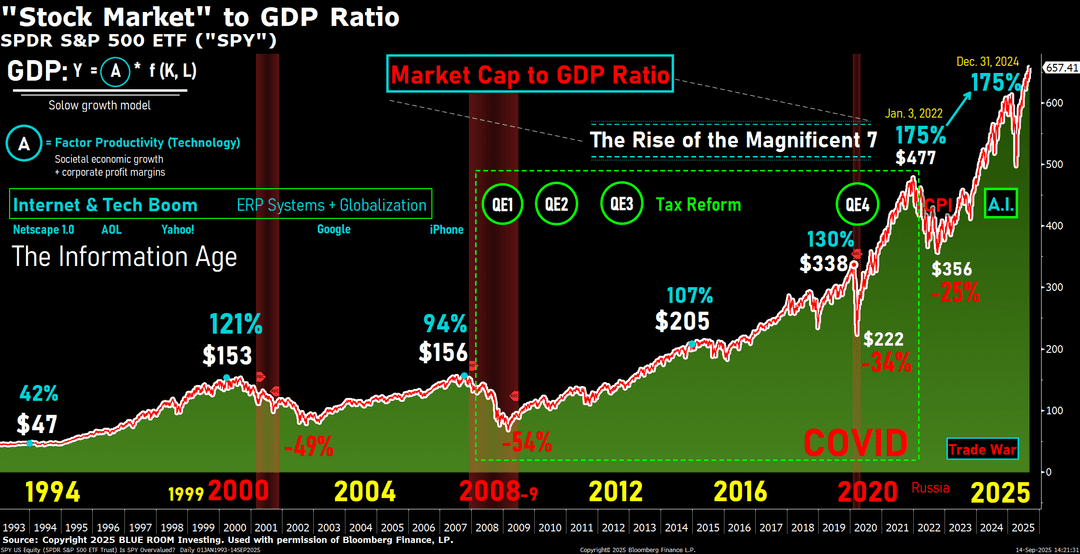

Meanwhile, the S&P 500 continues to grind out all time high closes as capital smells monetary easing, allowing Mega Cap stocks to levitate on declining cost of capital, completely discounting the ongoing misery of low income, and middle income Americans.

Buffett Indicator = 180%

Own puts, especially with VIX is stuck at historic lows.

https://www.reddit.com/gallery/1nh1tt3

Posted by meifx

1 Comment

Crash ain’t coming until the boomers finish retiring.

Buying calls