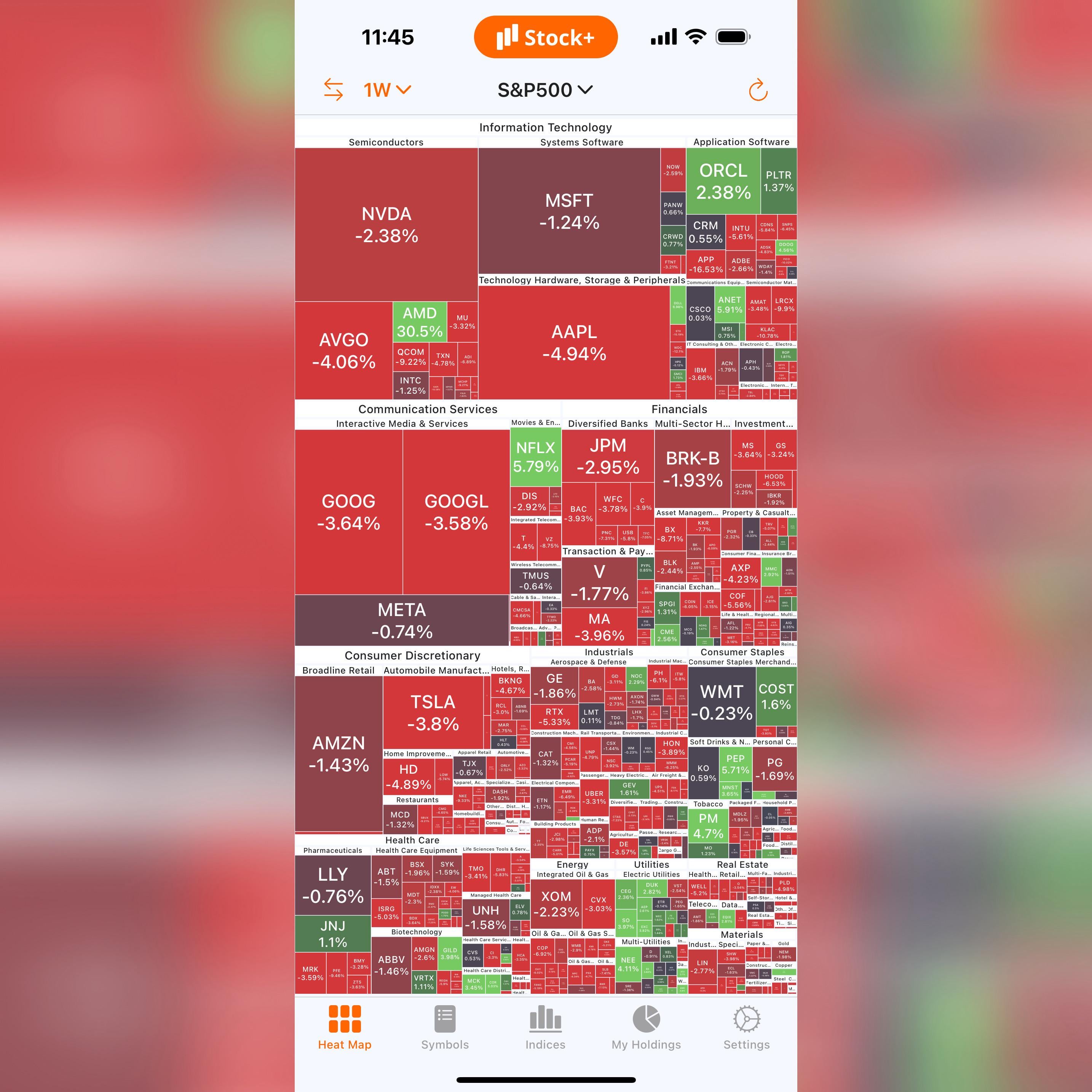

First of all, I don't want to be misunderstood. This heat map is weekly that it visualized via closing prices from October 3 to October 10.

Last week, the stock market completed a fully green week, but the gains were limited to around 0.5%. This week had some losing days, but they were still limited expect for Friday. The most important topic of 2025 came out again: Tariffs.

📊 Here are the S&P 500's week-by-week results for the last 4 week,

September 12 close at 6,584.29 – September 19 close at 6,664.39 🟢 (+1.22%)

September 19 close at 6,664.39 – September 26 close at 6,643.70 🔴 (-0.31%)

September 26 close at 6,643.70 – October 3 close at 6,715.79 🟢 (+1.09%)

October 3 close at 6,715.79 – October 10 close at 6,552.50 🔴 (-2.43%)

🔸 Monday: Trump said the stock market continually hit records highs. He's right. Many data releases were delayed or cancelled which helped the stock market. Volatility was lower. On the other hand, Gold and Silver continued to rise. The White House's Hassett said layoffs will come if Trump thinks shutdown negotiations 'are going nowhere'. The Dollar Index started rising from 97.5. The stock market opened higher. During the session, Trump announced all medium and heavy-duty trucks imported will be tariffed 25%. It was the first attempt for tariffs, but the stock market closed higher. 🟢

🔸 Tuesday: The Senate rejected Republican spending bill to end government shutdown. The stock market opened slightly higher. Precious metals have been very popular for a while and Goldman Sachs lifted its gold price target to $4,900 for 2026 year-end. The S&P 500 declined from 6,750 and pulled back. The stock market closed lower. The S&P 500 broken 7-day winning streak. 🔴

🔸 Wednesday: Gold rose above $4,000 for the first time in history. The stock market opened higher. Fed minutes were released and the stock market expects 2 more rate cut by the end of 2025. Next meeting will be October 29. CME FedWatch tool is showing 98% possibility of 25 point rate cut in October. The stock market closed higher. Nasdaq closed above 23,000 for the first time ever. 🟢

🔸 Thursday: Silver gained more than 3.5% and surpassed $51. $49,81 was the highest since 2011. Thus, it surpassed. Israel and Hamas agreed on 'first phase' of Gaza ceasefire. The stock market opened higher. The Dollar Index continued rising and completed 4-day winning streak. It reached 99.50. As a result, Gold and Silver could not hold their gains. The stock market closed lower. 🔴

🔸 Friday: Fed Governor Waller sees more rate cuts but central bank needs to be "cautious about it". Gold and Silver rebounded after Thursday’s loses. The stock market opened higher. Michigan 1-Year Inflation Expectations preliminary came at 4.6% that slightly lower than last month's 4.7%, but it wasn't the focus for today because Trump warned of new "massive" tariffs on China. Oil felt more than 4%. The stock market closed under heavy selling pressure. The S&P 500 felt more than 2.5% and Nasdaq dropped more than 3.5%. 🔴

The stock market continued to rise slowly while the government remaining closed. We did not see any labor market data, so the stock market could not get information from reports. The S&P 500 dropped more than 2.5% in a single day, but volume was only slightly above 20-day moving average. The stock market had made all-time high after another. I believe that we don't need to make any panic yet. We've seen this before.

What do you think? What do you think? How was your week?

❓ Note: Many people have asked where screenshots come from in my previous posts. I'm using Stock+ on iPhone and iPad. You can find it on the App Store. If you're using Android, I'm now sure if it's available, but you can try searching "Stock Map" or "Heat Map".

https://i.redd.it/yauku8yocpuf1.jpeg

Posted by vjectsport

4 Comments

When Trump and his friends are done buying the dip then he will tell everyone he changed his mind and presto! Instant money for his friends!

Rally continues.

Yep, expect him to talk shit all week and then Friday at 11 am he will say we are giving a 90 day pause

BTC prices are rallying today. Back in the $113k range