Historically this stock has gone up Nov-Dec (I think mostly because of idiosyncratic Christmas shopping demand, paired with good beta from Santa Clause rallyes):

2021: +17% from $457 -> $571

2022: -2% (ok that's an exception but market was difficult back then)

2023: +17% from $564 -> $659

2024: +8% from $866 -> $931

The stock is $150 below its ATH and based on the patterns above, I think buying a call here could make sense.

The C1000 (so 5% OTM) 01/17/26 are offered at $29.5, which means if the stock does 17% again, gives me a return of 4x.

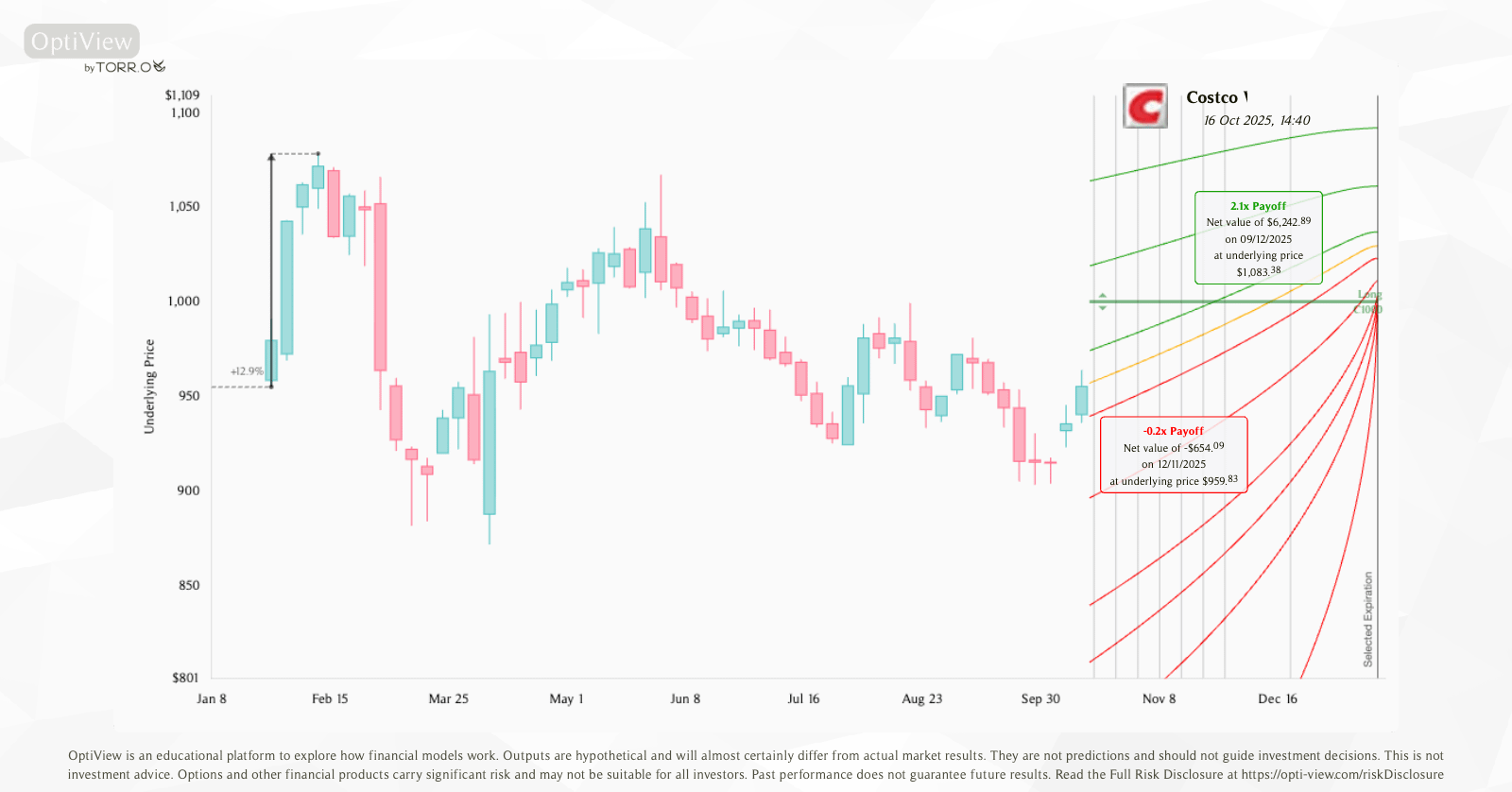

So buying it now at $955 seems good. But I'm a bit worried about the time decay. Optiview says it would lose already 20% by mid November if the market stays flat.

Anyone else looking to position themselves for year-end already? Is it too early?

https://s.opti-view.com/31da101c5b

Posted by Capital_Profit_4469

2 Comments

Never too early for Christmas 😉

If your “signal” is triggered simply by November being here, why not wait until then? Saves you two weeks of theta