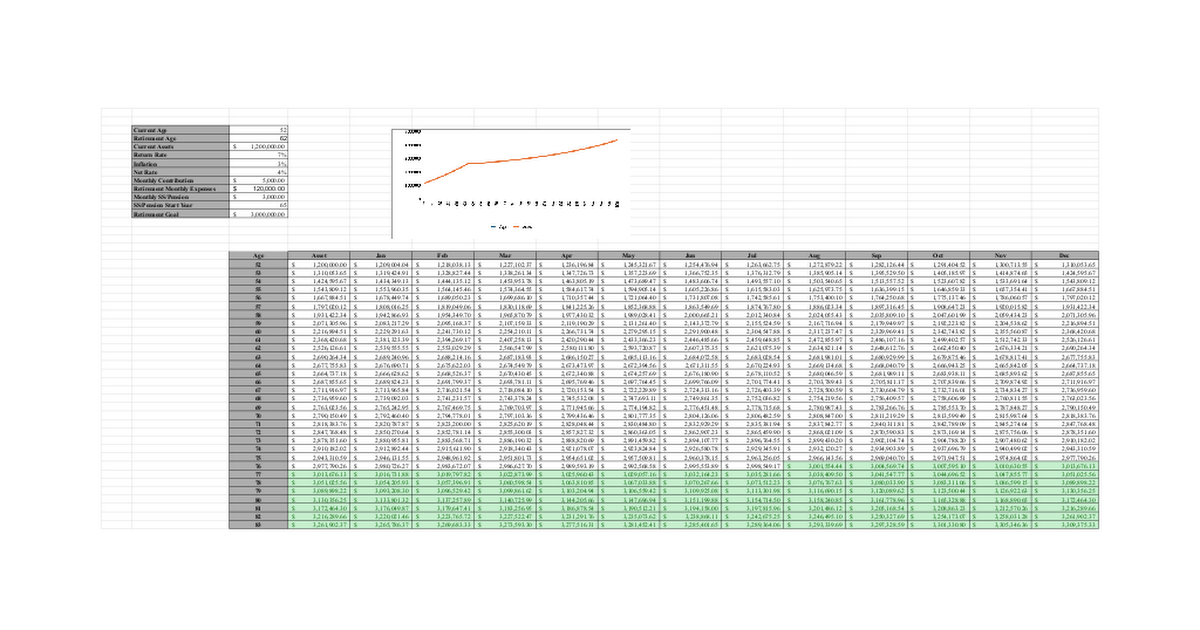

I built a retirement /FI calculator.

This calculator forecasts the growth of your assets from your current age to your 100 years, based on the following inputs:

Current Age & Retirement Age: The time frame over which the forecast is calculated.

Current Assets: The value of your assets at the current age.

Return Rate: The expected annual return on your investments (e.g., stock market growth).

Inflation: The rate at which your expenses are expected to increase over time.

Net Rate: The effective return rate after accounting for inflation.

Monthly Contribution: The amount you plan to contribute to your assets each month until retirement age.

Retirement Monthly Expenses: The monthly amount you expect to spend during retirement.

Monthly SS/Pension: The amount of Social Security or pension income you expect to receive each month.

SS/Pension Start Year: The year you expect to start receiving Social Security or pension benefits.

Retirement Goal: The target amount of assets you wish to have at retirement to sustain your desired lifestyle.

Key Functions:

Asset Growth Projection: The calculator grows your assets month-by-month, taking into account contributions, investment returns, and inflation.

Monthly Contributions: Contributions are made until retirement age, after which they stop.

SS/Pension Integration: Once you reach the SS/Pension start year, your monthly Social Security or pension benefits are added to your assets.

Expense Subtraction: Starting at retirement age, the calculator subtracts your projected monthly expenses from your assets each month.

The goal is to show you whether your assets will be sufficient to cover your monthly expenses after retirement, and how your asset growth will evolve over time.

Posted by anonydragon098

1 Comment

Nicee… I like that it shows whether your assets actually cover your retirement expenses instead of just a lump sum.