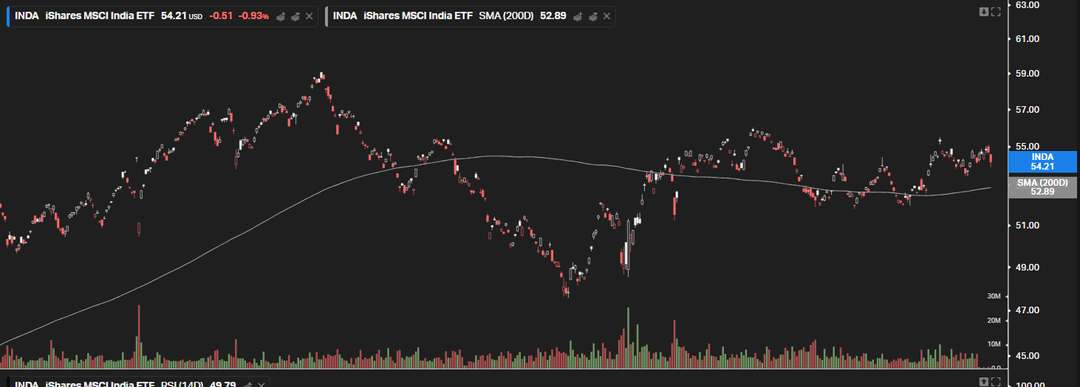

Hear me out guys, the 4-pillar of India growth story is cracking and nobody wants to say it out loud.

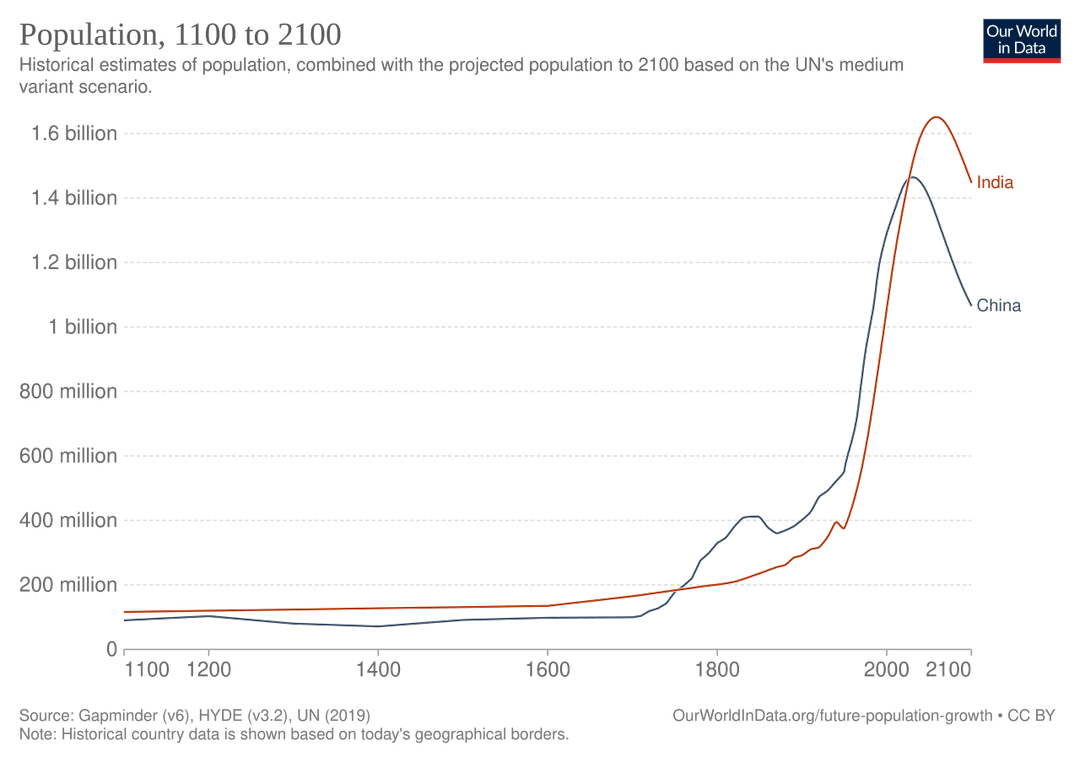

– Demographics? Supposed to be the big advantage. But if the “young population” can’t get real jobs then this dividend theory based on GDP per capita might not work.

– Manufacturing? Years of “Make in India” talk but the manufacturing share of GDP hasn’t meaningfully moved. Global supply chains are reshoring, automation is killing labour-cost advantages.

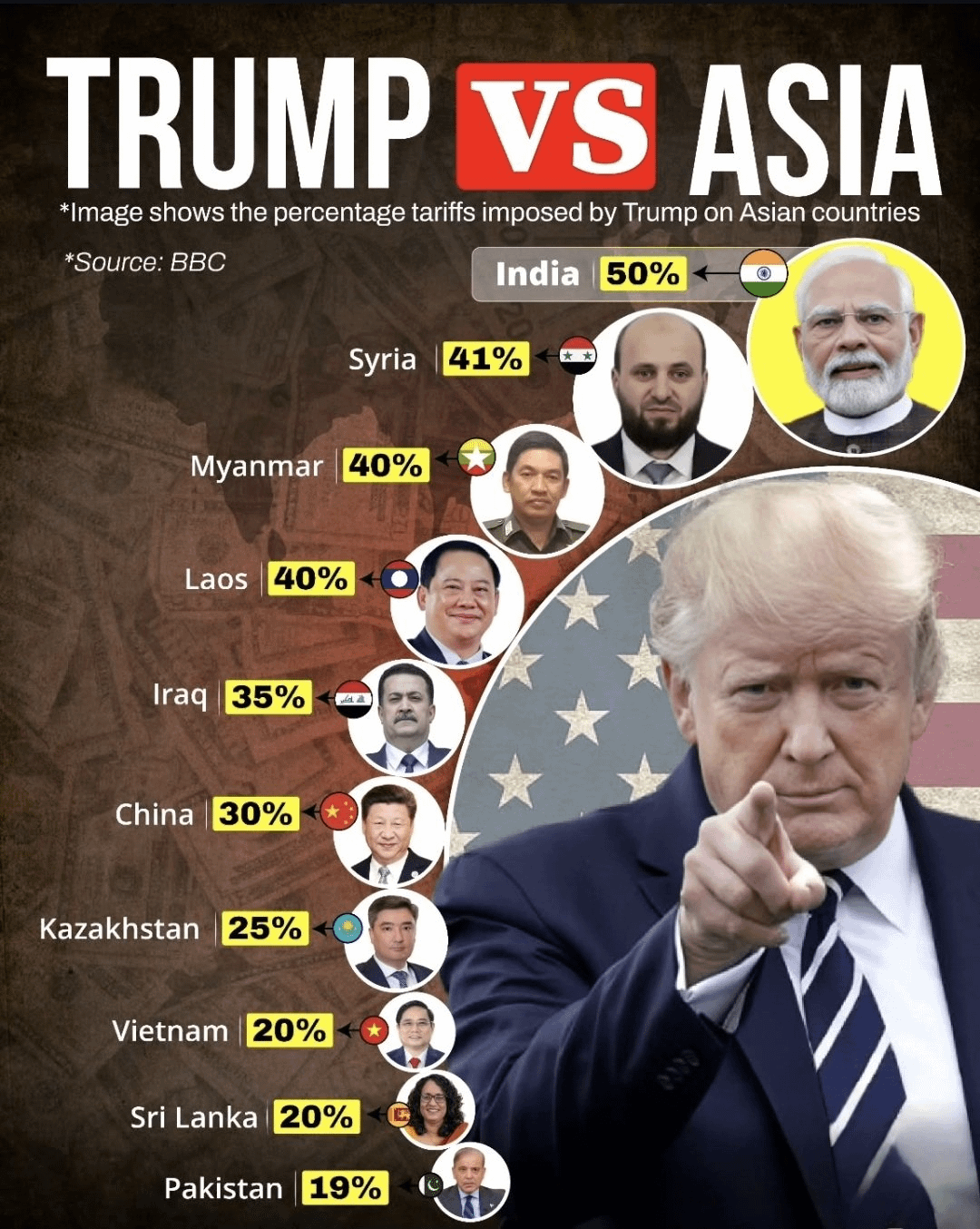

– Trade & capital flows? The whole 40-year neoliberal framework of free trade, capital and labour mobility is breaking down. Tariffs, geopolitics, fractures. India is stuck in the middle without any leverage over countries like US.

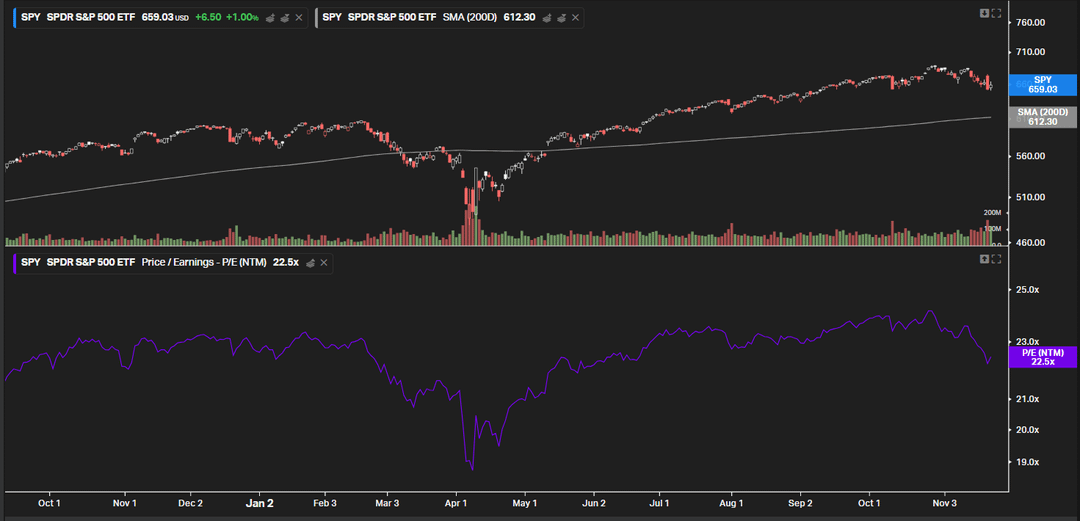

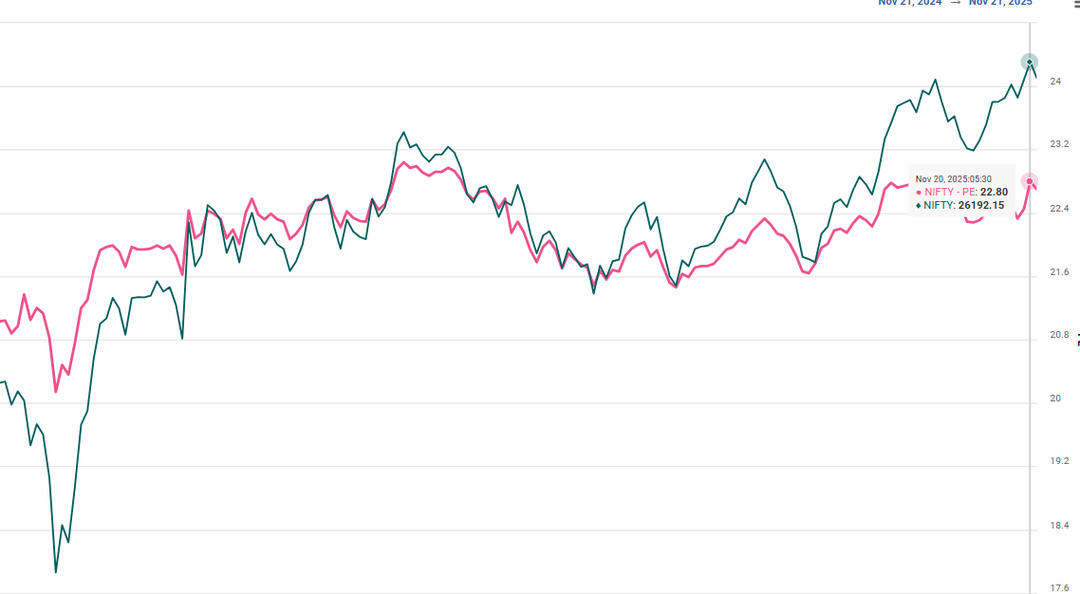

– Tech & innovation? The US and China are racing in AI, chips, robotics. India is cheering from the stands. Yet Indian equities trade at higher PE multiples than the US. Tell me how that makes sense.

People say "we about to have a bull market anytime now”. I say it's still a bubble built on narrative instead of fundamentals.

Therefore, I’m expressing my views through Indian brokers.

Positions here: https://limewire.com/d/36riI#WczVoMkNZI

Tell me what I’m missing.

p.s. BTC is the leading indicator of liquidity which tells us risk assets are about to go down.

https://www.reddit.com/gallery/1p4mt3i

Posted by isdjtantichrist

2 Comments

wow I forgot about limewire, it was such a big thing back in the day.

Good luck betting against the neoliberal framework when they (classical liberals) basically figured out all of modern economics. Full blown retard 😂