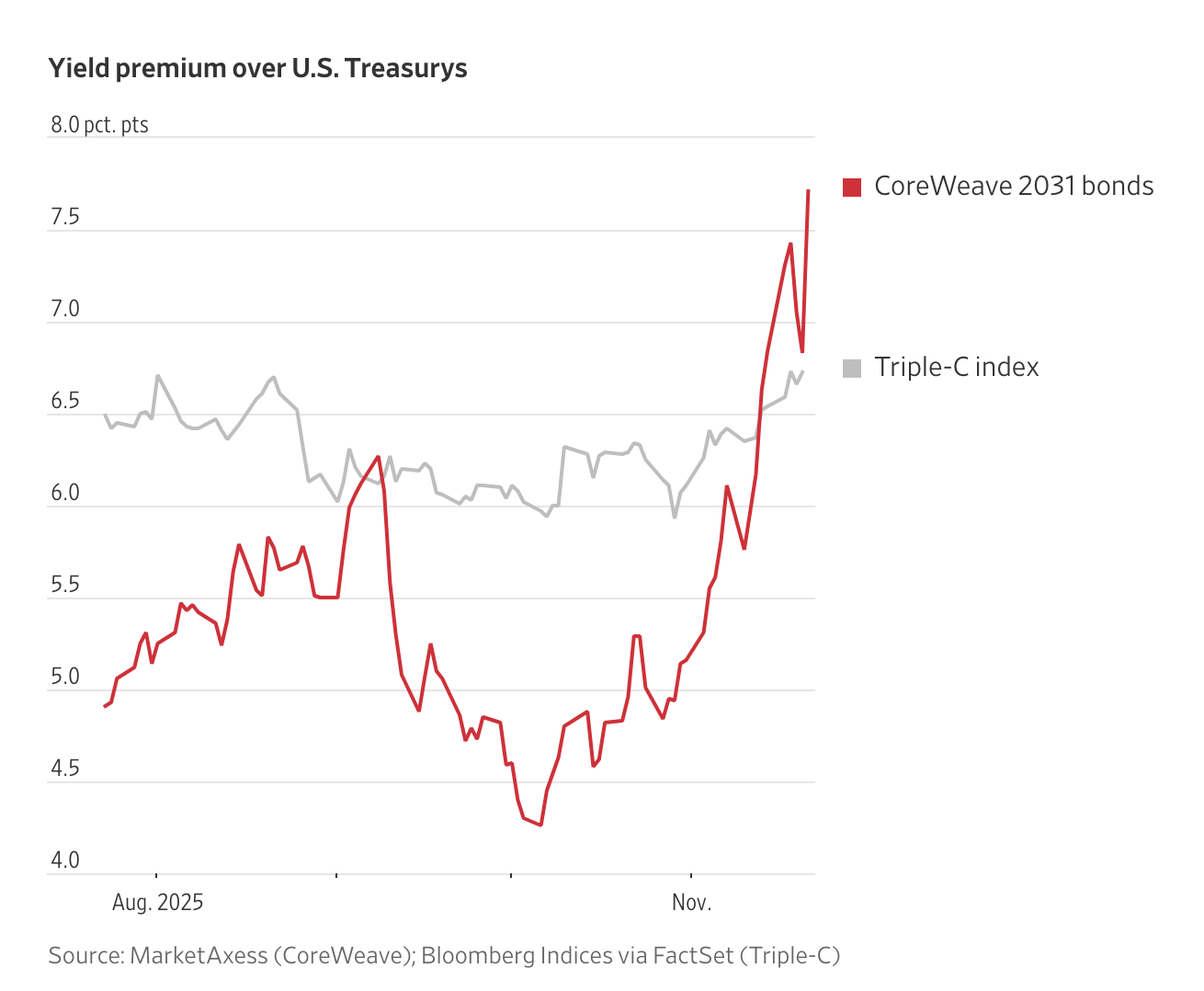

Other companies already are operating in that smaller debt market. Those include CoreWeave, the lone major AI cloud provider with subinvestment grade bonds. Its bonds due in 2031 that were issued in July recently traded at 92 cents on the dollar. That translated to a roughly 11% yield, about the same as the average triple-C rated bond—at the bottom of the ratings spectrum.

CoreWeave faces similar demands as its larger competitors but doesn’t have their legacy businesses, giving it less of a cushion, investors said. News that it faced data center construction delays helped drive its shares down 46% this month, though they remain up 79% since the company’s initial public offering in March.

From the graph, is about 7.7% + the short-term treasury rate, or about 11.5%. That matches the 11.44% yield to maturity on Trading View as of 11/21/25 for corporate bonds maturing on 2/1/31.

That thing has spiked like 350 bps in less than 2 months.

https://i.redd.it/4l1pqdzov43g1.png

Posted by Prudent-Corgi3793

6 Comments

They dont have to pay you. Those bonds arent covered

Dumb dumb

I’m full porting

I’m quite inexperienced with bonds. In this scenario, are you saying it will pay 11.5% yield *by* 2031 or are you saying it will pay 11.5% yield every year until 2031?

Coreweave seems like they are about to burst any time. Losing close to a billion a year on less than $3.5 billion a year in revenue seems absurd. Oh they compete directly with the juggernaut that is GOOGLE. Get crushed soon.

Stinks of desperation