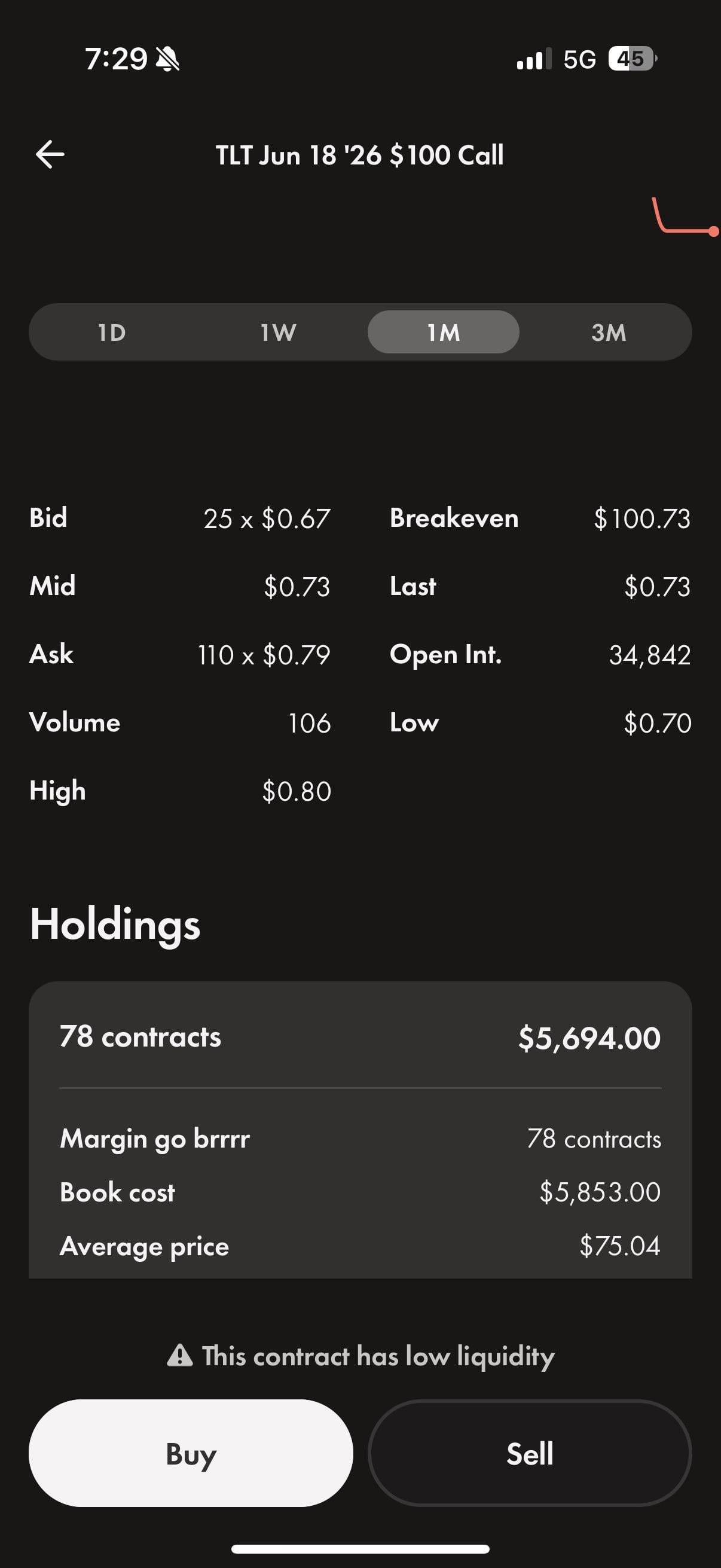

2 rate cuts will happen before march and these will slingshot, currently holding 78 contracts will average up on any dips this month & hedge with short term $88-90 puts also looking at buying 50 contracts of $88 06/26/26 calls if it drops below 4, NFA THESE WILL PAY BEAR OR BULL🥳🥳🥳

https://i.redd.it/4aox5kk79i4g1.jpeg

Posted by wiisports101

10 Comments

Didn’t these last two starts to a rate cut “cycle” make the longer end rates rise? Good luck genius.

https://preview.redd.it/q2s3fr8jai4g1.jpeg?width=239&format=pjpg&auto=webp&s=7e3b2b4f5cc9d164aff4de3d62094c39ead89a4f

Powell hinted at multiple rate cuts that never happed through ’24 and ’25.

I’de be more apt to say you’re going to get cucked by theta than anything at this point.

Bwahaha do you understand how macroeconomics work?? BWAHAHAH

This guy’s on tlt

Im a TLT bull buuuut I could see a nasty shakeout before it moons. Thinking double top on the ten year so TLT could make its way back to the 82s

Like Warren Buffett genius or Monkey ape genius?

How did you get it to say “margin go brrrr”

Well well well looks like another Wealthsimple regard who thinks bonds markets are easy to trade.

Hi guys, I’ve been wanting to dabble with options. I had a full plan to buy puts before Carvana’s last earnings. But, since the stock dipped before earnings, I got cold feet. It would have played out well. Now I’m considering buying calls for ultabeauty. My thought process is that since economic data is being hidden, it shows that we are most likely in a recession. Beauty stocks doing well are a recession indicator. Therefore it seems like a good play. With a P/E ratio of 20 it seems like it has some room to grow. Especially if they beat their earnings expectations.