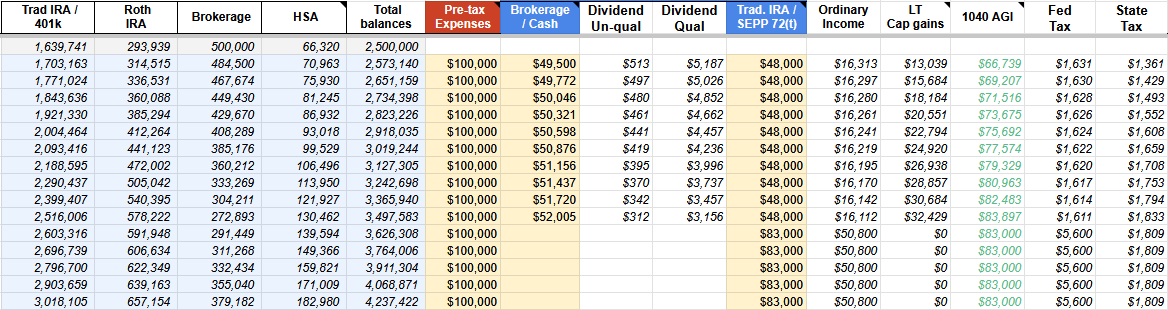

My personal situation, I will likely hit $2.5M with $0.5M in my brokerage. Depending on when I RE, I could have up to 15 years prior to 59.5.

For simplicity I will model $100k of expenses in each scenario below. The withdrawal strategy modeled is to spread the brokerage withdrawals over at least 10 years, and calculate the size of the 72t required to supplement during that time. I chose to begin the analysis with a 10 year draw-down, and the starting withdrawal equating to a historical 90% success rate for that time-frame (I used testfolio backtesting stats). Aggressive – but I have a $2M portfolio outside of the $500k. I understand this still leaves me with 5 years to figure out. For now, I will assume I would trigger a second 72t – or if I am lucky on sequence of returns, maybe the brokerage still has life.

I scaled the withdrawals to roughly match the reduction in dividends, so I can land on a fixed 72t.

I let the brokerage grow based on historical CAGR (real), so the 100/0 portfolio ends with a large balance. I stuck with SWR as the withdrawal amount vs. depleting both portfolios to ~$0, though I am not sure the right way to look at this. I tried to model so the two scenarios have similar risk profiles. Also – my expenses will increase in reality, but my brokerage will increase by more than what I am showing because I used inflation adjusted CAGR from testfolio. Is this fair approach?

Assumptions based on current stats (using VTI and GOVT):

| AA | CAGR (inf. adj.) | Yield | QDI | 90% SWR (10yr) |

|---|---|---|---|---|

| 100/0 | 7.9% | 1.14% | 91% | 9.9% |

| 60/40 | 5.7% | 2.05% | 55% | 11% |

Summary (stats on first 10 years):

| AA | SEPP | MAGI | Tot. Tax |

|---|---|---|---|

| 100/0 | $48k | ~$67-84k | $32.4k |

| 60/40 | $37k | ~$62-71k | $21.1k |

I used Roth basis to soften the blow and help with MAGI the last 5 years, not shown.

There is tax drag leading up to retirement (you shouldn't assume they both start at $500k). I am a high saver so I can build to $200k in my last ~2 years leading to RE. For now, I ignored this small amount of tax drag. For a longer ramp to 40% in the brokerage, it certainly should be considered. I think its noise given all of the other broad assumptions made.

Also in reality I can flex spending based on the market (VPW), and I am not sure I will actually quit working at a 4% w/r. The above is just a thought exercise on how to consider the impact of asset allocation.

Please poke holes in this, something tells me this is ignoring something or not adequately comparing the two. My broad take-away is a 60/40 in the brokerage during draw-down is perfectly reasonable, and additional precision might not change that opinion.

Tagging u/One-Mastodon-1063 – extending our discussion from yesterday.

Impact of Bonds in Taxable – a 10yr analysis

byu/hondaFan2017 infinancialindependence

Posted by hondaFan2017

2 Comments

Nice work on the modeling but I think you’re underestimating the tax complexity of the 60/40 – those bond distributions are gonna be ugly in taxable especially if rates stay elevated and you’re dealing with premium bonds rolling over

Also that 90% SWR for 10 years seems pretty aggressive when you’re banking on a second 72t to cover the gap, might want to stress test what happens if the market tanks in years 8-10 and suddenly your brokerage is toast

Very impressive granular modeling. You are effectively analyzing the trade-off between Tax Efficiency (100/0) and Sequence of Returns Protection (60/40).

The main “hole” isn’t in your math, but potentially in the risk priority. For a depleting “bridge” account, volatility is the enemy, not taxes.

While 100/0 is mathematically superior for taxes (QDI/LTCG), if you hit a 20% correction in Year 2, you are forced to sell depressed equities to fund lifestyle. That cannibalizes the principal far faster than the tax drag of bonds ever would.

The 60/40 allocation is perfectly reasonable because the job of this specific bucket isn’t “maximum growth”; its job is reliable liquidity to protect your larger $2M nest egg from being tapped early.