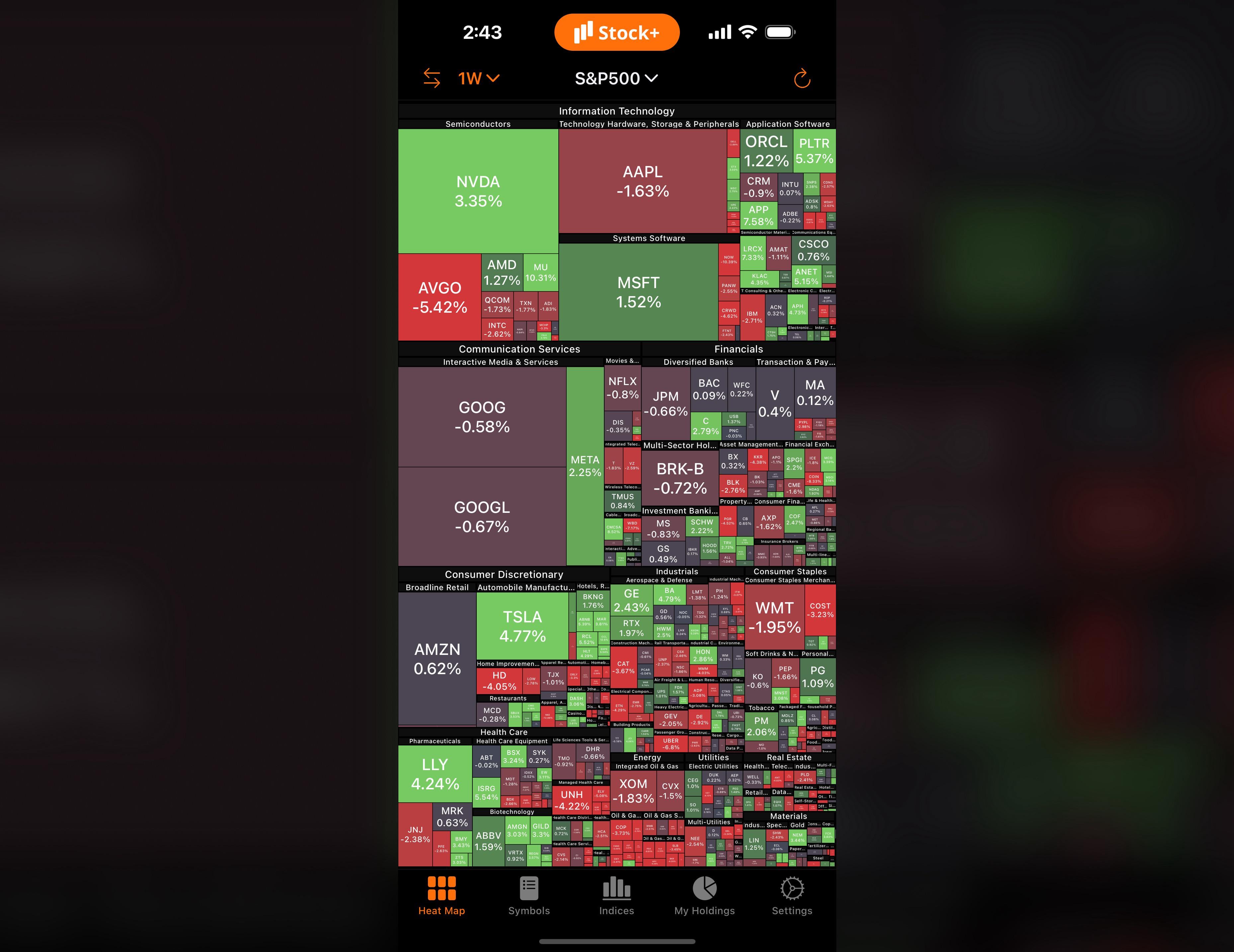

First of all, I don't want to be misunderstood. This heat map is weekly that it visualized via closing prices from December 12 to December 19.

There were 2 important interest rate decision this week. First, Bank Of Japan hiked by 25 bps. On ther other hand, Bank of England cuts by 25 bps to 3.75% as expected. This week's hero was exactly silver again and gained more than 8% in a week. Last week's was 6%. It has made 4-week winning streak and gained more than 30%. Impressive.

📊 Here are the S&P 500's week-by-week results for the last 4 week,

November 21 close at 6,602.96 – November 28 close at 6,849.09 🟢 (3.73%)

November 28 close at 6,849.09 – December 5 close at 6,870.40 🟢 (0.31%)

December 5 close at 6,870.40 – December 12 close at 6,827.41 🔴 (-0.63%)

December 12 close at 6,827.41 – December 19 close at 6,834.78 🟢 (0.11%)

🔸 Monday: The week began in Asia markets as rate hike looms. Bank of Japan said start selling ETFs. Volatility has high level in Nikkei throughout the week. The U.S. market opened higher ahead of CPI inflation datas week. Silver continued to rise again and passed to $64. The session was quiet on the news side, but the stock market lost all of gains and closed lower. 🔴

🔸 Tuesday: As we know, the government was shutdown for 43 days. Many datas could not released. The delayed November jobs report released on Tuesday and U.S. added 64K jobs. It's higher than expectations of 40K. It was the highest level in more than four years. The stock market reacted mixed ahead CPI inflation and opened lower. The Wall Street still expects two cuts in 2026. Oil prices fell to $55 for the first time since February 2021. Bessent said China has lived up to every part of trade negotiations so far. The stock market closed lower again. 🔴

🔸 Wednesday: Fed's Waller said The job market says Fed should continue to cut rates. The stock market opened flat. During the session, Blue Owl would pull out of funding from Oracle data center. Oracle dropped more than 15% during the session. It made high pressure on the tech stocks and Nasdaq fell more than 1.8%. 🔴

🔸 Thursday: Before the session, November CPI inflation was came. Year-over-year expectations were 3.1% in , but it came 2.7%. That's a very positive surprise. On the other hand, it was same percentage as November 2024. The probability of next rate cut moved to March from June, but it still 2 rate cuts for 2026. The stock market welcomed positive too and opened higher. Momentum continued to gain and closed higher. The S&P 500 broke 4-day losing streak. 🟢

🔸 Friday: The Bank of Japan hiked interest rate by 25 bps to 0.75 as expected. It's highest level since 1995. Japan's 10-year yield passed 2% and reached highest level since 1999. The stock market was expected and it did not impact on the U.S. side. The market opened higher. 1-Year inflation expectation came at 4.2% and down from 4.5% the previous month. Silver rose more than 3% and jumped to new all-time high. The U.S. launches review of advanced Nvidia AI chip sales to China and Nvidia gained more than 3.5%. The stock market closed higher and S&P 500 gained more than 2% over the last 2 days. 🟢

The week began quietly, but selling pressure was on the table. The Blue Owl news had a major impact on Wednesday about AI bubble concerns. CPI inflation results turned wind to opposite side. It had not changed total number of rate cut expectations for 2026, but first one date moved to March. On the other side, the Federal Reserve Chair will change. The next chair will be more familiar with Trump and the stock market may start pricing in more than 2 rate cut.

What do you think? What do you think? How was your week?

❓ Note: Many people have asked where screenshots come from in my previous posts. I'm using Stock+ on iPhone and iPad. You can find it on the App Store. If you're using Android, I'm now sure if it's available, but you can try searching "Stock Map" or "Heat Map".

https://i.redd.it/top5x2y4il8g1.jpeg

Posted by vjectsport