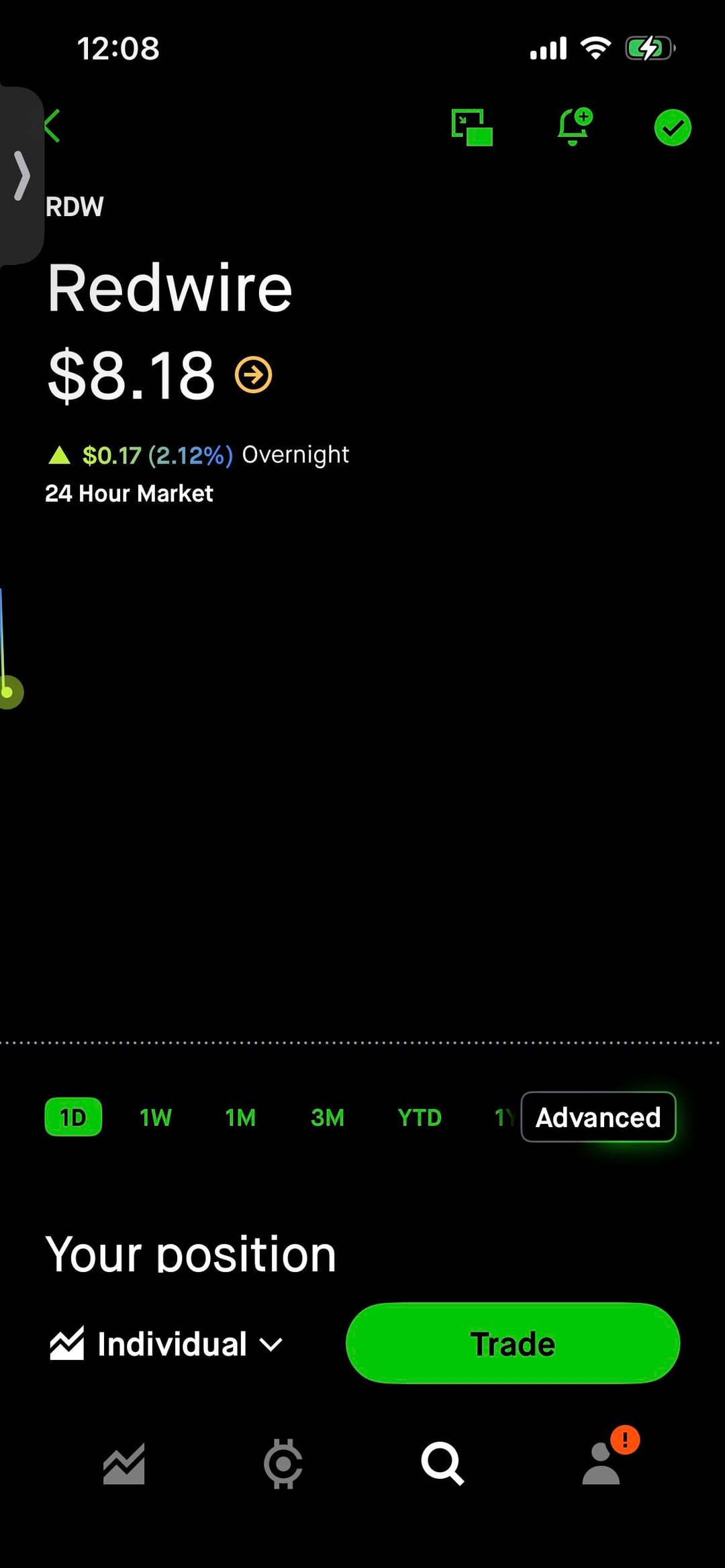

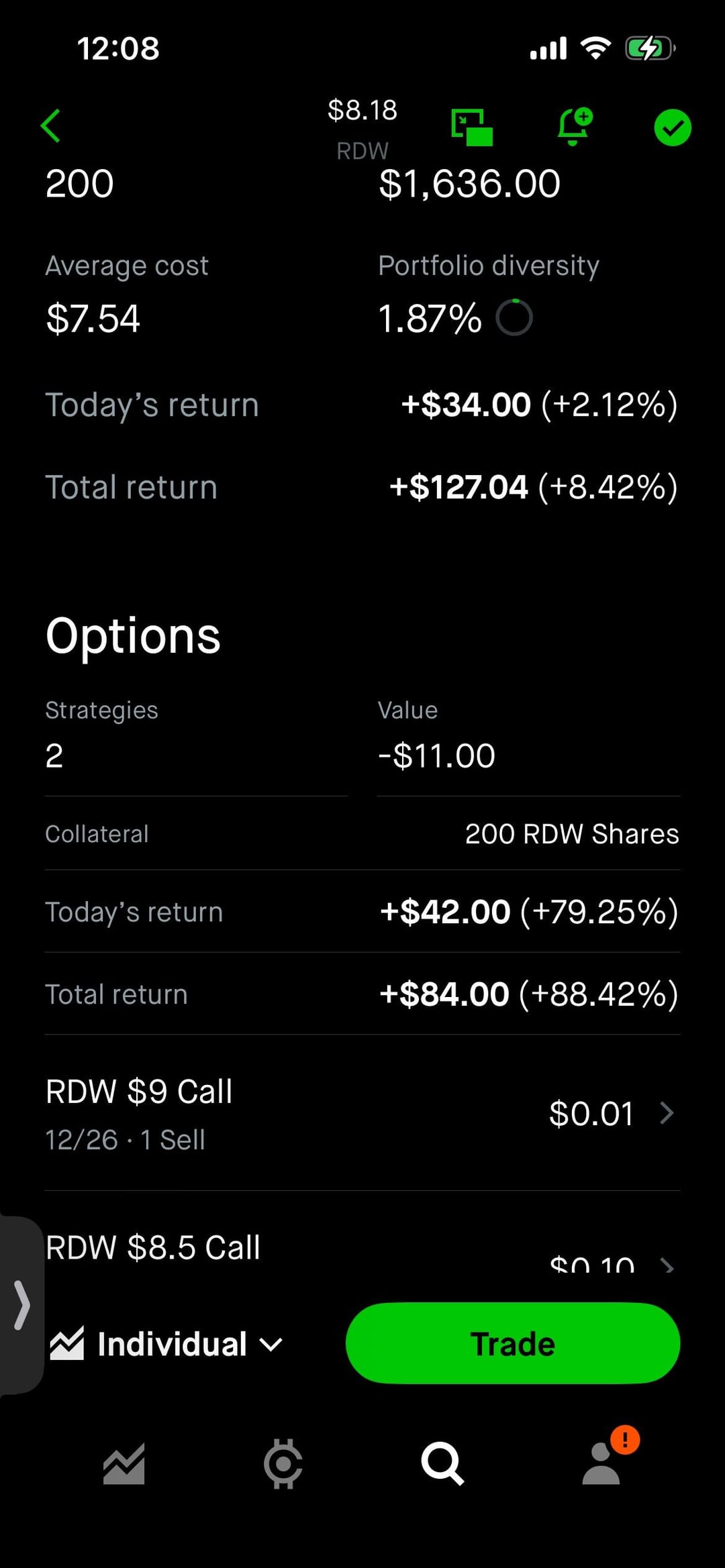

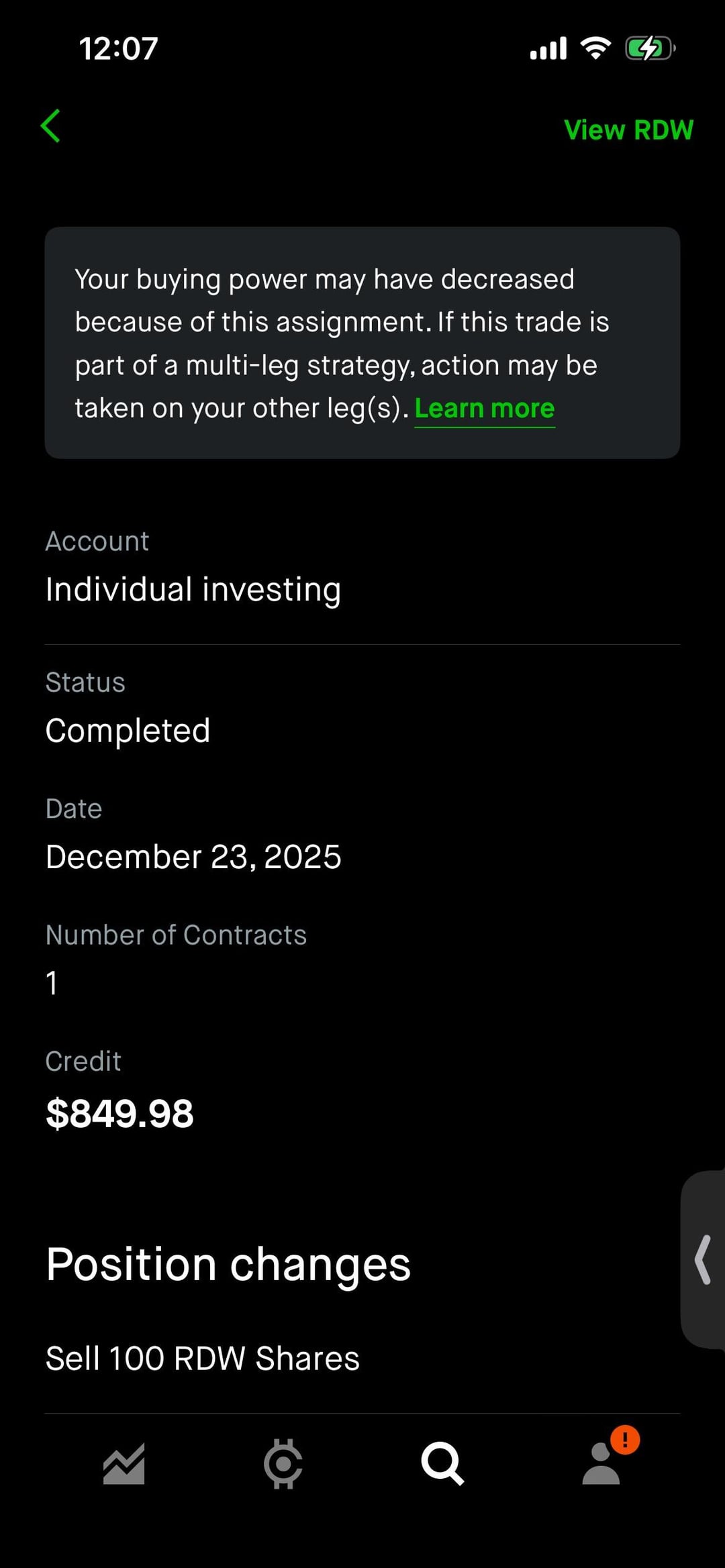

I had 300 shares of RDW average around $7.54 and sold 2 covered all $8.5 strike average 0.45 per shares so $45 x 2 =$90.00 for premium, what I don’t get is someone just exercised one of my $8.5 strike today and they are trading around $8.14 overnight so my question is what is this reason for exercise?

https://www.reddit.com/gallery/1puf9x3

Posted by Ineedstopcovercalyol

9 Comments

It’s called a gift we all hope for this

Tax season?

Merry Christmas you filthy animal.

If this was gamestook you would cause a cascade of posts about hedgies paying over ask to get shares to cover

>what I don’t get is someone just exercised one of my $8.5 strike today and they are trading around $8.14 overnight so my question is what is this reason for exercise?

During the day it hit $8.99, so well above your strike. Someone likely wanted to get the shares at that point since it was above their breakeven (even though its still not really a good financial move to do this) so they exercised their call around that time.

Most brokers will allow immediate option exercise(for american style options obviously) and will take the contract and will loan out shares they had themselves to fulfill the contract. Then once the OCC runs through their option clearing process, broker submits their contract and someones shares get called to replenish the ones broker loaned out during the day.

This is very likely what happen in your case, so congrats, max profit and early exercise all at the same time.

It can happen around dividend time, when it’s worth exercising the option at a slight loss to capture the dividend for a greater gain. Obviously that wasn’t the case here, but whatever the reason was, congratulations.

https://preview.redd.it/cilpc6lgc39g1.png?width=1018&format=png&auto=webp&s=131d43ae781a67dd9d9ffabb672113149c703ac0

Somebody who has secret info. Oh yeah and the drone ban is allegedly happening now.

So wait. How does this shit works ELI5!