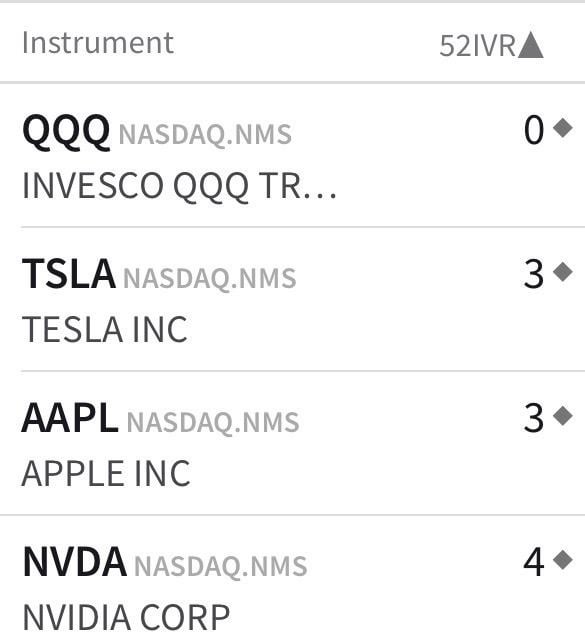

These last few days of the year, it looks like we’ll be at rock bottom for IV Rank. With levels in the low single digits for stocks like AAPL, NVDA, TSLA, and QQQ, this is a terrible time to be aggressively selling options. The premium you collect simply won't compensate you for the risk you're taking on. Hold off on selling strategies until volatility expands and you can actually get paid fairly for the risk.

Since selling options is unattractive right now, here are some better strategies for this low IV environment:

- Buy options instead of selling them When IV is cheap, it’s actually a good time to be a net buyer. Consider buying calls or puts if you have a directional view, since you’re getting them at a discount.

- If you still must sell options:

- Make it a day trade – IV rank won't move much intraday, so you can capture quick premium without the overnight risk of an IV expansion.

- Look to sell options that have statistical low probability of being challenged regardless of IV environment.

- Diagonal spreads Buy longer-dated options and sell shorter-dated ones against them. This lets you take advantage of time decay on the short leg while maintaining upside exposure through the long leg.

- For example, if you think TSLA is going to hit 500 in early January, you can sell the 500 call for Jan 2, and buy the 500 call for Jan 9. This automatically gives you a 50% discount on the Jan 9 call, and if volatility expands, the Jan 9 call will benefit more.

- Best case scenario, TSLA drifts to 500 and your Jan 2 calls expire worthless and your Jan 9 calls double.

- Or for example, if you think TSLA is going to hit 450 in early January, you can sell the 450 put for Jan 2, and buy the 450 put for Jan 9. This one automatically gives you a 40% discount on the Jan 9 put, and if volatility expands, the Jan 9 put will benefit more.

- Best case scenario, TSLA drifts to 450 and your Jan 2 puts expire worthless and your Jan 9 puts triple.

- For example, if you think TSLA is going to hit 500 in early January, you can sell the 500 call for Jan 2, and buy the 500 call for Jan 9. This automatically gives you a 50% discount on the Jan 9 call, and if volatility expands, the Jan 9 call will benefit more.

https://www.civolatility.com/p/warning-iv-rank-hits-rock-bottom

https://i.redd.it/lpg2sa8ber9g1.jpeg

Posted by Alizasl

4 Comments

IV Rank is almost 100% useless at predicting when volatility snaps back.

In that case, you are just betting on seasonality: we are in the middle of holidays and vol should indeed be back when trading resume in a few weeks.

If you buy, it is not the way you think about it; it is long term hedge you will never touch and are basically the insurance part of your book. Buy 3 to 6 months out and forget about it. Not to speculate.

Christmas rally in effect. Long Friday $631 calls expiring Friday

A low volatility environment is usually good for opening calendar spreads.

Weekly Diagonals give you protection with short ATM however also check weekly ATR and set price alerts at trade setup to be alerted of price movement in either direction. You may want to roll if you Price alert is exceeded. Practice practice practice before real $$$$$