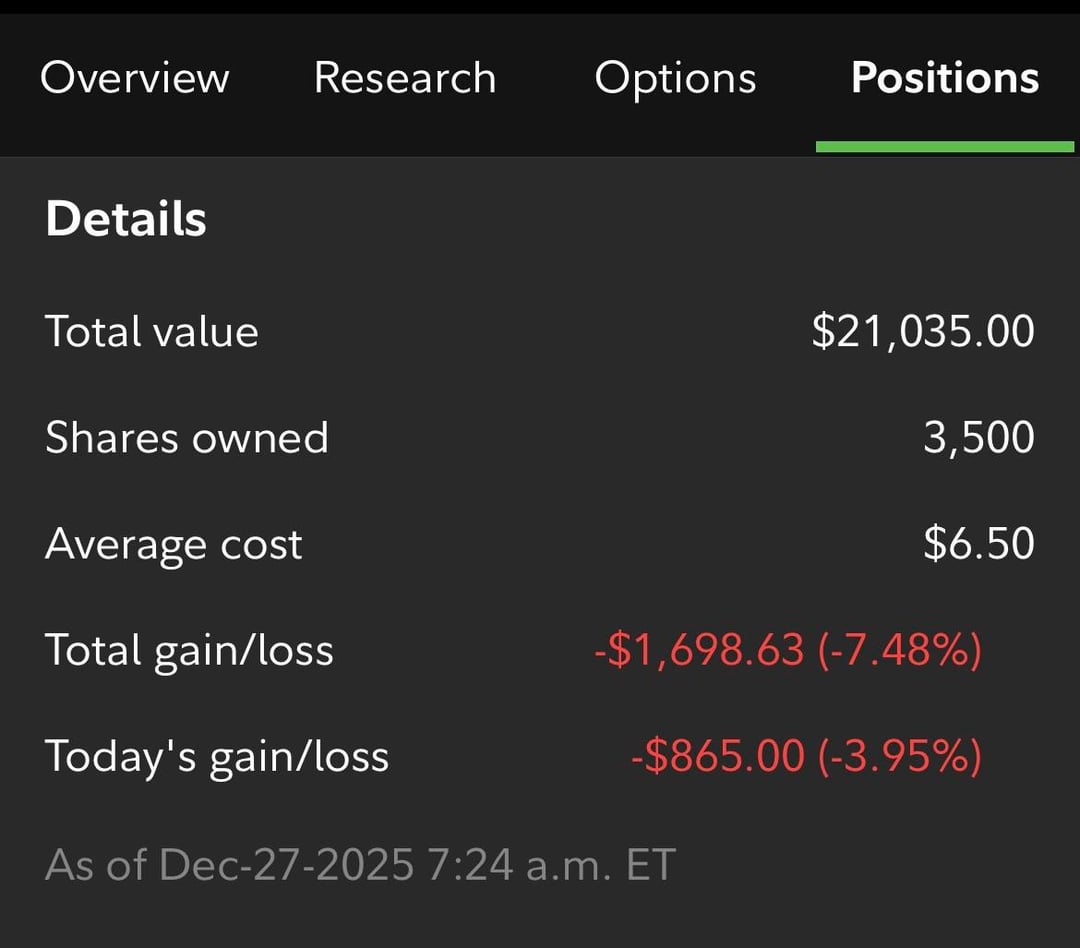

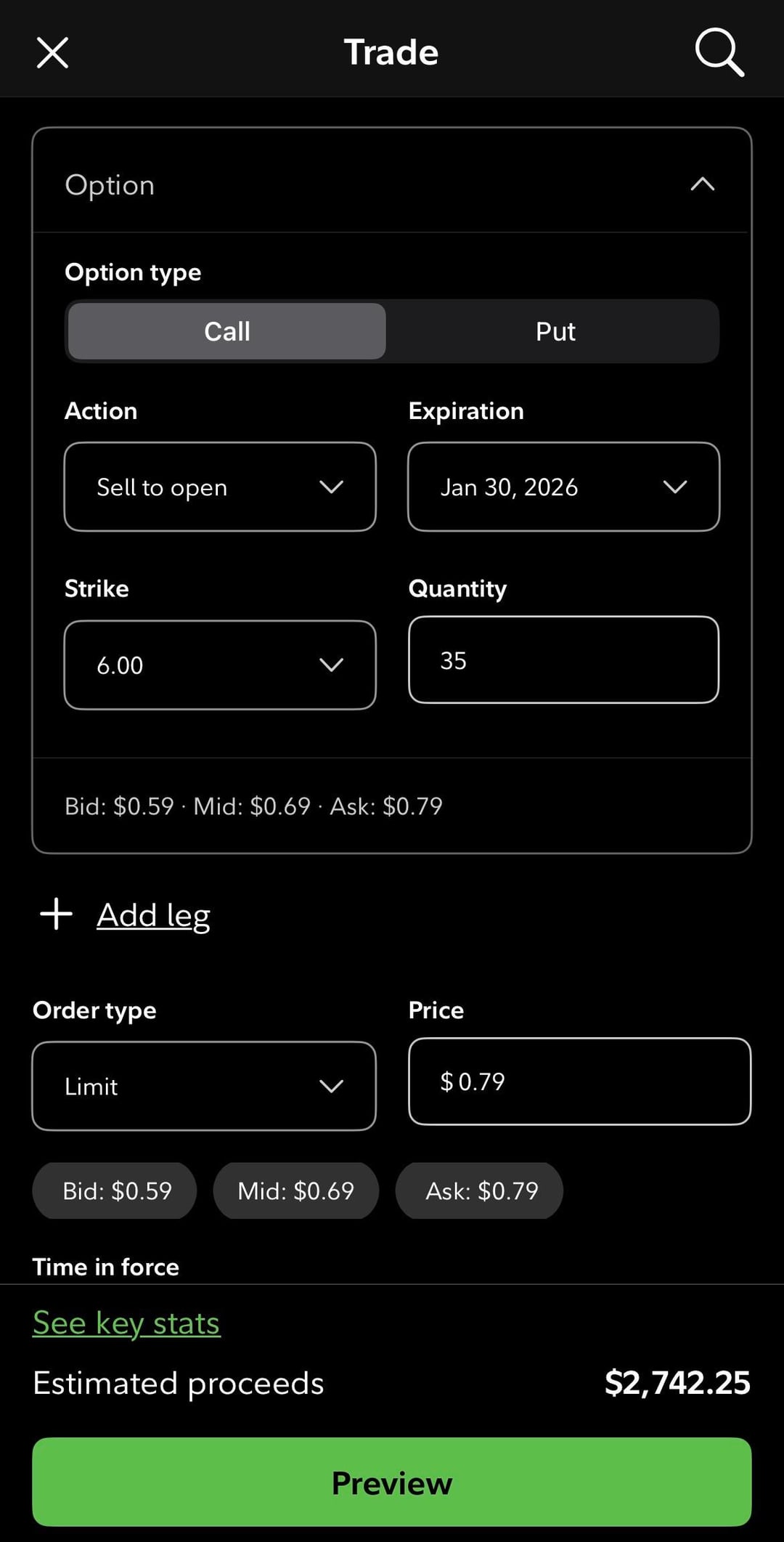

So I’m holding 3500 shares of a stock and my cost basis is 6.50. I’m down $1700 at the moment. The stock currently trades at 5.94 after Fridays close. I’ve never sold covered calls before so I’m a bit confused. I have a mock trade pulled up and If I sold 35 $6 covered calls with a 1/30 exp I could collect $2742.25. I would essentially make money on this otherwise failed trade and my shares would get called away immediately which I’m fine with. Did I stumble on my golden ticket out or am I trippin? Can someone analyze this

https://www.reddit.com/gallery/1pxds97

Posted by ECHuSTLe

4 Comments

U set ur strike below cost? That won’t work. 2700 – 1750 = 950

Call is around $0.78? Then you would not lose money if called away. It would not be “called immediately”. You would make max 0.28/share if called away at expiration but would lose out on any upside above $6

You bought this stock at $6.50. By selling the call, you get paid $0.79 (at the ask) to sell the stock at $6, if the stock at expiry is higher than $6 by one penny or more, so you’ll make $0.29 per share on the trade. The tradeoff is that this applies to any stock price above $6. If it went to $7, for example, you still only make $0.29, compared to $0.50 per share if you did not sell any calls against your share. I.e., you trade all upside profit potential for the up front premium.

There’s no “golden ticket” – simply a trade off between profit potential for premium.

Theta everyday will make you question the reality of options calling