TL;DR

FactSet is being valued as if its core business is weakening, despite decades of consistent, subscription-driven growth and high customer retention. The company continues to generate predictable cash flows through multiple market cycles, while current valuation reflects unusually low expectations. The opportunity here is it is mispriced as risk due to AI, but it will remain durable.

Background

FactSet sells financial data and analytics to institutional investors, asset managers, wealth firms, and corporates. Its product is embedded in client workflows, which makes switching painful and churn low. For this reason, retention stays high even when asset managers are under pressure, cutting headcount, or seeing AUM decline. FactSet’s revenue doesn’t depend on optimism or inflows — it depends on necessity. Most revenue is subscription-based, which gives the business strong visibility and predictability.

That model has worked for a long time. FactSet has now grown revenue every year for over four decades.

Recent Earnings

In its most recent fiscal year (ended August 31, 2025), FactSet reported:

• Revenue of $2.32B, up about 5% year over year

• Organic Annual Subscription Value (ASV) growth of ~5.7%

• Net income of ~$597M, up ~11%

• GAAP EPS of $15.55, up nearly 12%

• Continued strong free cash flow, alongside dividends and share buybacks

Guidance for FY 2026 calls for 4–6% organic ASV growth and revenue of roughly $2.42–2.45B.

Why Stock is Low

Margins have come under pressure, mainly from higher compensation and ongoing technology investment. FactSet, however, isn’t spending defensively — it’s spending to deepen the product and expand how clients use its data.

Why that Doesn’t Matter

A key point that gets overlooked is that FactSet owns and curates a large portion of its proprietary data. That matters in an AI-driven environment. Many competitors rely more heavily on third-party data, which limits pricing power and flexibility when new tools are layered on top. FactSet’s approach allows it to integrate AI into workflows without giving away the core asset that clients are paying for.

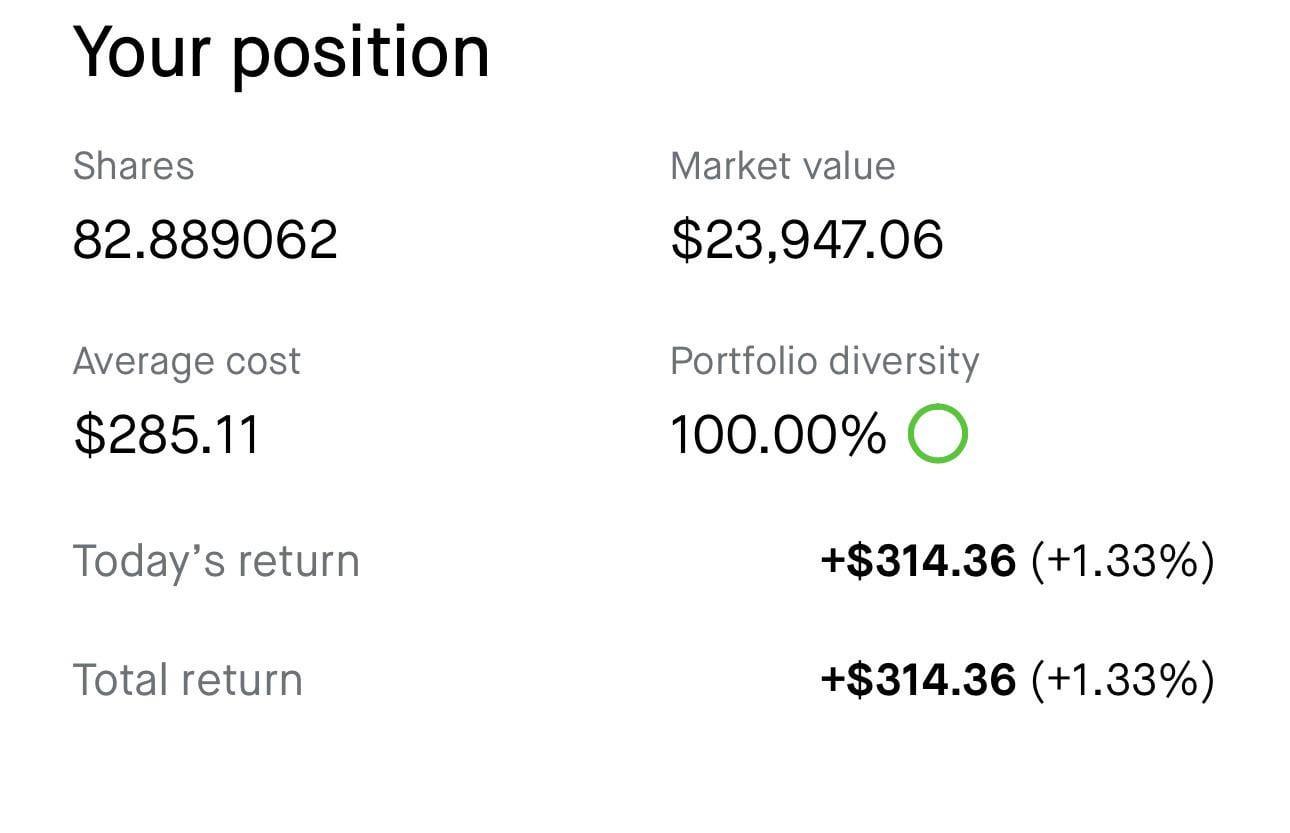

Position

https://i.redd.it/vhersifkkqbg1.jpeg

Posted by LostandConfused2024