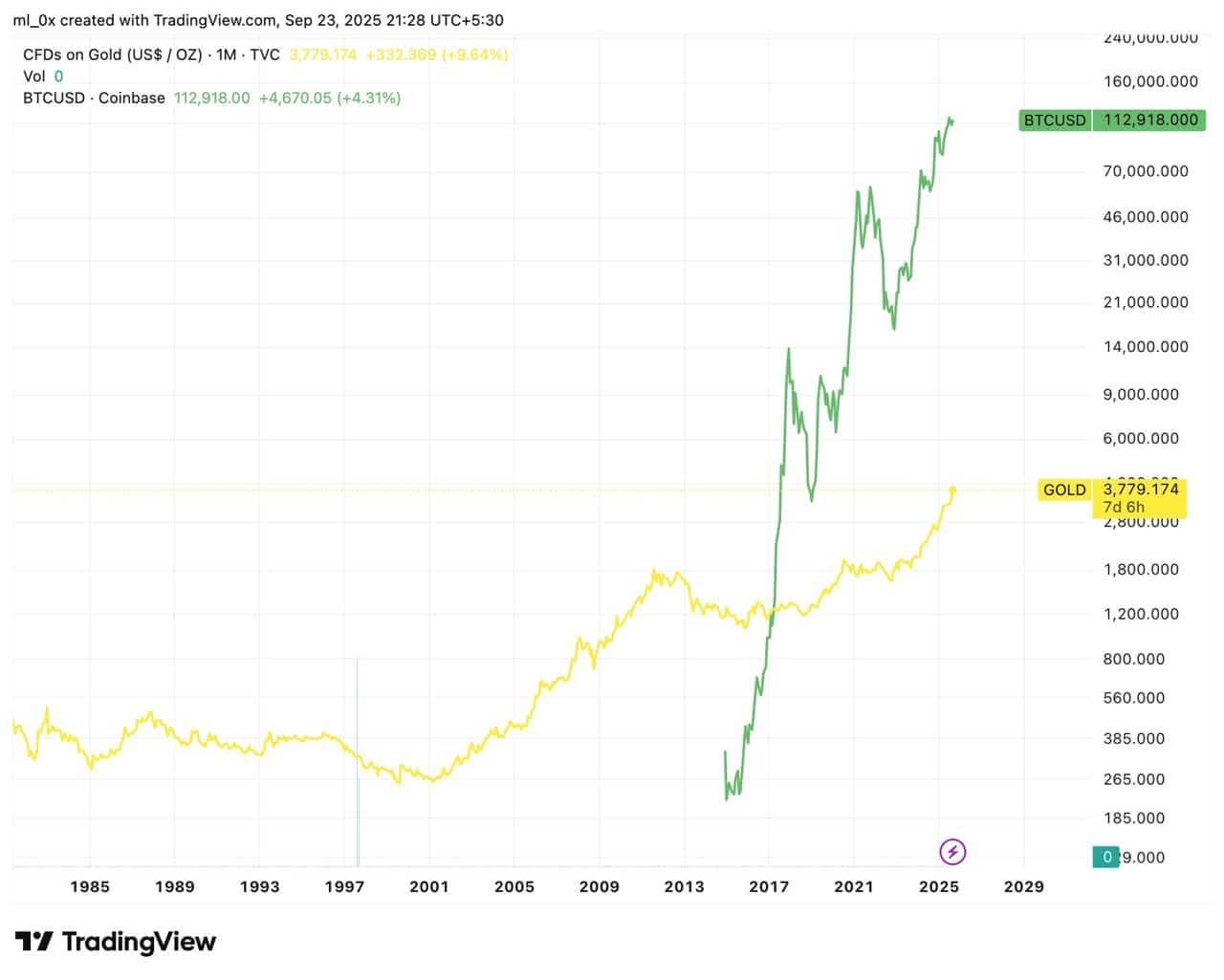

Central banks reported record-breaking Gold accumulation throughout 2025, but the market is starting to see this for what it is: a desperate hedge against a global debt spiral that is reaching its final stage. While Gold remains the classic analog refuge, it lacks the protocol-level transparency and perfect inelasticity that a digital age requires.

In my view, we are watching the start of the final rotation. Gold has an elastic supply—higher prices lead to more mining. Bitcoin’s supply is governed by math, making it the only asset in human history with a truly fixed issuance schedule that anyone can audit with a simple node.

The transition from a speculative "tech" asset to a global reserve standard is happening in the institutional order books right now. Every satoshi vacuumed up by sovereign or institutional mandates is a unit of wealth that will never return to the legacy fiat system.

Curious to see if anyone here still finds a logical reason to hold physical metals as a primary hedge, or if the auditability of the network has made that entire analog model feel like a relic.

https://i.redd.it/eel73mhh17cg1.jpeg

Posted by thecryptoguide13

4 Comments

Gold crawls, Bitcoin flies 🚀

Analog scarcity vs digital scarcity — which one wins long term?

The point about ‘perfect inelasticity’ is really the clincher. When Gold prices rise, miners are incentivized to dig up more, inflating the supply. When Bitcoin prices rise, the issuance schedule doesn’t care. That absolute scarcity is something the world has literally never had before. Great write-up.

This chart desperately needs market cap, not price.

“One way street” is a story. It only works to the right.