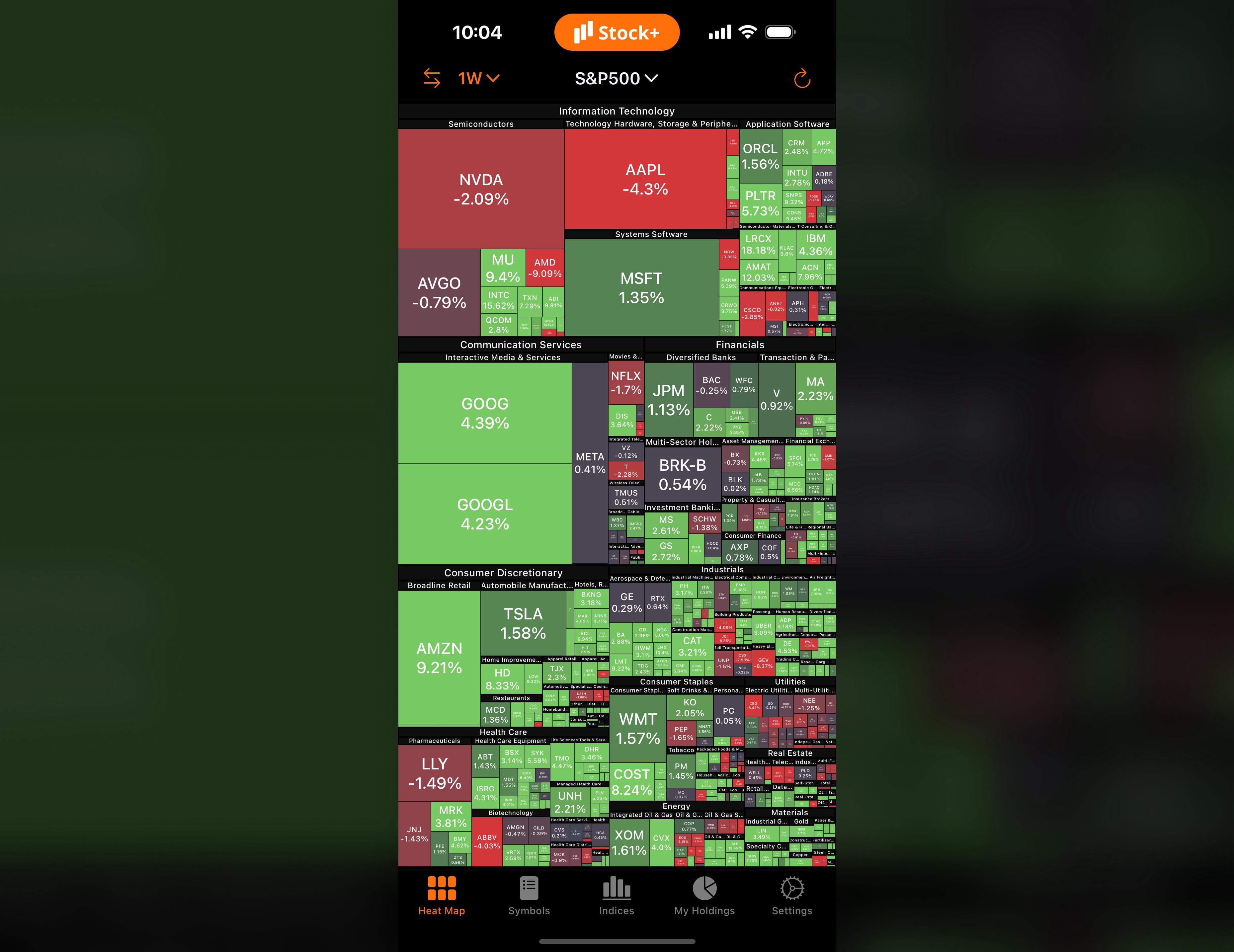

First of all, I don't want to be misunderstood. This heat map is weekly that it visualized via closing prices from January 2 to January 9.

This week was the first full trading session of 2026, and it began with pretty nice gain. The stock market closed higher. Trump's move supported gold and silver prices.

📊 Here are the S&P 500's week-by-week results for the last 4 week,

December 12 close at 6,827.41 – December 19 close at 6,834.78 🟢 (0.11%)

December 19 close at 6,834.78 – December 26 close at 6,929.94 🟢 (1.40%)

December 26 close at 6,929.94 – January 3 close at 6,858.47 🔴 (-1.03%)

January 3 close at 6,858.47 – January 9 close at 6,966.28 🟢 (1.57%)

🔸 Monday: After Trump's Venezuela move, precious metals were rising. The stock market opened higher. On the Asia side, Japan's 10-Year yield hit 2.12% for first time since 1999. Oil stocks surged following Trump's actions. The stock market closed higher. The Dow closed all-time high. 🟢

🔸 Tuesday: Silver continued to rise and reached $80 again. The stock market opened slightly higher. Energy sectors continued rally from Monday. Dow companies led the indices again. The stock market closed higher more than 0.5%. The Dow closed above 49K for the first time ever. 🟢

🔸 Wednesday: ADP Nonfarm Payrolls came at 41K and it was below expectations of 49K. On the gold side, China continued to increase reserves and extended streak to 14 consecutive months. The stock market was mixed around zero. After the session opened, Job Openings fell to 7.146M from 7.449M. It's the lowest level since March 2021. The labor market seems weak. The stock market closed lower. After the 2 days of gains, the Dow dropped around 1%. 🔴

🔸 Thursday: Continuing Jobless Claims rose 1.914M. It's still below the critical 2M level, but the gap is closing. The last week's data was around 1.8M. The stock market opened slightly lower. Trump and Bessent continued to talk about Fed and rate cuts. Trump said has a decision in mind but hasn't discussed it with anyone for Fed chair. Bessent said Fed shouldn't delay rate cuts. The stock market closed higher, but the S&P 500 gained only 0.01%. 🟢

🔸 Friday: December Nonfarm Payrolls rose 50K, missing expectations for 66K. The U.S. unemployment rate fell from 4.6% to 4.4%, better than estimates. The stock market opened higher after the jobs data due to increased rate cut bets. Gold gaining around 1% and reached $4,500 again. Michigan 1-Year inflation expectation came at 4.2% and same as last month. After all the economical data, the stock market closed higher. 🟢 The S&P 500 closed new all-time high.

On the stock market side, Trump's Venezuela move did not have a major impact. Energy sectors benefited at the beginning of the week. After the middle of the week, the market focused on job datas. In January, the stock market is not expecting any rate cuts and February does not have Fed meetings. For March, CME FedWatch tool is showing 25% possibility of 25 point rate cut. I think, this percentage will increase as we get closer to date due to labor market.

What do you think about rate-cut and Trump's move? How was your week?

❓ Note: Many people have asked where screenshots come from in my previous posts. I'm using Stock+ on iPhone and iPad. You can find it on the App Store. If you're using Android, I'm now sure if it's available, but you can try searching "Stock Map" or "Heat Map".

https://i.redd.it/nr82x6i3mqcg1.jpeg

Posted by vjectsport