Relatively new, and looking for feedback from more experienced vertical spread traders.

- Account: margin, can comfortably handle risk

- Underlying: META around 615

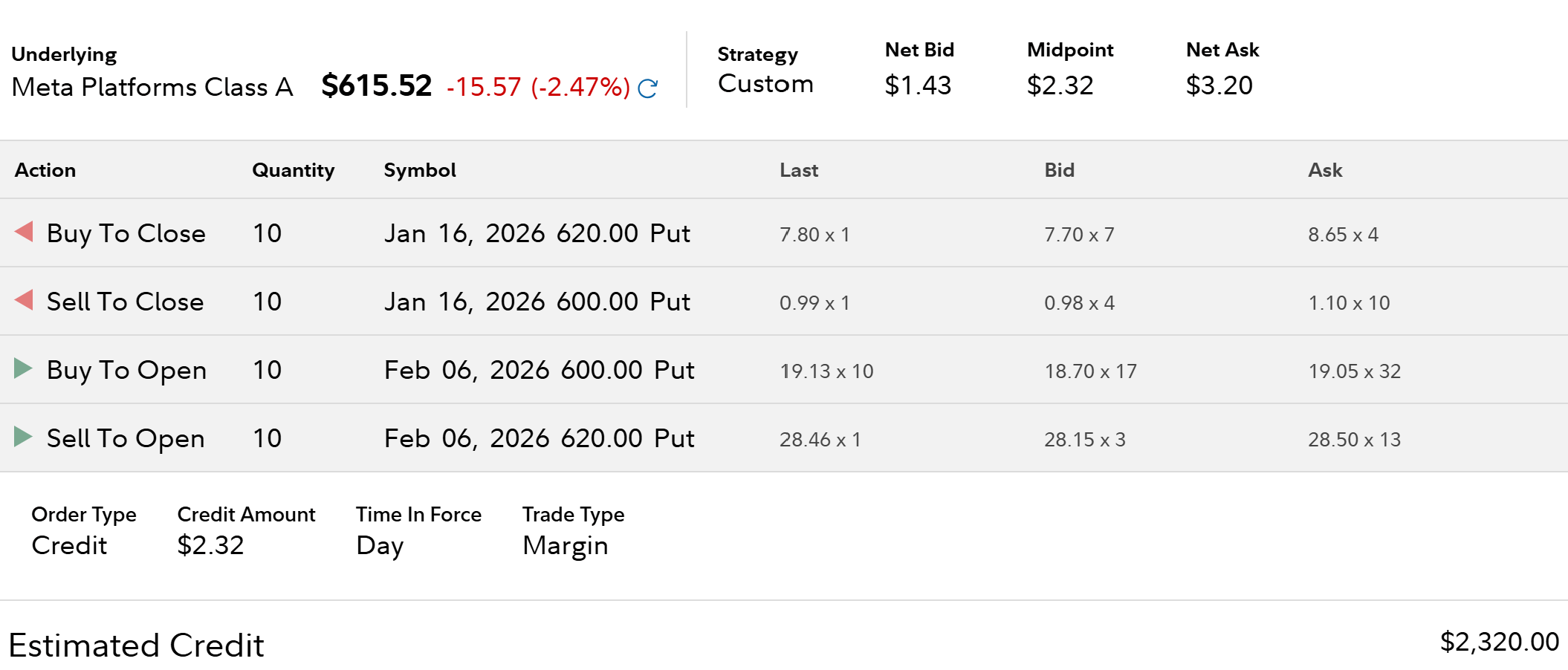

- Current position: 10x Jan 16 2026 620/600 put credit spreads

- Original net credit: about 1.01 per spread

- Max loss: about 18.99 per spread (~$18,990 total) if META finishes below 600

- Current spread price: around 7+, so I’m sitting on a large unrealized loss

What I’m considering:

- Rolling Jan 16 620/600 to Feb 6 620/600 in one 4‑leg order for about 2.32 additional credit

- That would make my total credit ≈ 3.33, and reduce max loss to ≈ 16.67 per spread (~$16,670 total), giving me ~3 more weeks for META to bounce.

Does this make sense? Not looking for personalized financial advice, just trying to sanity‑check my thinking and risk management.

https://i.redd.it/yy2lqgpvzddg1.png

Posted by Ok-Elevator9738

3 Comments

I’d roll here. It’s basically ITM now and assignment risk is real.

For spreads I just focus on staying in control. Roll it down a bit to give price some room. Don’t force credit either — small debit is fine as long as your total rolling P&L stays positive.

If you widen the spread, I usually cut down contract size to keep risk reasonable. And honestly, assignment isn’t the end of the world — sometimes I’ll just let part of it get assigned.

One thing I do a lot is when I roll, I’ll leave some short puts on at prices I’m actually ok owning. Kind of DCA-ing. That also makes future rolls easier, but only if you’re fine taking shares there.

Main thing is don’t panic and keep things in your control

If you are new, you shouldn’t open a position with 10 contracts. Start with 1, and then increase size as you gain confidence.

Looks like a decent trade.

Did you consider a $585 / $605 Feb 6?

A $595 / $615 Jan 30?