He actually also closed ~20k ETH during that drop but re-opened again.

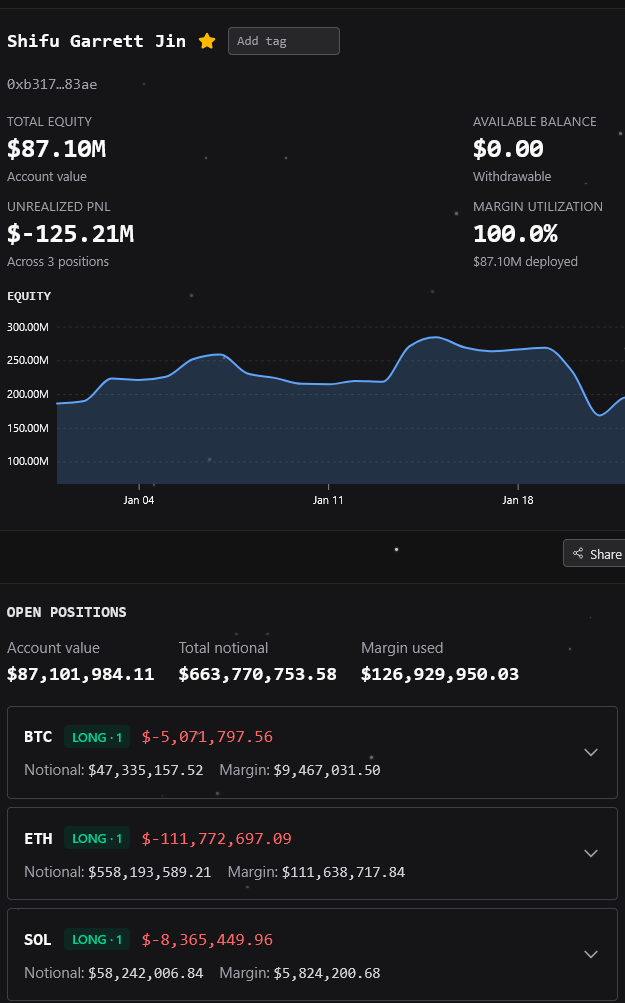

From around 60 Million Up he's now in a 125 Million Drawdown.

Now here is where it becomes interesting, you'll often hear that this is likely a hedged position of his binance positions.

But the data suggests otherwise.

He moved OUT 107k ETH from binance and a bit of Bitcoin ~ 300 Million.

So he bought more ETH with his profits from hyperliquid and he did not go short.

He also still has large untouched ETH and BTC positions.

Anyway, he moved it off the exchange.

And then he borrowed 180 Million USDC against it on AAVE.

He bridged 20 Million of that but generally just left the rest untouched.

Which makes me wonder, if it wasn't to cover his position here (would literally make it so he can't get liquidated) what are the funds going to be used for?

And will he let this account get any closer to be being closed for him? https://wangr.com/watch/0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae Or add more margin which he obviously has?

Mysteries.

Thoughts?

https://i.redd.it/0ze0oz7yxogg1.png

Posted by obolli

2 Comments

Ballz of steel is all I got to say.

Dude loves losing money