TL;DR: I have all my financial data recorded monthly for the first half year since I graduated university and started working full time. I put it into charts that you can see here: The Graphs

This post is heavily influenced by u/personalfanonymous and the great posts they put out tracking their NW over the years!

I am a 24 year old that graduated university May of 2025 and started working full time as a software engineer in the automation industry at the end of June the same year. I too discovered FIRE right at the beginning of my career. Like I have done with other hobbies (coding, anime, games, etc.), I am excited to create a log of everything I have contributed since I started investing. I feel this will really become something cool once time has been allowed to compound my data!

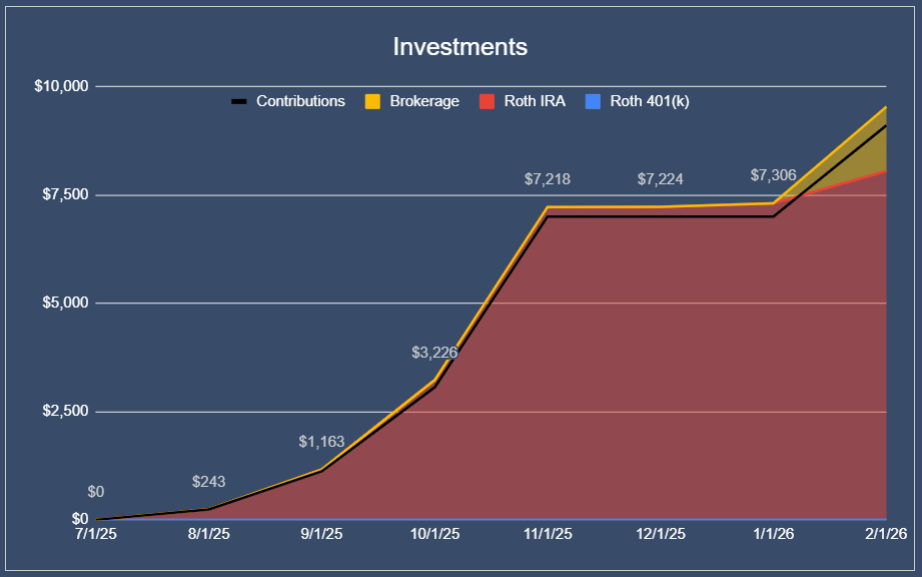

I am mainly tracking my investments, though I do have my savings account tracked to keep a liquid net worth number. Any money I put into savings is not counted as contributions.

My salary over time:

- June 2025: $57,500

- January 2026: $66,560

Current account balances:

- Savings Account: $6,041

- 401(k): $0

- Roth IRA: $8051

- HSA: $0

- Brokerage: $1481

- and Contributions: $9,100

When I graduated, I had essentially $0. I spent all of my savings and otherwise through school and was living off of video games and tv rather than food and sleep by my final semester. But my parents made sure I was debt free by saving throughout my childhood, a great boon to my financial life. I also would apply for scholarships and do part-time jobs.

Before I started my career, my parents generously gave me the rest of the money saved for my schooling, which was ~$4k (this went directly into savings). I also moved back home for my job and so I am not paying for rent or food, despite my asking to.

Plan

Now for the fun stuff, my plan! I have mapped out monthly investing to have, in today's money, $850k in a taxable brokerage account when I'm 50 years old and $2m in retirement accounts when I turn 60. I plan to withdraw $100k/yr in perpetuity with a 2-3% "raise" each year for inflation. I formed my plan using 1/1/26 as the start date, so maxing my Roth IRA last year is bonus cushion!

$850k w/ $100k withdrawal rate over 10 years on FI Calc gives me a 69% chance of success, but I will be able to redeem saved health receipts in the HSA or take contributions from the Roth IRA if I need extra. If the market performs bad in the first or second year, I will also have the opportunity to just go back to work for a while.

$2m w/ $100k withdrawal rate over 30 years on FI Calc gives me an 80% chance of success. The nice thing about a 30+ year plan is that it takes.. 30+ years! If my plan is not working out in 1 or 2 years, I will adjust it. If my plan works for 15 years then starts looking low, I will adjust it. If my plan has my accounts growing too large, I will adjust it.

I currently do not have access to a 401(k) or an HSA, as I need to be employed at my company for 1 year and our insurance plan does not allow for HSAs, respectively. So the money on top of the Roth IRA that I would be investing into retirement accounts is going into my brokerage account for now.

My plan comes out to $2,100/month invested, or $25,200/yr. I recognize that this is an unfeasible savings rate without my family's assistance, and I am wildly appreciative of their help. I also am using this as a loose plan; this is a path that I have laid out to either choose to follow or choose to go a different way. Trying to save without such plan would cause me to way over save or way under save, but this puts me on a trajectory, which I really enjoy.

sidenote: I recently became aware that this does not math out unless my contributions are inflation adjusted as well. My solution will be to give my investments a 3% increase each year. Thank you u/wonderdude2

Even though I have built this plan per month, I am executing it per paycheck and receive bi-weekly paychecks, so I will have 2 more paychecks, or essentially 1 extra month of contributions than I plan for each year (26 paychecks/yr vs 12 months contributed bi-weekly, or 24 investment periods/yr). I will also be increasing my investing as I increase my income, to further build cushion on my plan.

Portfolio

- 25% IVV (S&P 500 ETF)

- 20% BRK.B (Berkshire Hathaway Stock)

- 10% VB (Small Cap ETF)

- 10% AVUV (Fama-French ETF)

- 20% VEA (ex-US Developed Markets ETF)

- 5% VWO (ex-US Emerging Markets ETF)

- 10% BITB (Bitcoin ETF)

I am looking to swap my 25% IVV for 25% UPRO, a 3x leveraged S&P 500 ETF, but I am waiting for a market correction before I do so. With my time horizon, I do not mind waiting a couple years before one occurs.

For my taxable brokerage account, I do not hold BITB and instead hold Bitcoin itself.

I am interested in swapping out my VWO holdings for an emerging markets value fund like AVES, but I need to do more research on this.

I am using BRK.B as essentially another large cap ETF like IVV, but with more diversity as Berkshire Hathaway is not heavy in tech at all. I am definitely not sold on Berkshire for life though.

I would appreciate any insight into my portfolio and what you would change.

Life

I travel a lot for work, 3 or more weeks out of every month. It is kinda AWESOME, and I'm really enjoying getting to see the U.S. and the world. But of course this is not a lifestyle that I plan to live forever, and I will be looking to transition to a more remote role or to a different company in time.

I have gotten to visit amazing places that would take another person a lifetime to experience, from Chicago to Maui to Vegas to Berlin and more! I recognize that I am wildly blessed and want to soak up as much "living" as I can while I am in this season. I regularly have experiences in the places I go, from shows to fancy meals to hiking to night life, so I feel I currently have a good balance between investing and living, which has been made possible by my staying at home.

Conclusion

I am excited to continue investing, excited to continue my work, excited to continue having new experiences, and excited to achieve financial independence! I hope you appreciated my post or at least my graphs, and I would love to hear any thoughts you have!

0.5 Years of Finance Data: $0 to $15k

byu/Fuskiller infinancialindependence

Posted by Fuskiller