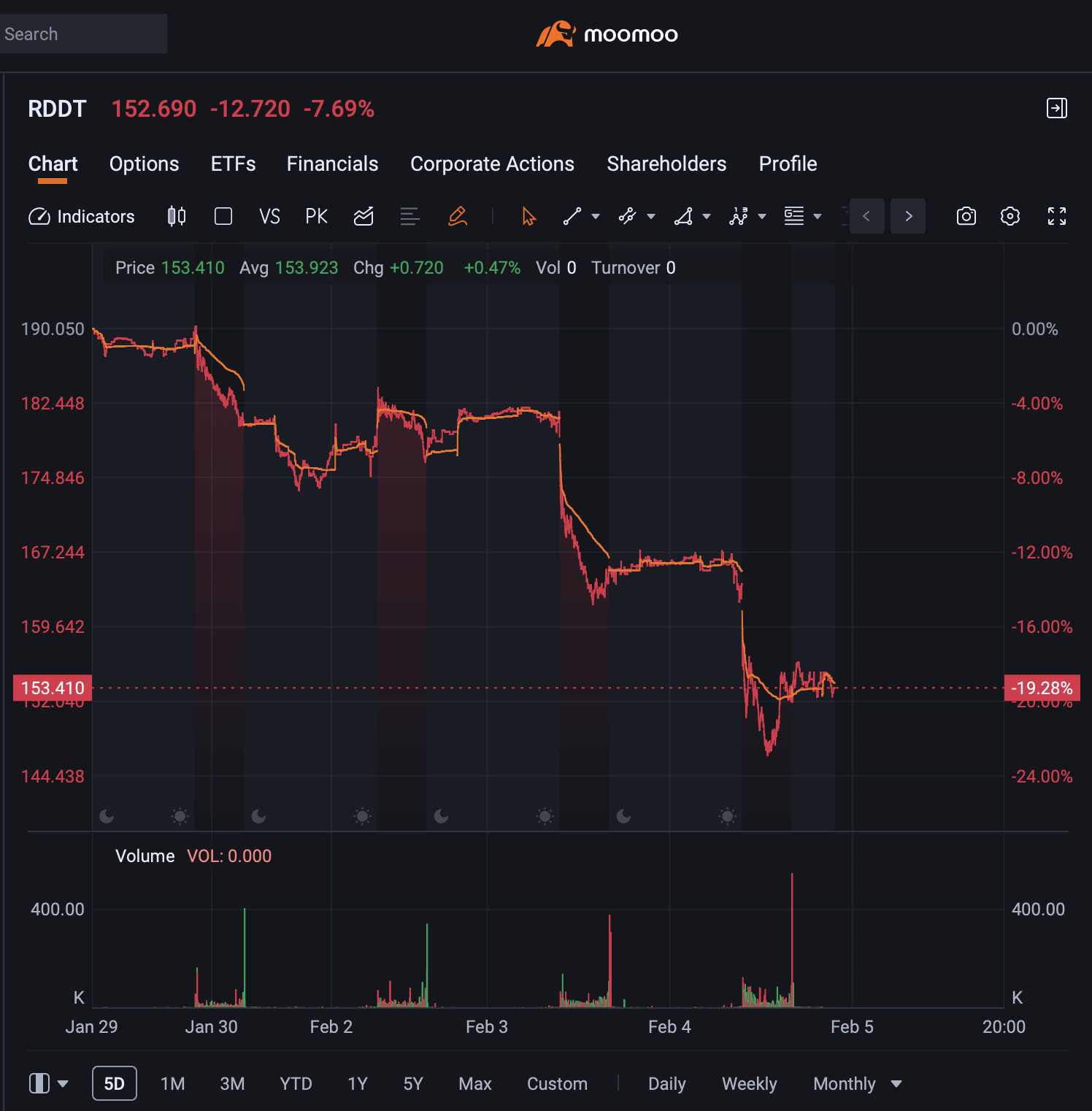

RDDT dropped from 260 to 150 in just 3 weeks. Earnings are coming out today, and from a fundamentals standpoint, it doesn’t feel like much has materially changed since the stock was trading a lot higher. The selloff looks more like sentiment cooling off and positioning being unwound rather than a clear shift in the business itself.

Technically, it’s also getting pretty stretched to the downside. RSI is sitting in oversold territory, and we’ve seen before that RDDT can move aggressively around earnings. I still remember 2 quarters ago when it ran from 155 to 190 after the report, and sentiment back then was pretty optimistic.

What's your thoughts now?

https://i.redd.it/bgkwom5vblhg1.png

Posted by eher271

9 Comments

Based on the market moving as a whole, I think more bloodshed to continue.

Reddit will be indicted for sensitive material involving AI most likely. That is my guess

My regard prediction is that it dives back down to $100 because nobody actually puts money into Reddit.

It’s 99% bots pretending to be liberals, are we surprised?

Don’t hold your breath

I think it’s oversold and will probably be fine in the medium-long term, similar to other tech stock.

I don’t buy the media spin on AI coding, or rather I know enough not to care about it.

Probably related to OpenAI somehow

Price around 85-100 is the fair value range so keep an eye on that range. If it goes below that range then it’s undervalued and scoop it then. Anything above 100 is still shark waters

They’ll beat earnings and stock will stay stagnant or go down 😭 long term it’ll be up.