I had this intraday setup I was feeling pretty good about.

15-min chart.

Buy when MACD crosses above signal and RSI is above 50.

Sell when MACD crosses below and RSI below 50.

1:2 risk-reward. Swing low/high stop.

On charts it looked clean. Nice entries. Logical.

So I ran it through AI to see how it actually performs.

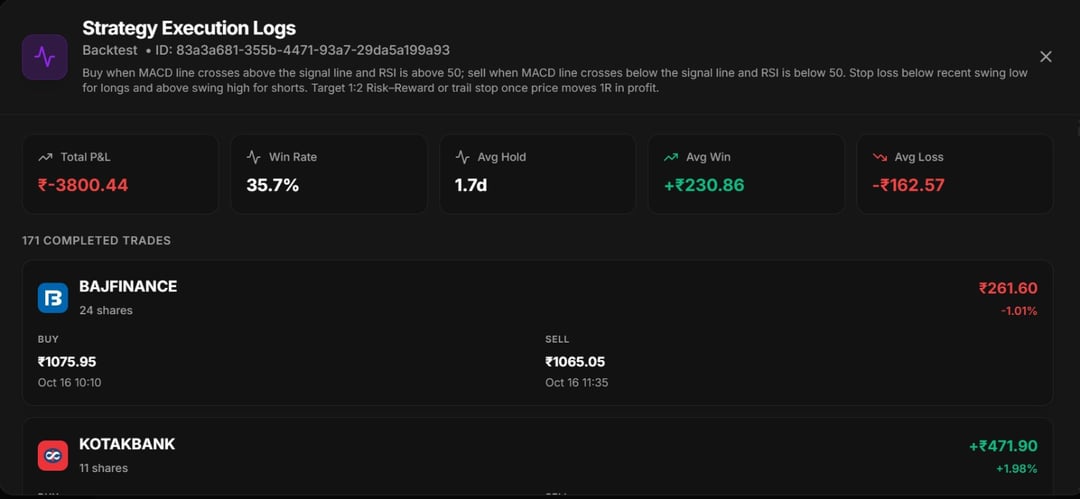

171 trades later…

Win rate: 35.7%

Avg win: ₹230

Avg loss: ₹162

Net result: -₹3800

Yeah… not great.

It wasn’t completely broken, but clearly not strong enough to trust with real size.

Instead of ditching it immediately, I asked the AI what it would improve. And the suggestions were surprisingly practical and not magical, just structural tweaks.

It said I should probably add volume confirmation.

Which makes sense, MACD cross without strong volume is just noise half the time.

Then it suggested adding a 50 SMA trend filter.

Only take longs above it, shorts below it.

Honestly, that alone might filter out a lot of chop.

It also pointed out my stop-loss logic could be smarter.

Instead of fixed swing stops every time, maybe trail after 1R so winners can breathe but profits are protected.

Another thing I hadn’t thought much about – time exits.

If a trade doesn’t move after 2–3 candles, just exit.

No point babysitting dead trades.

It even suggested testing other timeframes. I was only using 15-min.

Maybe the logic behaves better on 5-min or 30-min. Fair point.

What I liked most was this:

It didn’t say “this strategy is bad.”

It treated it like a rough draft and helped refine it.

No promises.

No “AI found the holy grail.”

Just structured improvements.

Honestly, seeing -₹3800 on paper probably saved me from losing more live.

Curious how you guys improve strategies. do you systematically refine them like this, or mostly adjust based on feel?

https://www.reddit.com/gallery/1r3uhny

Posted by kairoX_14

3 Comments

Sorry, but nobody cares

Saw ₹ and stopped reading

If you ask an LLM for advice on a bad idea, the fact that it responds doesn’t change it into a good idea.