Source: https://wccftech.com/western-digital-has-no-more-hdd-capacity-left-out/

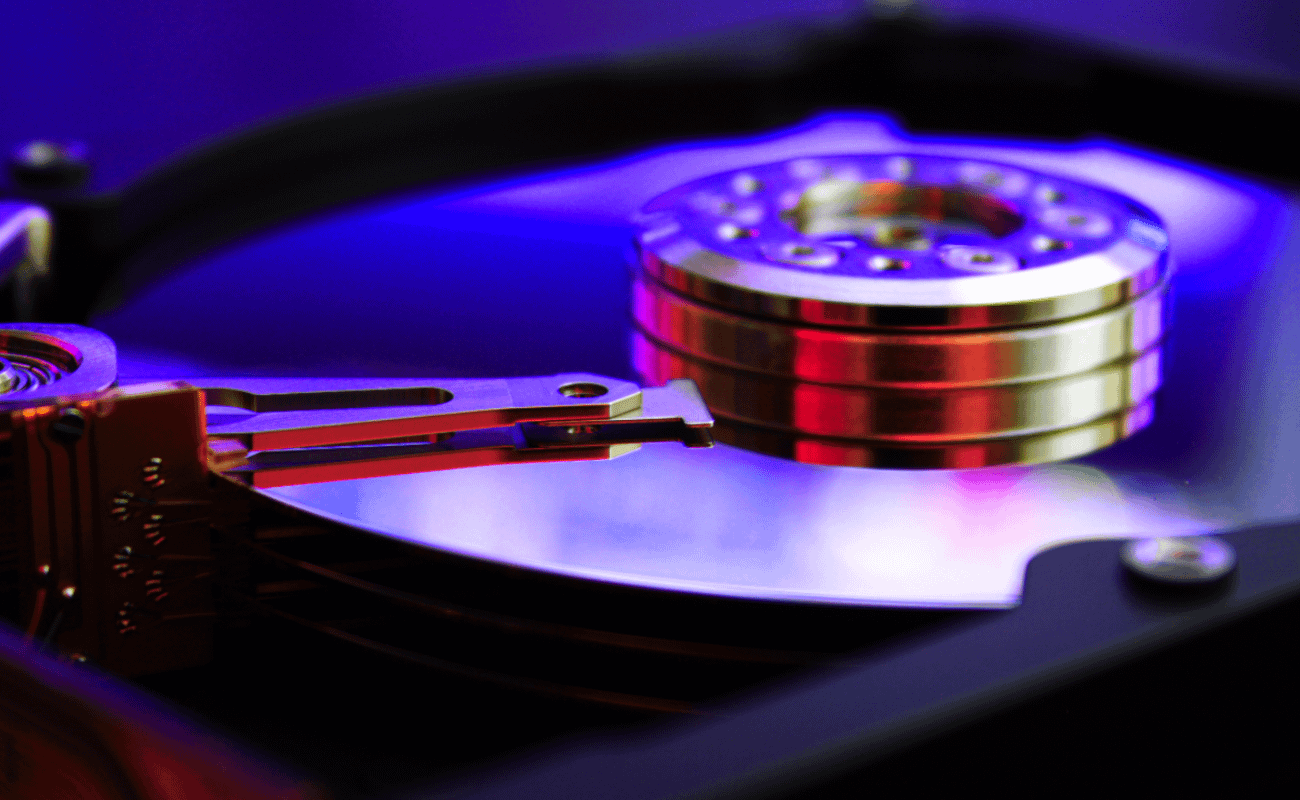

HDD capacity from one of the world's largest manufacturers has started to run dry, according to Western Digital's CEO, as major LTAs have been signed out.

Western Digital's Consumer Share Drops to 5%, as Enterprise Demand Gobbles Up the Supply

Well, the ongoing AI supercycle has disrupted supply chains, and we have talked about DRAM and NAND before, but it appears HDDs are also in significant demand: according to WD's CEO, Irving Tan, the manufacturer's entire capacity for this year is booked out. Speaking at the Q2 earnings call, Tan revealed that the focus has been on developing products that cater to the needs of enterprise customers. Given the pace of hyperscaler buildout, it's fair to say demand for HDDs will only increase going forward.

Yeah, thanks, Erik. As we highlighted, we’re pretty much sold out for calendar 2026. We have firm POs with our top seven customers. And we’ve also established LTAs with two of them for calendar 2027 and one of them for calendar 2028. Obviously, these LTAs have a combination of volume of exabytes and price.

– WD's CEO

When we talk about major PC-first manufacturers pivoting towards AI, it is clear that demand is coming from the segment, as WD's VP of Investor Relations noted that the company's cloud revenue accounted for 89% of total revenue. In comparison, consumer revenue accounted for just 5%. When the numbers are too distant, as in WD's case, it makes sense on a business level to pivot towards enterprise demand while sidelining the client segment, as every other manufacturer is currently doing. And, in the case of Western Digital, well, this strategy is working for them.

The demand is primarily driven by the large-scale data center buildout occurring worldwide, with HDD requirements being more prevalent in US-based facilities. For those unaware, AI is nothing without data, and to store large quantities of data, CSPs use HDDs, which are the most cost-effective and efficient storage medium. The data scales to exabytes in data centers, encompassing content such as scraped web data, processed data backups, inference logs, and related data. Like AI memory, HDDs have seen massive adoption in recent years, putting suppliers under pressure.

With the AI frenzy, we have seen major PC components go into short supply, and unfortunately, this trend will persist for quite some time before we witness a meaningful recovery.

Western Digital says 2026 HDD capacity 100% sold out, hyperscaler AI data center cloud 89% of revenue, consumer 5%, long term deals to 2028

byu/callsonreddit inwallstreetbets

Posted by callsonreddit

13 Comments

Similar stocks: MU SNDK STX

Market caps:

* MU: 460B

* SNDK: 90B

* STX: 90B

* WDC: 90B

I believe these memory chip stocks have the potential to be trillion dollar companies. Obv not in a few years but 10+ years out considering they expand to other products too

Edit: You guys can downvote me all you want but I told my dad to buy SNDK in Oct 2025, before the hype, and he is +300% on his shares. Clearly I do my research and have decent predictions

NRGV will power all this

Just order some from Amazon basics. Solved it for you.

Edit to add this nugget from my Gemini discussion on the subject of Amazon owning and reselling hdd:

The Difference: Ticketmaster uses dynamic pricing to maximize profit on a finite number of seats. Amazon uses it to manage inventory levels across a global supply chain. It’s less about “greed” and more about “automated supply-and-demand management,” though it feels like gouging when prices jump 20% in an hour.

Think if IBM didn’t sell it’s hard drive manufacturing division. Western Digital eventually bought it.

Or if Intel didn’t sell off its SSD products. It finalized its SSD business to SK Hynex in March last year for a measly $9 billion.

These companies would be swimming in cash today if they just tried to hire less MBAs and consultants that focus on the quarterly reports. They wouldn’t have been told to sell their high volume, low margin businesses.

BUBBLE NO ROI IMPENDING CRASH DOOM DOOOM DOOOOOMM

This AI circlejerk is going to be the biggest rugpull when it comes crashing down.

So investors are cooked when this blows up is all I hear here.

sooo, they are fully sold for the year, deals till 2028, 90% of their costumers are hyperscaler AI, and in the first months of 2026 we are crashing because of fear of a bubble ?????

I pray the bubble burst daily. 🤬

https://preview.redd.it/w1xijp9pbvjg1.png?width=651&format=png&auto=webp&s=cef30b01d5cf8a8446f971b095f1e8126b4f9c70

BRB digging my old pc I built in 2010 out of the basement to scavenge the 500GB platter Hard drive

Hell yeah 😂🤣 time to pump this thing to 2000 dollars per share boys!

Only way is down from here.