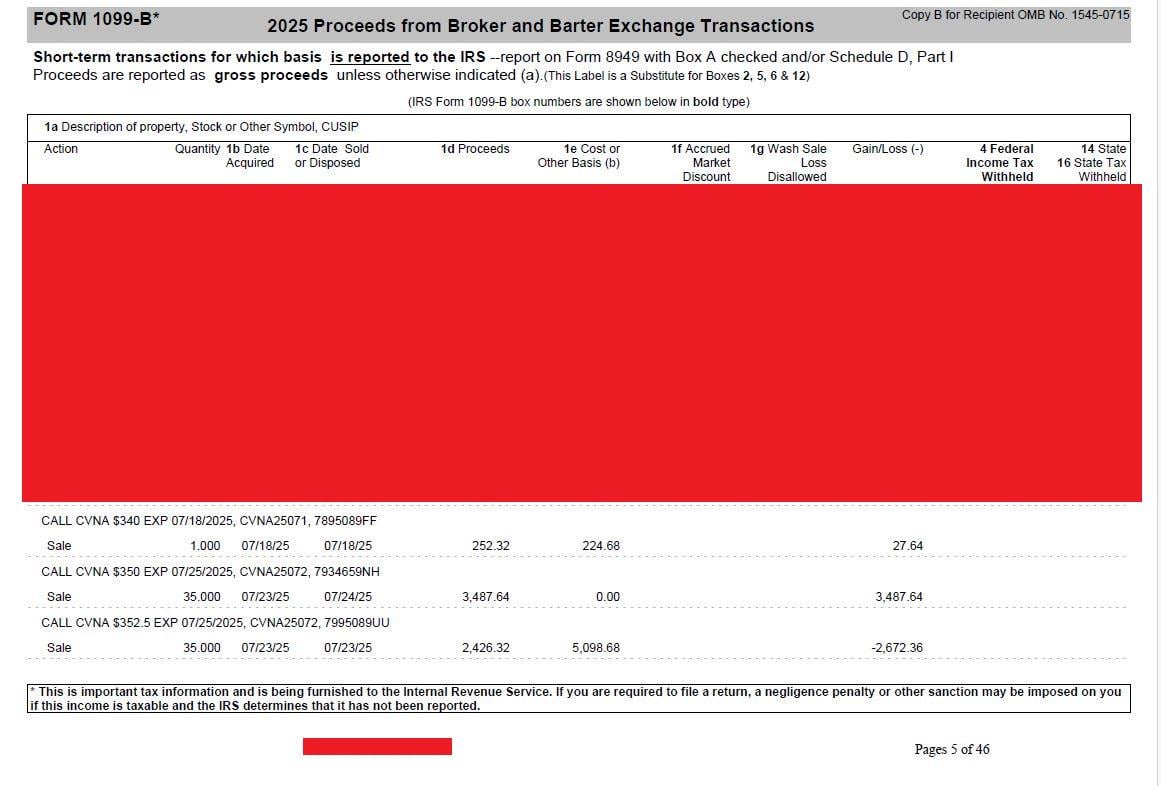

Had a $11,611.03 loss trading CVNA call options in 2025. It generated wash sales turning it in to $7,445 taxes owing on this loss. Still trying to process and understand how wash sales can f*ck option traders and if im stuck with this tax bill on my loss.

Looking at my fidelity ledger and adding up the net proceeds of buying and selling of all CVNA call options its: -$11,611.03.

Looking at the 1099B net realized gain/loss its: -$51,065.85.

If you subtract the real loss (-$11,611.03) from -$51,065.85 you'll get $39,454.87 (which is $0.26 off from the wash sales number of 39,455.13 on the 1099b idk why, maybe some sort of rounding)

Am I fucked? Here are (7) pics: https://imgur.com/a/nMJHV8m

($11,611.03) CVNA options loss wash sales resulting in tax bill going for $0 to $7,445. Cant make this shit up.

byu/Full-Mouse8971 inwallstreetbets

Posted by Full-Mouse8971

11 Comments

Carvanguh

Why are you washing a sale

Must have been traded in December? Wash sales should equal back out after a 30 day period without any trading of that same contract/ticker. So if It was December although you’ll show a gain last year you’ll show a loss for 2026 assuming you don’t keep trading the same contract and washing it out further. Is my understanding at least

U belong here bro

Don’t do the crime, if you can’t pay the taxes

bad news for you, wendys is closing so many locations at such a fast pace you might genuinely be completely fucked.

Bro got absolutely bodied by the IRS while already bleeding out from his trades, that’s some next level financial masochism right there.

At least you took your yearly bath. Filled to the brim with your blood, sweat, and tears.

Had a similar situation a few years ago. Go talk to a good accountant and explain. Also the irs basically doesn’t exist right now so you can try to just hope for the best. Not tax advice.

IRS is your father now sadly Wendy’s can’t save ya

You telling me a carvana washed this sale?