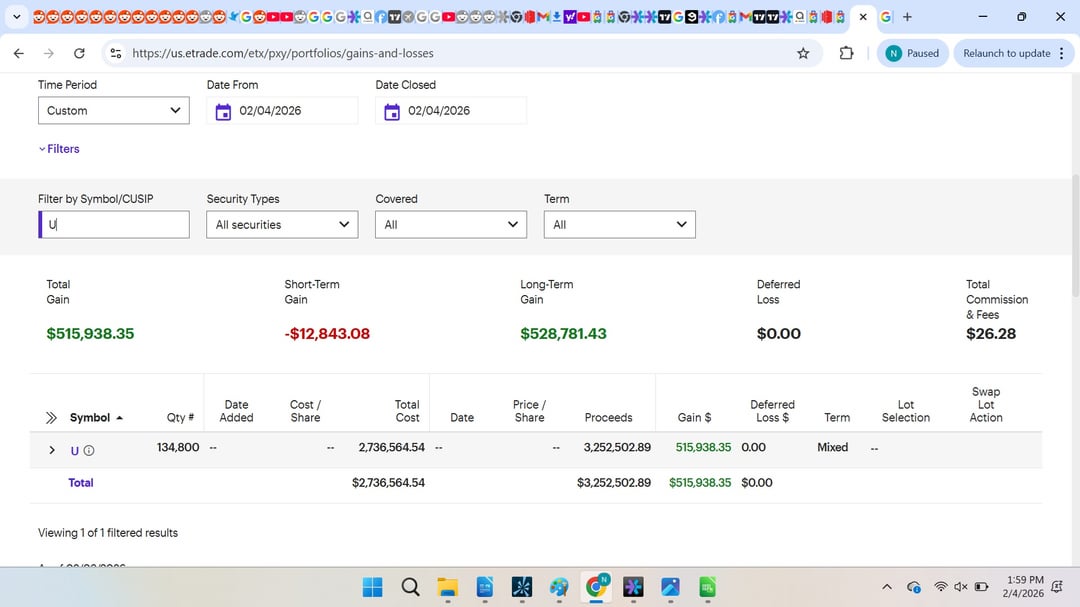

On 2/4 when the market was dropping, an Etrade glitch added 21100 shares of ticker U ($25 a share) out of nowhere to my account as shown in pictures. I panic sold and closed out my position. Since it was down like 10% that day on a million dollar position on margin, I force closed my position after seeing the six figure loss. This is when I found out they glitched out and added 21100 shares to my total because closing my position resulted in a short position due to their error while the stock rebounded so I ended up chasing it back up and buying to cover. Despite me having a 530k realized gain, my account balance did not reflect this and decreased due to the heavy losses I incurred from their phantom U position they added. The realized gain still was not fixed so I spent 5 hours on the phone with them while they made me dig through all my transactions myself since they are incompetent and were saying no error occurred while my other stocks were dropping resulting in another six figures in losses on my other positions. When I asked for compensation, they say errors like this happen all the time and their terms of service says it can happen. Their customer service is bad and I'm forced to eat a loss because of their incompetent system. What can I do?

TLDR: don't use Etrade. They increased my position by 21100 shares of U and added a fake 530k realized gain while my account balance decreased due to their system error and said errors and glitches happen all the time and they aren't liable. Please help

https://www.reddit.com/gallery/1r9n261

Posted by Ok_Moment_7362

22 Comments

Wow

For entertainment purposes only. Machine malfunction voids all payouts.

Did you try it in incognito mode?

Why the fuck do you think wsb can help lmao

“Brokerages and financial advisors are primarily reported to the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) for misconduct, fraud, or unethical behavior.”

1969- nice.

Contact customer service. Wallstreetbets is not ETrade staff

It was added out of the blue? Then you won’t have an order for it correct?

E*trade does have a sub though, and if it’s like fidelitys then they have customer service reps answering on there.

Not buying the whole “out of nowhere” story. Why that particular stock? Also, why would the compensate you for your other positions losing money while you were busy messing with this one? You’re whole post sounds shady to me.

The nail in the coffin is those tabs…. look at all of them. Never trust a man with that many tabs open.

You must’ve f-cked around at some point because it sounds like you found out.

U need to talk to ETRADE.

Also, your TLDR is as regarded as you. Theres nothing wrong with Etrade, but theres def something wrong with you.

lmao

[https://www.reddit.com/r/Daytrading/comments/1puz63z/this_is_to_warn_others_that_webull_is_the_worst/](https://www.reddit.com/r/Daytrading/comments/1puz63z/this_is_to_warn_others_that_webull_is_the_worst/)

[https://www.reddit.com/r/Thailand/comments/1oblvff/comment/nkq2242/?context=3](https://www.reddit.com/r/Thailand/comments/1oblvff/comment/nkq2242/?context=3)

Did you have any contacts out involving Unity? If they accidentally tossed them into your account by accident, why would you sell them? You generally have a few days on a margin call to act before they liquidate stuff. It seems like they would have reversed stuff easily but selling creates a lot more unwinding needs.

This is beyond customer service OP

* File complaints simultaneously with FINRA, the SEC, and your state securities regulator

* You will find a securities attorney (look for that specifically), you’ll likely get one on contingency at that level of damages

You likely have a viable case imo, whether you recover all of it is another question given you made a conscious decision, which will weaken it for you

so you used money that wasn’t yours to gamble and lost it? sounds like everything from the point you sold on is on you.

Uhhhh anyone getting this?

All your tabs open caused the glitch! You are a degenerate. OMG. Do you know how much memory all those tabs are eating up.

Dont worry bro, I’ll fix it

“Glitch”

Setting aside the fictional position, if the end result is shorting and then buying to cover, that establishes a cost basis, you don’t have 500k in realized gains.

Call back and tell them you want to file a trade dispute, don’t talk to a front line rep or their manager, ask for someone that specifically deals with dispute resolutions. Don’t threaten to call a lawyer or you’ll have to go through their legal team and that’s a pain in the ass.

You won’t get back anything for opportunity cost or trades that you “could have placed” because that’s speculative and not how these work.

Tell them you want the sale based of those non existent shares and the subsequent buy to cover busted, like it never happened.

If they won’t let you work with someone that handles trade disputes, then file a Finra complaint, all brokers are required to respond to you and Finra in those instances.

Quality shit post