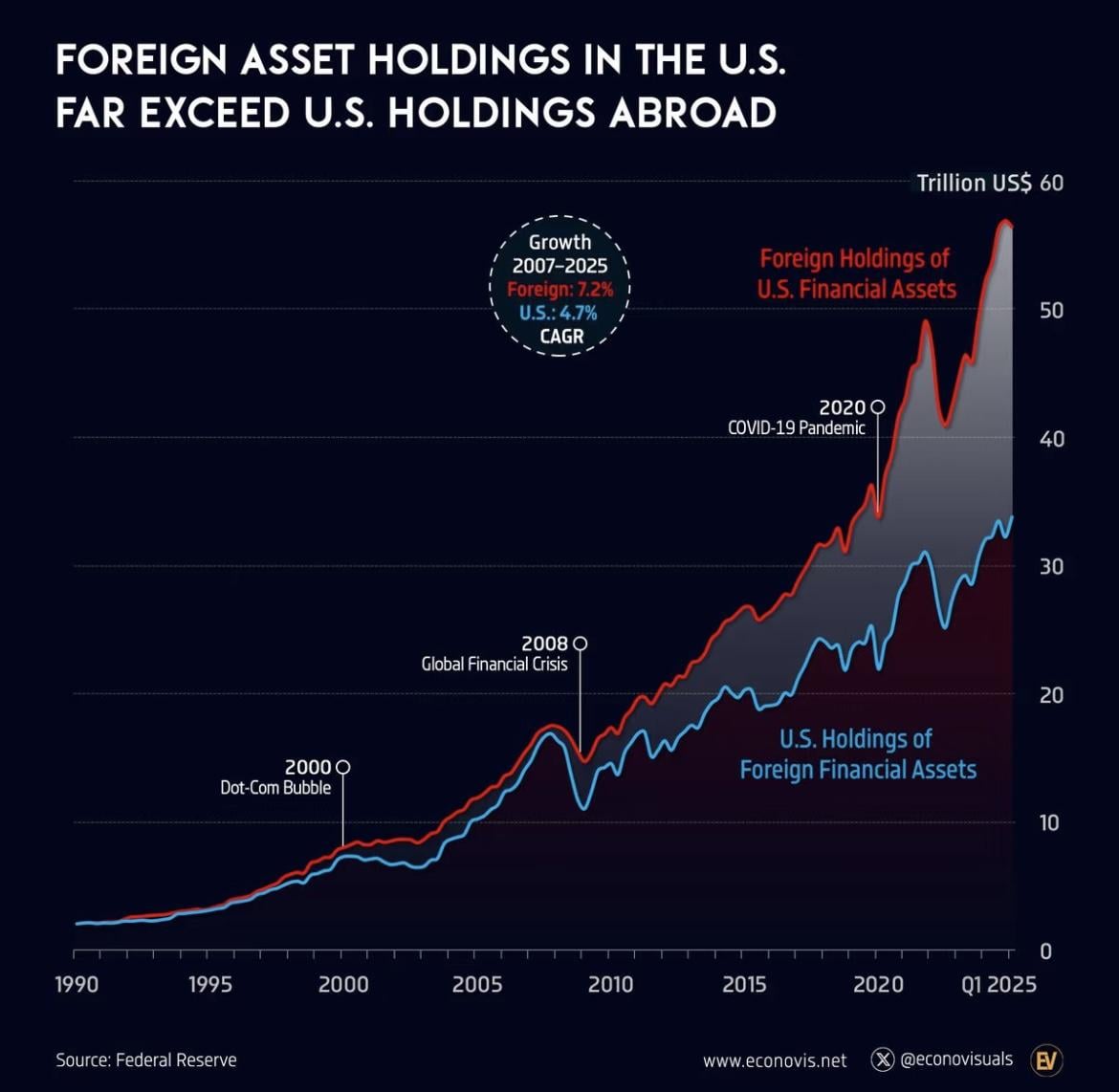

Since 2007, foreign ownership of U.S. financial assets has grown at an annual rate of 7.2%, far outpacing the 4.7% growth rate of U.S. ownership of foreign assets, reflecting the sustained global appetite for U.S. markets.

While in Q1 2025, foreign investors held over $55 trillion in U.S. financial assets—almost 1.6 times the value of U.S. holdings abroad—underscoring America’s increasingly solid position as a net capital importer.

Key turning points include the 2008 financial crisis and the 2020 pandemic, when U.S. equities and dollar assets attracted even more safe-haven flows, widening the gap further.

Source: Federal Reserve

Stocks worth watching in recent market would be NVDA, AIFU, AMD, OKLO, TSLA, PLTR

https://i.redd.it/t0ac9kcxmmpf1.jpeg

Posted by North_Reflection1796

14 Comments

That kind of goes with being the world reserve currency.

I wouldn’t bet on it continuing that way with worsening polarisation and undermining of democracy

Quit trying to pump AIFU, it belongs nowhere in that list

Is there logarithmic graph instead?

This along with record participation in 401ks explains the bubble like valuations.

Not surprising, us has been the best place to invest. US, for the good and for the bad, is the most business friendly developed country

As always 🇺🇸

OR, this just means Americans aren’t investing as much as they should overseas recently.

AND/OR, the whole world simply has much more investable assets than the US recently, so more is flowing to the US.

AND/OR, US stocks have grown faster than foreign recentlu

Perhaps we need at least two more lines on this chart, US->US and Foreign~>Foreign, not just Foreign->US and US->Foreign to draw any conclusions?

Looks like a house of cards

Crazy to see how dominant U.S. markets have become, foreign capital has been flooding in at 7.2% a year since 2007, while U.S. investments abroad only grew 4.7%. Foreigners now hold ~$55T in U.S. financial assets, nearly 1.6x what Americans hold overseas. Crises like 2008 and 2020 just pulled even more safe-haven money into the U.S., and that gap hasn’t stopped widening. No wonder big names like NVDA, TSLA, PLTR and AMD keep riding the wave

The trade deficit needs to be reflected somehow. We buy goods with dollars and the foreign country needs to either buy goods back from us or invest those dollars.

It’s almost like we devalued the money they were holding from trade, which was a bad deal for them, so they turned right back around and put it in our markets.

World instability at an all time high, people are betting on the US as they should, being somewhat stable and in the unique position of not being in danger of an invasion. This is despite the issues it faces internally.

We’ve known this for years. Michael made a documentary about who owns us…