Just crossed with this Leon Tweet talking about RWAs on Arbitrum tokenized by Robinhood and even if I dont like at all Robinhood and everybody should stay away from them this is kind of bullish for Arbitrum and Ethereum ecosystem because it tells us that Ethereum is the go to ecosystem.

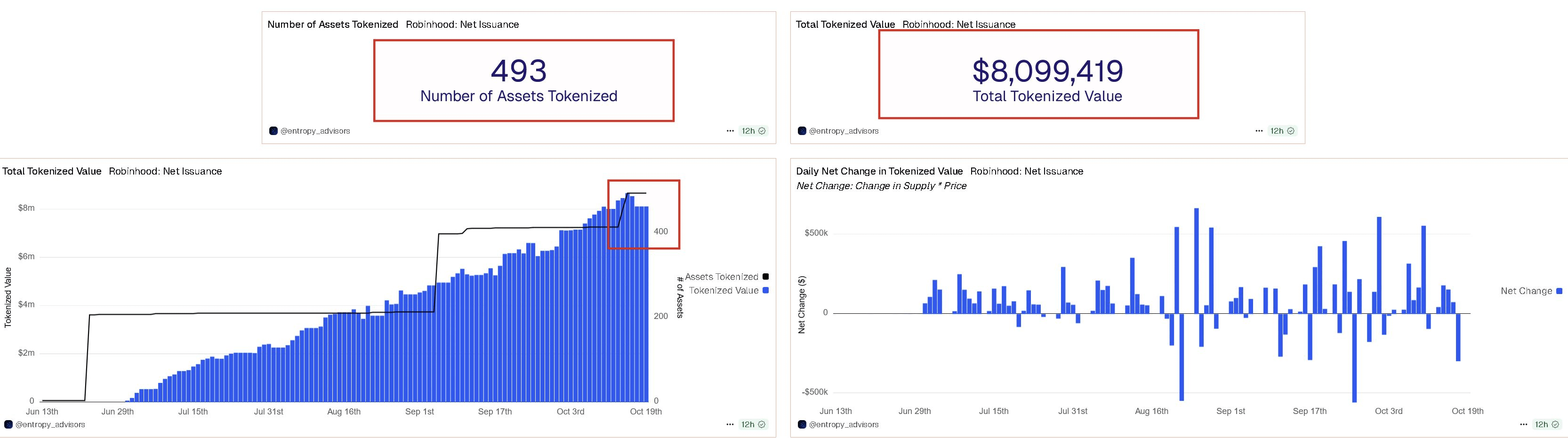

As you can see in the image above, Robinhood has officially crossed a massive milestone with 493 US Stocks and ETFs that are now tokenized on Arbitrum, equivalent to a total value of $8.1 Million.

We are not watching a simple experiment, we are seeing a real movement and lifecycle activity for tokenized equities. The total mint volume has reached $19.3 Million with $11.5 million burned.

As the tweet states the top five tokenized assets by value right now are:

- GOOGL – $745K

- BMNR – $589K

- VOO – $377K

- PLTR – $373K

- IREN – $363K

This is really great development for a lot of reasons, this keeps showing how traditional financial assets are evolving to gain digital twins on chain, bridging regulated equities to decentralized infrastructure Furthermore, choosing Arbitrum, an Ethereum Layer 2 known by speed and low fees, shows that scalability and cost efficiency are now enough for mainstream fintech integration.

One thing cant be denied, onchain transformation of traditional finance is accelerating. Not so long ago this was just a theory or a pilot program, but now, this is real. Real capital, real assets and real liquidity are now flowing through public blockchains.

What a time to be alive!

Source:

$8.1M in Tokenized US Stocks on Arbitrum: Robinhood Pushes Real World Assets Further Into Ethereum’s Ecosystem

byu/kirtash93 inethtrader

Posted by kirtash93

5 Comments

[AutoMod] Metrics

Do you think that this will increase arbitrums price?

It’s awesome to see crypto bridging the real-world gap!

^(!tip 1)

Development keeps coming to ETH and its ecosystem !tip 1

As a ARB usecases this is awesome:)

I am still sad for the people who will buy tokenized stocks on Robinhood, they will be taken advantage of for sure.

!tip 1