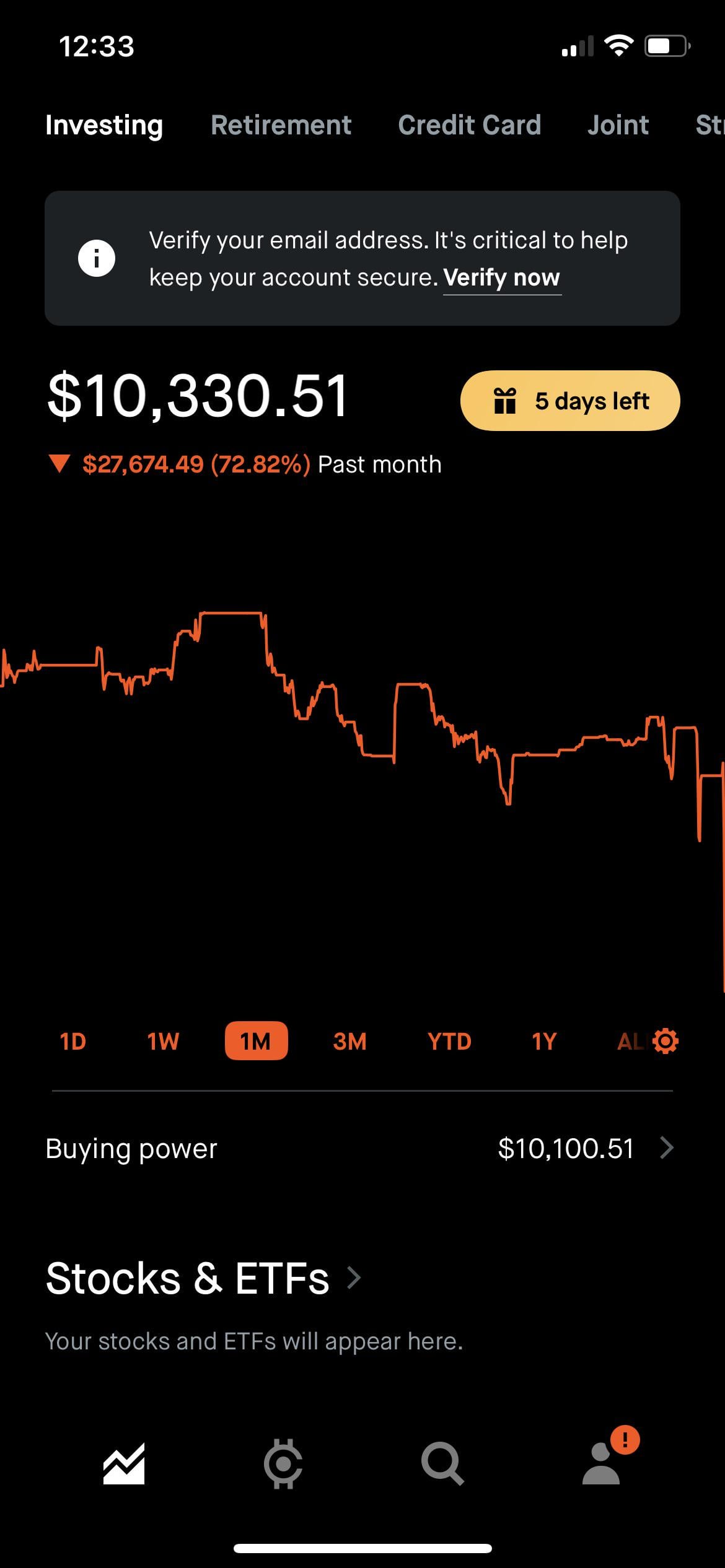

I’m not gonna lie and say I invest in index funds. I like volatile/hype tech stocks. But having 24/7 “prediction markets” on a trading platform is pretty crazy.

I’m not gonna be a baby and blame anyone but myself. I had surgery on my shoulder and can’t drive, workout, game, and schoolwork takes twice as long. I can’t use my dominant arm for literally anything. So this is what my dumbass brain resorts to.

Anyways point and laugh at the regard, I know it always made me feel better.

https://i.redd.it/9zg3s1cy3y2g1.jpeg

Posted by ApatheticOblivion

17 Comments

Got more then me at 28 lol I’m starting with just a thousand. But I’m gonna start it in index/ lower portfolio positions with higher volatile stocks. You got 10k use it smart now and take this as a lesson. You got this

https://preview.redd.it/lap23ukz4y2g1.jpeg?width=1080&format=pjpg&auto=webp&s=afde56724e51a35fe122e5f69c892433ecacf845

At least you don’t have a margin call, like a lot of us regards did this week.

Are you great yet?

Just be careful and don’t risk the rest all in man.

The prediction part of robinhood barely registers to me. But also, I do lots of other things that aren’t good for me. I guess we all have our vices

dont forget to verify your email address. wouldnt want you to get locked out of holding that bag.

yeah. i ve been using the robinhood prediction markets also to “invest” in football games. a lot of people do. they are going to crush next earnings. calls on robinhood

Idk how the app

https://preview.redd.it/m5iva18tdy2g1.jpeg?width=900&format=pjpg&auto=webp&s=baf56b64d41381b66bdac8fa02f7adb145996b64

Those are rookie numbers kid, gotta get those numbers up.,..

You got $27,000 in your account and you haven’t even verified your email address yet… now that’s some next level regardium right there! 😂

Clear the cash & storage… It will fix the red thing 😎

10k weekly spy calls gonna be huge

You have already more than what is enough to recover quickly. Just stop gambling and be responsible in your trades and you will see wonder. Just stop gambling and focus on trading and investing. Wish you all the best

Bro at least you didn’t liquidated like the rest of us

And you haven’t lost more then 100% yett…

Margin is a beast but can enslave you from pver extensions

Hey CHATGPT, how did this random Redditor nuke his account?

Bro, this guy didn’t lose $27k in a month on normal stocks — he was clearly nuking himself with Robinhood’s 24/7 prediction markets (basically casino bets dressed up as finance).

The clues:

1. The chart shape

Straight down in sudden cliffs + weird spikes = gambling contracts going to zero, not stocks.

2. His confession

He literally says he trades “volatile/hype tech” and got sucked into prediction markets while bored and recovering from surgery.

That’s peak degenerate behaviour.

3. His buying power

$10,100 buying power with only $10,330 portfolio value = he sold everything at losses and the cash just settled. That happens when you place tons of rapid-fire bets.

4. Speed of loss

You don’t lose 72% in one month with NVDA.

You lose it by YOLOing prediction contracts and weekly options.

Verdict:

He wasn’t investing — he was basically pressing the “roulette button” on Robinhood until his money evaporated.