I am writing this on my phone. So forgive me for any typos or formatting mistakes.

What IOVA does?

Iovance Biotherapeutics is the first company to get an FDA approval for a cell therapy that works in solid tumors. (Roughly over 90%, remaining 10% being Blood)

Their product, Amtagvi (lifileucel), is a one-time TIL therapy (tumor-infiltrating lymphocytes). Doctors take T cells from the tumor, Iovance expands them into billions, and those cells get infused back into the patient. Very intuitive, essentially using our own bodies cells to fight cancer.

Melanoma patients who failed everything else can now get a therapy that produces real, durable responses.

This is the first real proof that cell therapy can work outside blood cancers. Recently 5 year real world data was released and it only strengthened its proof that the drug works.

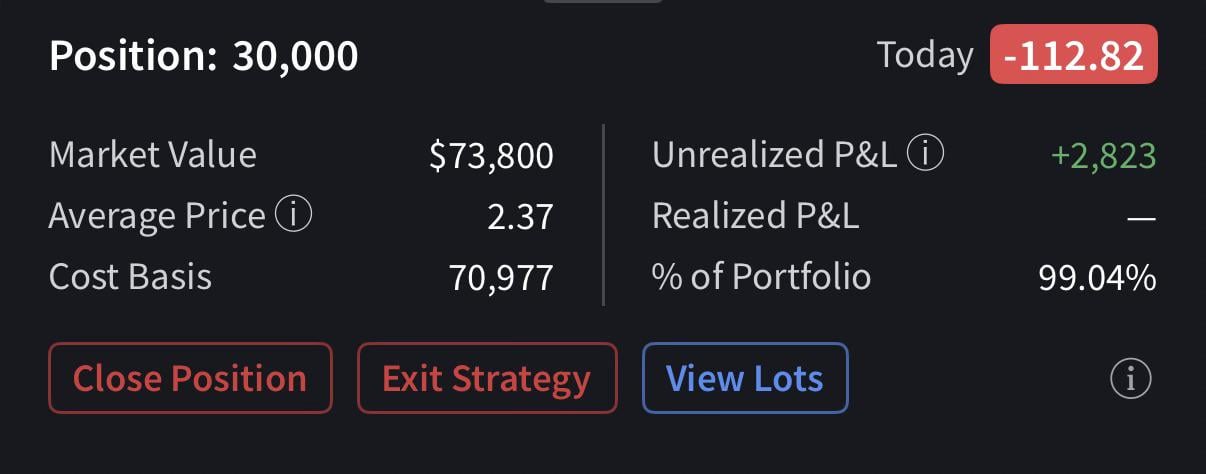

I hold 30,000 shares.

2) Why This Is Actually Big

Solid tumors are the majority of cancer deaths. You may have heard of CAR-T but that doesn’t work on them. They only work for blood cancer which is only 10% of TAM, rest being Soldin tumor cancer. Chemo and immunotherapy are the current 1L treatment, and 2L severely lacking treatment.

If TIL therapy becomes a category across multiple cancers, the market is massive.

Melanoma alone is 1 billion USD.

Add cervical, NSCLC, head and neck, ovarian: the upside gets wide quickly.

In fact the pipeline already includes ongoing trials for all of the above indications, with several already in late stage phase 3. The biggest one being NSCLC which is notorious in the oncology space for being one of the hardest cancer to treat. And Amtagvi is kicking ass in this area. With the recent early results indicating that they are the best in class drug with over 2 times better efficacy across all metrics with current best in class treatment. NSCLC itself is at least 5 billion USD market

IOVA has the head start in this space. No other TIL player is even close to where IOVA is. They have their own manufacturing facilities that’s worth 1 billion USD itself.

3) Sales Are Actually Real

Amtagvi launch started in mid-2024.

Early numbers:

• Q2: around $31M

• Q3: around $62M

Over 100 patients treated in a single quarter.

70+ treatment centers active or onboarding.

Revenue guidance for 2025 is around the 250-300M range. And management has reiterated their range for EOY.

For a ~$1B market cap company, that’s extremely low valuation.

3) Bear Case arguments that don’t hold water

Execution:

With IOVA bears and shorts never questioned the science but about the execution. I will admit that execution in Q1 has been terrible. However, they bought in a new CFO (Corleen Roche) in Q3

and she had already improved margin by 40% in Q3 alone along with several other improvements planned for Q4

Adoption:

This was another pain point, during the early days and up until Q2 for IOVA. Since, it is a Novel treatment. Patient referrals by Doctors was slow, and they had to figure out the logistics part of the process. In Q3 IOVA has teamed up with McKesson (The biggest healthcare distribution and services company in the world specializing in Novel therapies). The benefit from this partnership will be reflected in Q4 earnings and they continue to setup more ATCs and train up staff. Q4 will be explosive.

Upcoming Catalysts

These matter far more than the long essays analysts write:

1. Quarterly revenue beats

Sales are ramping fast. If they keep beating, the market re-rates this quickly. Recently after Q3 earnings several analyst have rerated already to high target. Q4 will be huge for this stock

2. New indications

Cervical cancer filing potential.

NSCLC Lung cancer data updates for FDA approval

First-line melanoma combo with Keytruda in Phase 3.

3. Global approvals

EMA and UK reviews underway. (UK is already approved but not announced)

Canada already approved.

4. Manufacturing improvements

Shorter turnaround time = more patients = more revenue.

5. Buyout potential

If the tech proves generalizable, any major pharma would want this platform. 2026 will establish IOVANCE as a platform for TIL therapy

Long-Term Bull Case

If TIL therapy works across multiple tumors, this becomes the cell therapy platform for solid cancers. The total addressable market becomes enormous. At least $30B and at current share prices that’s $75 per share. Even if you are super bear about this stock at $10 minimum is already better than its current price. Q4 will be the breaking point for this stock.

First-in-class advantage, strong early sales, a huge melanoma market, and a pipeline that expands into larger cancers.

If they execute, this isn’t a 5 percent upside story. It’s potentially several multiples.

This is why I’m long 30K shares.

Risks

Not sugarcoated:

• Manufacturing is complex.

• Treatment is intensive for patients but they are already developing less intensive treatment without the need for Interlukin 2

• Reimbursement must stay strong. Currently have cash till 2027 H1

• Trials outside melanoma can fail. But highly unlikely given its recent data release. It’s incredible

• Volatility is brutal. Shorts have been at this stock with about 35% shorted. However, about 80-90% is owned by Institutions. Big names like Blackrock, GS , etc..

• They’ve diluted before and might again if sales don’t scale fast enough. But this is expected and normal in Biotech

You don’t buy this thinking it’s a safe biotech. You buy it because the upside outweighs the risks. And the upside heavily outweighs the risks

Bottom Line

IOVA has the first approved TIL therapy, real revenue, growing adoption, a pipeline aiming at much bigger cancers, and a valuation priced like it’s dead.

I’m long 30K shares because this is one of the few biotechs where the science, the market, and the timing actually line up.

If they deliver on the next 12–24 months of catalysts, this has legitimate multi-bagger potential. Q4 will be turning point. Get in before the stock rips. It will create generational wealth.

If you want an actual shot at a big biotech move that isn’t complete vapor, this is one of the few worth watching.

https://i.redd.it/0b301g3lcl4g1.jpeg

Posted by supp0rtlife

10 Comments

u/martinshkreli thoughts?

It didn’t take that long to scroll through your post. I’m not buying it

Cancer has been cured like 500 times already, yet people still die of cancer. This is just another 50/50

omg stop pumping this garbage

https://preview.redd.it/gkn14udvkl4g1.png?width=2816&format=png&auto=webp&s=c36187ef59480954b2cb680742ebb8522aabc3fc

Hasn’t even been a year yet and we’re back to pumping IOVA again? r/wallstreetbets losing its touch 😔

my zodiac is cancer so i’m in.

I think today is a black Monday.

Fool me once, shame on. . .actually, fuck you for fooling me last time with this turd company. Worst trade of 2025 for me. Gtfoh.

look we all wish cell therapies worked, but they have all invariably flopped. For one, harvesting TILs from solid tumors is seldom successful (<30%). So there goes the majority of your patient base. I’ve lost hope in all cell therapy approaches, at least for solid tumors.