Lately, everyone seems to be talking about the Santa Claus Rally. I happened to analyze the historical performance of several major indices and stocks during this period while… uh, let's say, "focusing" during a team meeting.

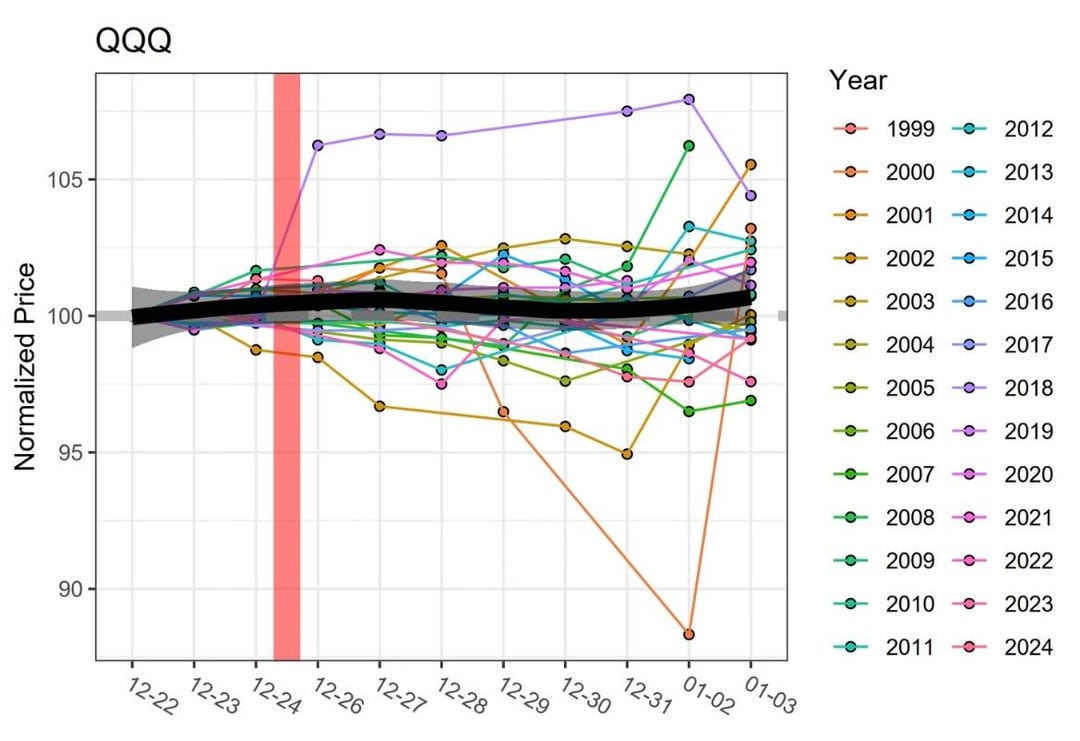

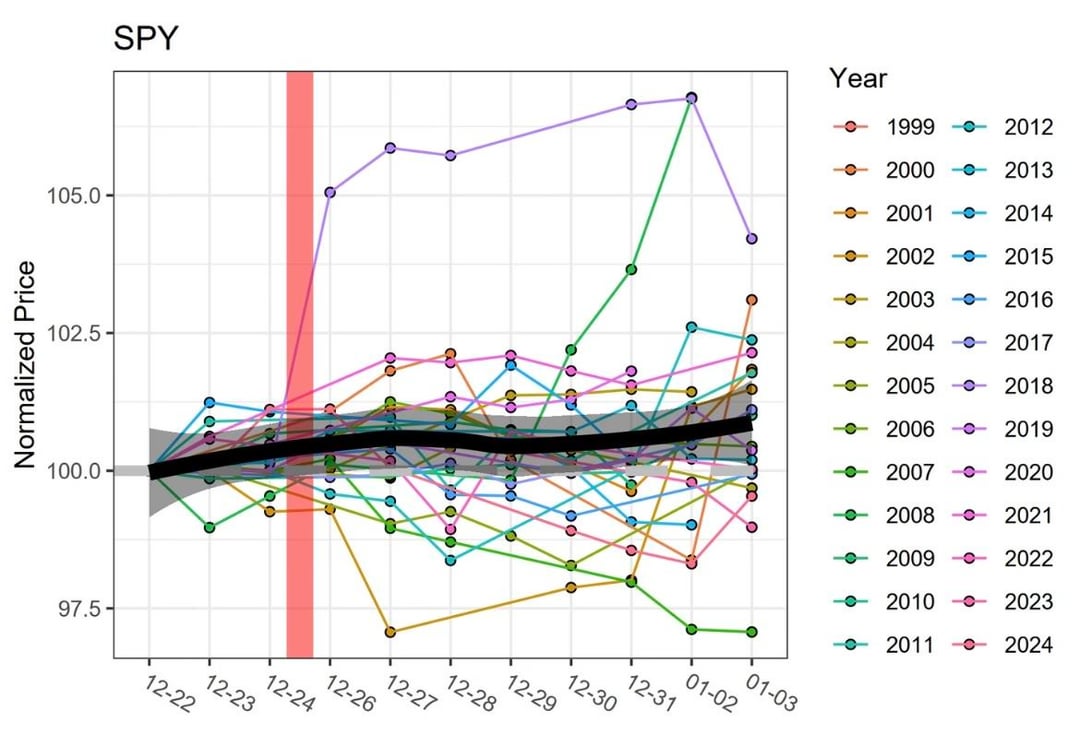

Among the indices, both the S&P 500 and the Nasdaq show a slight upward trend, but it's not a rock-solid guarantee.

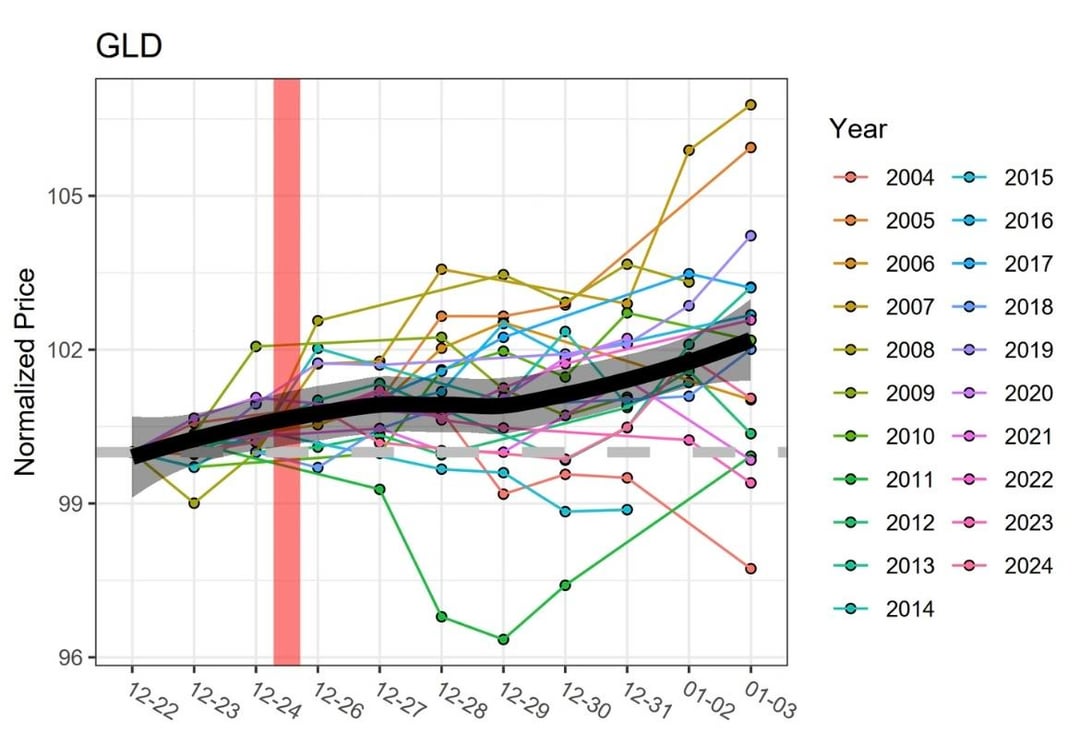

Gold's trend, however, is much more pronounced. On December 26th and 27th specifically, the data shows only two negative years out of many, which almost made me question if there was an error in my code.

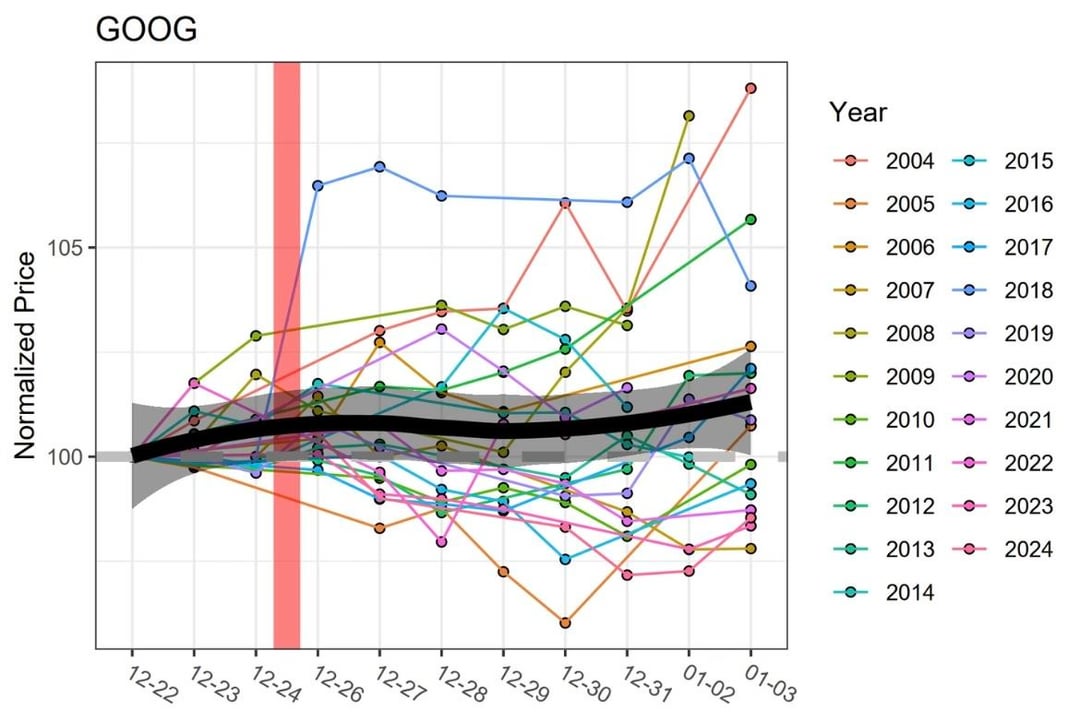

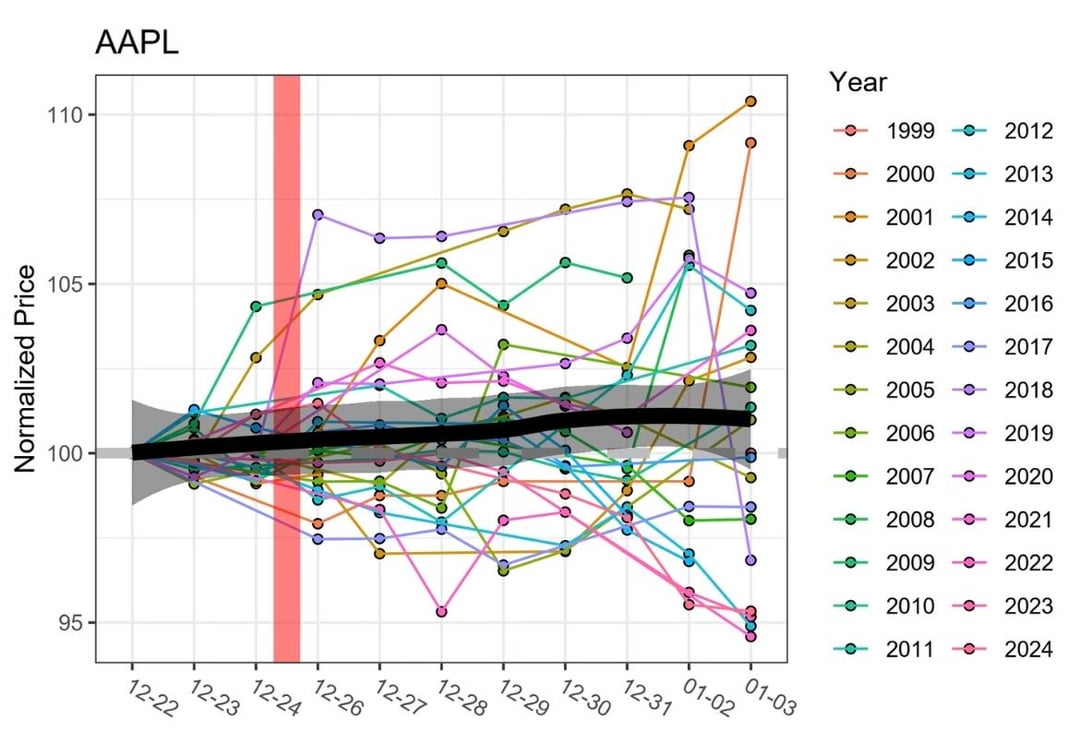

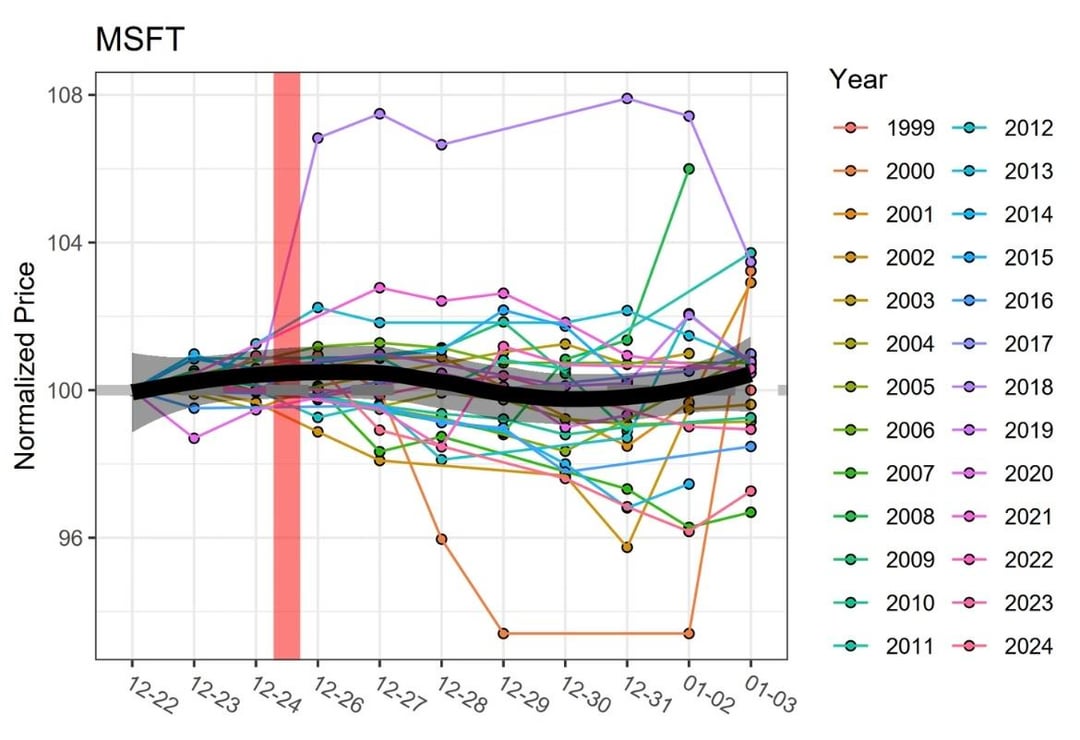

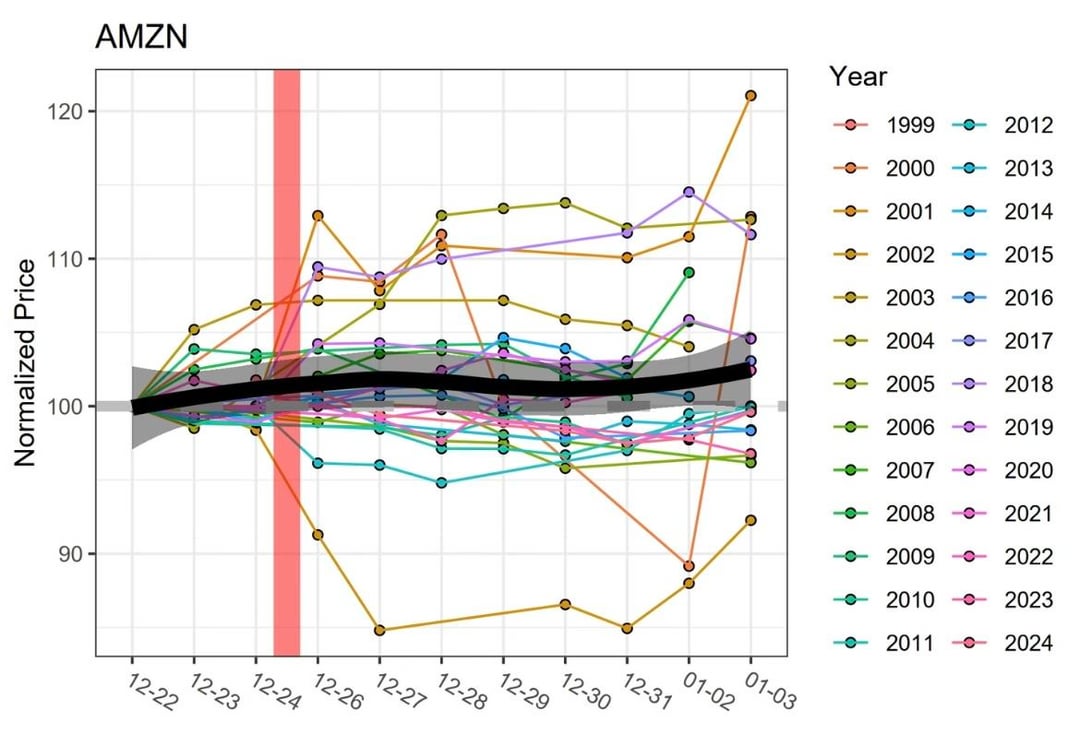

Looking at major stocks like Apple, Google, Microsoft, and Amazon, the overall trend is a modest gain. But it's definitely not the "high-probability money-making machine" some make it out to be—there are still plenty of years that end in losses.

Other potential could be caught up: SNDK, MAAS, HOOD, WDC

Not financial advice…

https://www.reddit.com/gallery/1psxz2g

Posted by North_Reflection1796

5 Comments

Yes, draw as many lines as possible I love it

I think the play was to sell out options banking on December not being a red month. Not really buying calls for a rally.

I really am disappointed I don’t see the term “candle” used here.

Bro how are you even seeing anything with that many lines lol

This is where graphs are a bad idea and it’s easier to just write it in text form for each year.