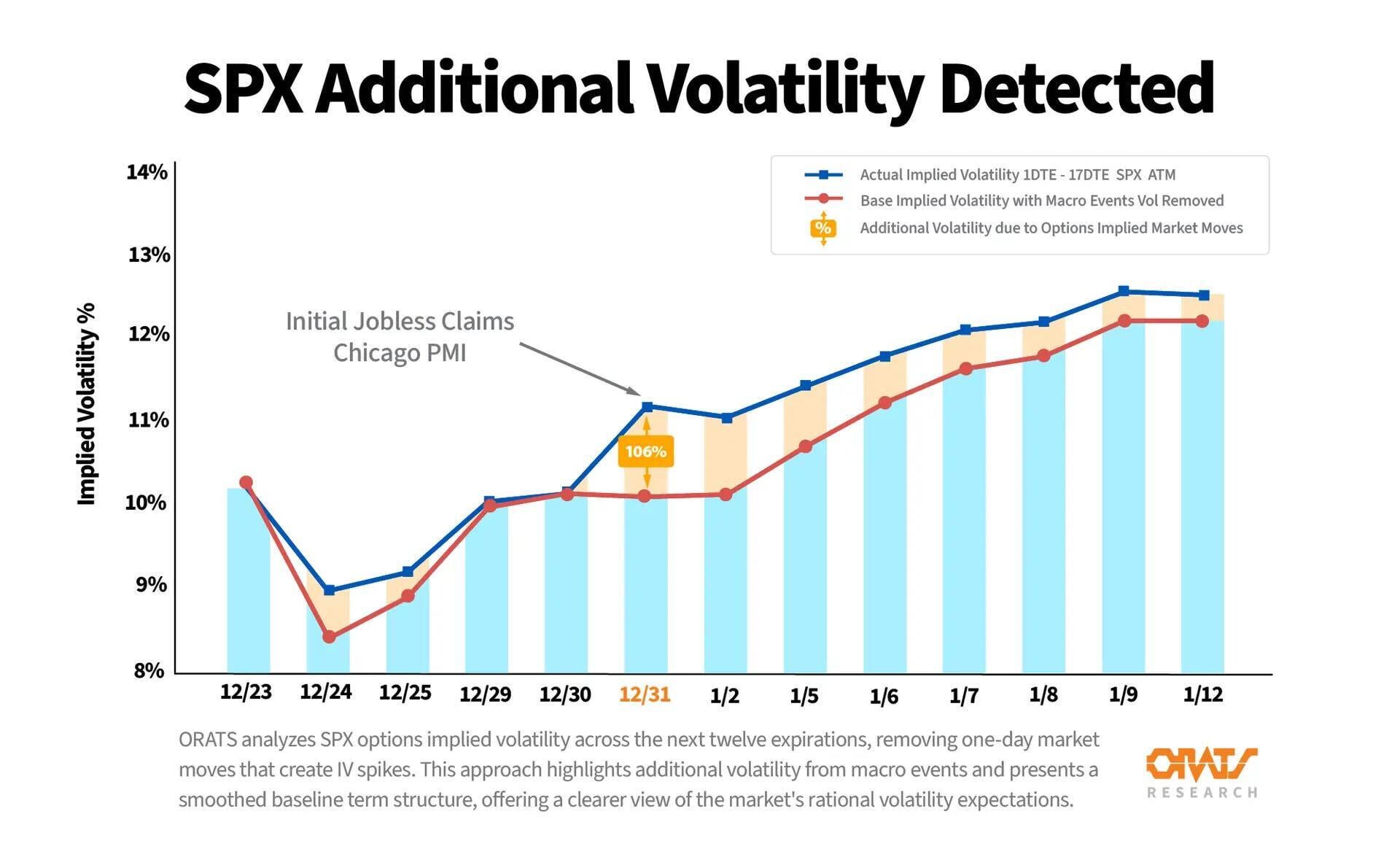

Looking at SPX implied volatility across late December and early January expirations, the surface read appears uneventful. Low-teens implied volatility. Differences measured in only a few tenths of a percent. At first glance, nothing stands out.

When implied volatility is normalized correctly by accounting for time, variance (volatility squared), and non-trading days, a different structure emerges. The market is concentrating multiple days of risk into a single trading session.

That is what is occurring around New Year’s Eve.

Holiday weeks are not simply weeks with fewer trading hours. Liquidity tends to be thinner. Positioning can become more asymmetric. Overnight gaps matter more.

In this case, Wednesday, December 31st also includes multiple high-impact labor releases, including Initial Jobless Claims at 8:30am ET followed by Chicago PMI.

Raw implied volatility rises only modestly into that expiration. However, after adjusting for blended time that includes weekends and holidays, the normalized variance distortion exceeds 100 percent.

In practical terms, the options market is pricing roughly double a normal day’s variance into that single session.

https://i.redd.it/z0fgb6r5e69g1.jpeg

Posted by ORATS_Matt

1 Comment

Why not just show forward implied move for each date? It would be much cleaner