https://img.cryptorank.io/snapshots/c3b3b95f6d700abb4a38e78d.png

Obviously, no one can predict the future. The only thing investors can reasonably do is draw on historical data and past market cycles, while assessing forward-looking fundamentals such as tokenisation, stablecoins, and broader blockchain adoption.

Historically, Ethereum’s price has been heavily influenced by macroeconomic factors, including wars, political instability, pandemics such as COVID-19, tariffs, and periods of heightened uncertainty. Another significant driver is retail participation and media attention. In 2025, a large share of retail and media focus shifted toward AI, which likely diverted capital away from crypto and into AI-related equities and narratives.

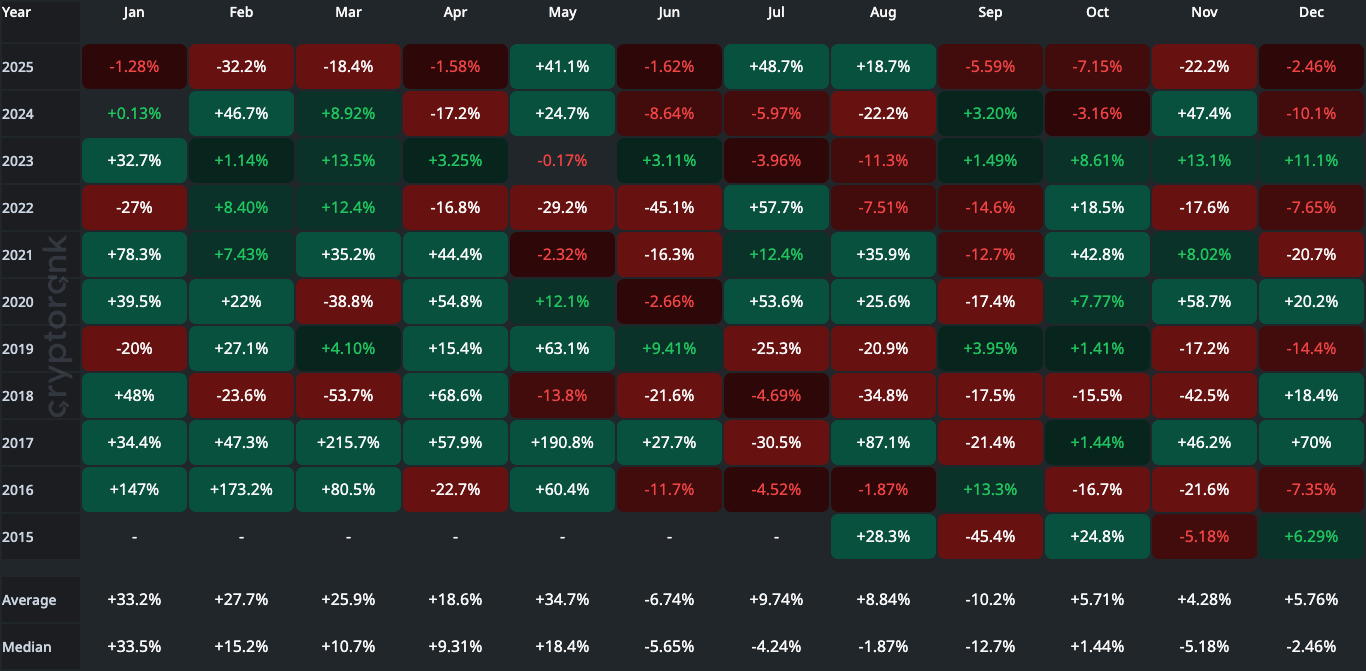

Looking at the data, certain years stand out as particularly weak for Ethereum, notably 2018, 2022, and, so far, 2025. This raises the question of whether Ethereum could extend this pattern of underperformance into 2026.

While my personal opinion is ultimately irrelevant, I remain cautiously optimistic that the early months of the year, particularly January and February, could see more constructive price action because of the following reason. There are several potential catalysts that could support the crypto market, including progress on U.S. crypto market structure legislation in January, the possibility of Federal Reserve rate cuts as inflation eases and new FED chairman. Also, at the beginning of the year, retail usually invests when there is liquidity.

Any thoughts?

Posted by Talento90

2 Comments

Regulations, potential rate cuts, more liquidity.. I think there will be a rebound Q1.

^(!tip 1)

Hope 2026 will be our year

!tip 1