Michael Kitces is a major influencer and educator for financial advisors, especially RIAs (fiduciaries using AUM, hourly, and retainer models) in the GenX and Millennial generations. In this article, the staff at his website, kitces.com, explain the rules for new Trump accounts and ultimately conclude that custodial accounts like UTMAs and UGMAs have better features on balance.

Here is the article: https://www.kitces.com/blog/taxable-accounts-custodial-kiddie-tax-obbba-trump-accounts-one-big-beautiful-act-roth-rmd-529-plan/

At one point, they note the following:

There's already no shortage of ways for parents to save money for their children's benefit, from 529 plans to regular (non-TA) traditional and Roth IRAs to taxable UTMA or UGMA custodial accounts – all of which have their own flavors of tax incentives for various saving purposes. And so, TAs really only make sense as a savings vehicle if they represent an improvement over those other options.

I will add to these alternatives 1) insurance products and 2) simply saving more at the parent level and passing that on or giving it later.

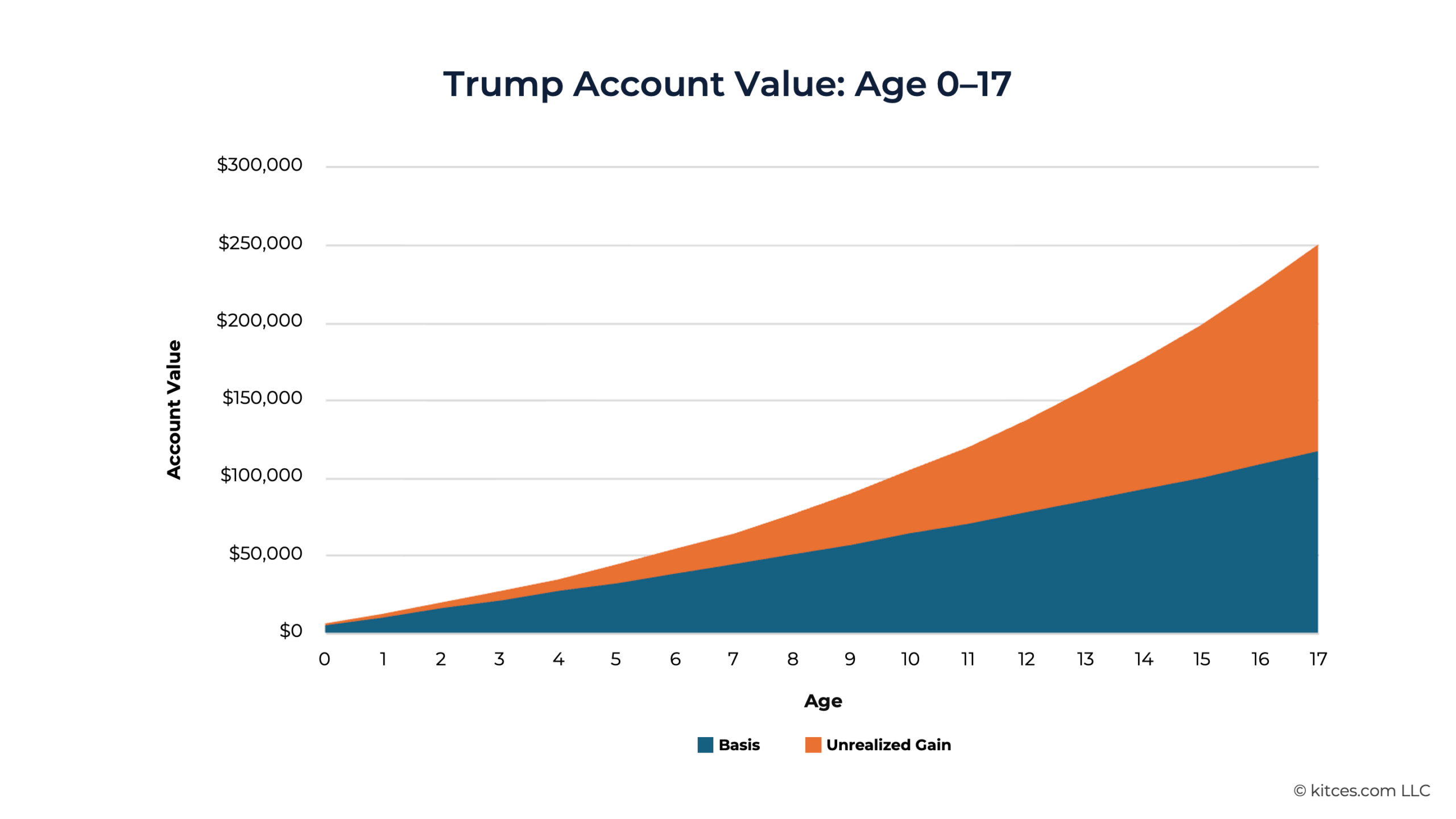

The crux of the argument boils down to the tax treatment of Trump accounts. The primary carrot of the accounts is tax deferral, but family contributions to Trump accounts are made with aftertax dollars, and earnings are ultimately taxed as income, which makes the tax treatment similar to nondeductible IRA contributions or nonqualified annuities. This treatment has severe disadvantages for stock assets, which in a taxable account have minimal tax drag since most earnings are naturally deferred as capital gains that don't have to be realized, and the capital gains can be realized at lower tax rates (including the vaunted 0% LTCG rate!). That makes the Trump account a weak choice from a tax perspective.

The argument at Kitces.com closely mirrors this sub's conclusions reached basically instantaneously before the OBBB ever passed. Nevertheless, it's nice to have our conclusions confirmed by thought leaders in the financial advice industry.

There is one interesting idea they bring up. The experts at the Kitces organization believe the Trump account, as a nuclear mutant step child of IRAs funded by nondeductible contributions, can be converted to Roth IRAs shortly after age 18, but ideally after the child is no longer a dependent on the parents' tax return. That can come with a one-time tax hit for the growth that happened until then, though, which makes it still non-ideal.

Kitces Concludes UTMA Accounts Are Better than Trump Accounts

byu/financeking90 infinancialindependence

Posted by financeking90

3 Comments

I think the title is a bit misleading considering there’s no way an UTMA account beats having a free $1000.

The article itself is talking more from a contribution standpoint and has the caveat that it’s worth opening a Trump account for the free money.

The main benefit of Trump accounts is the matching dollars (edit: comments clarify this is provided unconditionally rather than as a match), which I find baffling. I don’t fully understand the logic of opposing the funding of basic social programs for the working poor, while simultaneously stuffing dollars into a complex financial instrument that will mostly be used by the better-off (relatively speaking).

If you dive into the rabbit hole here, there are competing proposals and reforms to the existing accounts that actually add value. I wish they’d get rid of the vanity naming though.

IRS draft guidance released a couple of months ago allows Trump accounts to be added to employer cafeteria plans. That means that, if added by your employer, the Trump account can allow you to defer Trump Account contributions from your salary. If you can fund a Trump Account with pretax dollars in this way, that means that it becomes essentially the same tax treatment as a traditional (tax-deferred) 401k – making it the best kind of savings vehicle for upper income workers, whose marginal income tax rate may approach 50% while working