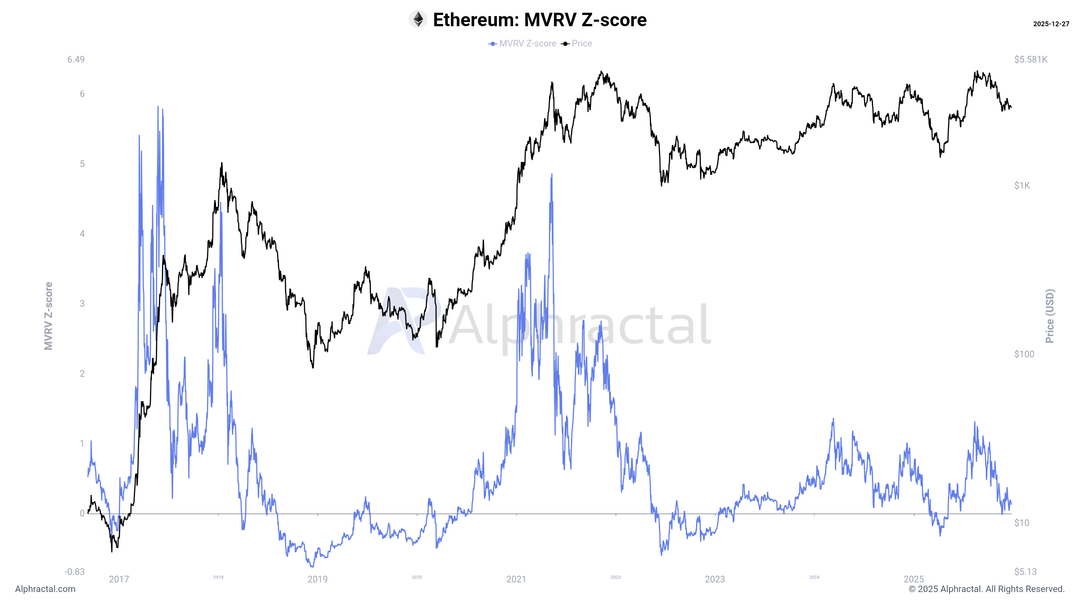

Ethereum’s Last Line of Defense: On-Chain Data Warns of Sub-$2,000 Risk

Ethereum is currently holding onto three critical on-chain support levels. If these supports fail, the probability of ETH revisiting levels below $2,000 increases significantly.

-

MVRV Z-Score indicates that ETH is sitting exactly on its final support zone before a potentially more aggressive downside move. This level must hold — otherwise, downside pressure could accelerate quickly.

-

The Market Cap Growth Rate, which reflects the real expansion of Ethereum’s market capitalization over time, is also testing a crucial structural support. A breakdown here would signal weakening capital inflows.

-

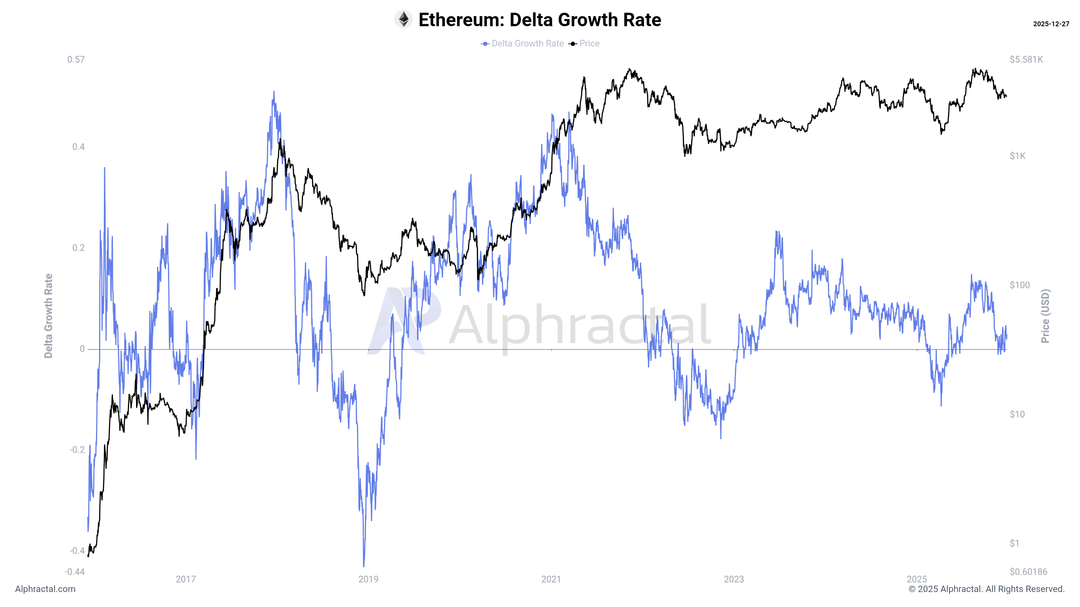

Lastly, the Delta Growth Rate — measuring the divergence between Realized Cap growth and Market Cap growth and generating an on-chain alpha signal — is likewise at support.

A loss of this level would suggest speculative capital exiting the market, increasing the likelihood of a future capitulation phase.

For higher-risk investors, current price levels may still offer a tactical opportunity for exposure. However, from a broader perspective, Ethereum remains in a fragile position.

If these on-chain foundations break, there is a high probability that ETH trades below $2,000, as supply pressure increases against declining demand heading into 2025.

Monitoring remains essential.

Charts: Alphractal

https://www.reddit.com/gallery/1pwx9sx

Posted by joao_wedson