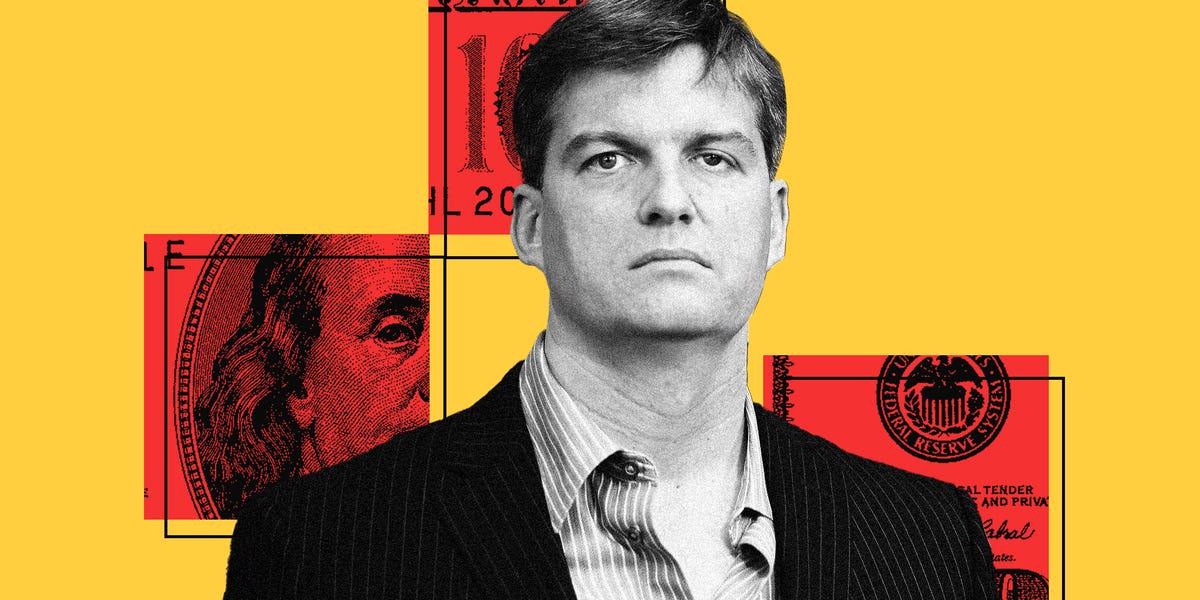

‘Big Short’ investor Michael Burry says markets are missing a trick as the Venezuela raid just ‘changed the game’

https://www.businessinsider.com/big-short-michael-burry-us-venezuela-maduro-oil-energy-china-2026-1?utm_source=reddit&utm_medium=social&utm_campaign=insider-economy-sub-post

Posted by businessinsider

11 Comments

**TLDR:**

* **Michael Burry says markets aren’t pricing in the longer-term impacts of the US raid on Venezuela.**

* **The “Big Short” investor wrote on Substack that the “game just changed” for global energy.**

* **Burry said the US economy stands to benefit while China, Russia, Canada, and Mexico may lose ground.**

Michael Burry bullish? 😰

“He added that Russian oil “just became less important” in the mid to long term, as tapping Venezuelan oil could strengthen the US and “reduce Russia’s income and power.””

Will Swain on YouTube would dispute this. His theory is that the shadow market, which Russian, Iranian, and previously Venezuelan oil was sold on will be routing the shadow fleet of ships back to Russia to move oil. That alone will help Russia. If there is a bump in price of oil as a result that will also certainly help.

India is getting squeezed via threat of higher tariffs to reduce their shadow market oil purchases from Russia, which they get at significant discount. It will be likely they purchase more. How India progresses with Russian oil will be all one needs to know about whether Russia is hurt or aided by the US take over of the V oil industry

>Michael Burry says markets aren’t pricing in the longer-term impacts of the US raid on Venezuela.

The impact people are wondering about is any “quagmire” aspect to this. Iraq and Afghanistan come to mind.

The markets didn”t react to this nor to the “The Best Economic News Ever” that’s been coming out of the BLS for the same reason: Trump creates uncertainty. The man is simply untrustworthy, cannot go 5 seconds without saying something outlandish or false, and therefore everything is in wait and see mode.

The Venezuelan invasion could massivley backfire on the US for several reasons, not least of which the imcompetence and corruption of the people in charge. We can’t say what the long term impacts will be, we’ll just have to wait and see. Just like all this great econ news. Is it real? We don’t know. It’s Trump. We’ll have to wait and see.

Generally people think it’s impossible for there to be any negative blowback from this. We’re so big and mighty and they’re so small amd weak, They forget Afghanistan, Iraq, Somalia, Viet Nam, etc etc etc invasions where the same nonsense logic was applied and disproven, This is not necessarily easy money.

Or is it? We’ll just have to wait and see. It’s Trump.

I think he’s latched on to the main theme that not everyone is directly reporting. This is primarily an eff you to China. They seriously outmaneuvered Trump in the I’ll-advised sanction wars, and he had to get them back somehow.

Burry’s track record speaks for itself when it comes to finding gaps in the market. And if the US secures more reliable energy supply outside OPEC+ influence from this, that’s a giant strategic win. China and Russia losing ground is obvious because Venezuela’s been their geopolitical hedge in the Western hemisphere. If that flips, their energy options tighten and costs rise.

2/3 of current oil production from VZ is sold to China.

TheOrangeBastard is going to end up bullying the wrong country and will soon be in the FO phase.

They didn’t react because nothing in Venezuela has actually changed. The same old regime is still running Venezuela just now with someone else at the top instead of Maduro. The future outlook for Venezuelan oil production hasn’t changed even one iota.

There is no scenario where Trump is going to be able to threaten and bluster his way into the control of an entire country. The apparatus of corruption and grift holding that regime together is a lot stronger and a lot scarier than the 160th

Imagine the impact of an USA under sanctions … championed by Russia and China, with the irony lost on no one. How quickly would the dollar be ejected as the fiat currency?

We are running back to 1860s foreign policy, you know, when the Tzars still ruled Russia?

If Canada and EU decide to pull their money, US is down the drain. Michael is a bit fast to call it, the other players still have to make their move. I can tell you from Europe, the anti-US sentiment has never been stronger and people will be taking their money out of the market.