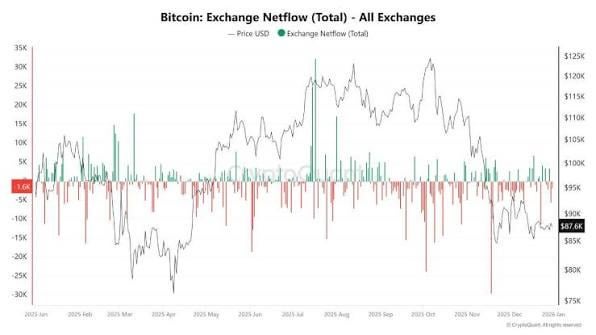

The price action over the last 48 hours is the clearest signal yet that the old rules don't apply anymore. In previous cycles, this level of holiday low volume would have been a playground for whales to liquidat retail. This time, the bid floor didn't move.

Institutional desks are back today, and they aren't here to trade the volatility; they're here to execute mandates. When billions are being allocated as a structural baseline for 2026, the 4-year cycle theory is likely headed for a major reality check.

I’m curious if anyone else is starting to feel that the "big dip" everyone is waiting for is being front-run by players who don't care about a 10% discount when they're buying for the next decade. Or are we all still stuck in the 2021 mindset?

https://i.redd.it/kuj1ag5uelbg1.jpeg

Posted by thecryptoguide13

12 Comments

What ‘big dip’ is ‘everybody’ waiting for?

Straight to a million it is

Thinking the little guy ever held the steering wheel is the ultimate psychological cope.

Lots of big institutional players in the game now and lots of signals that say why BTC will go up or down. I am just HODLING but looking at charts (raw price action only).

I’ve been following this sub and the bitcoin market daily since about 9 years and I agree with this statement. And noticed a switch since about 9-12 months. And considered this possibility since ETF.

Not out of the woods yet. Hold your horses. Retest of 50MA rally very common in early bull. If we pass 50MA without major rejection however…

So….buy bitcoin?

It’s not the death it’s a pause. Retail is broke rn so they don’t have extra funds to buy investments and definitely not enough for memes and alts. Once retail can afford to invest it they will be back.

Not much of a problem if you’re a HODLr

Good riddance – retail are fucking idiots that pump, buy and then sell after dumping.

It’s will hit 50 k before it truly turns around.

That was the dip. When it hit $80k that was the dip that I predicted according to the charts. Idiotic to think it would drop any lower.