I’ve seen a few questions lately about combining income strategies with longer-dated directional bets, so I thought I’d share how I approach it. This isn’t advice, just a description of what I actually do and how it’s played out for me.

At a high level, my core strategy is pretty simple:

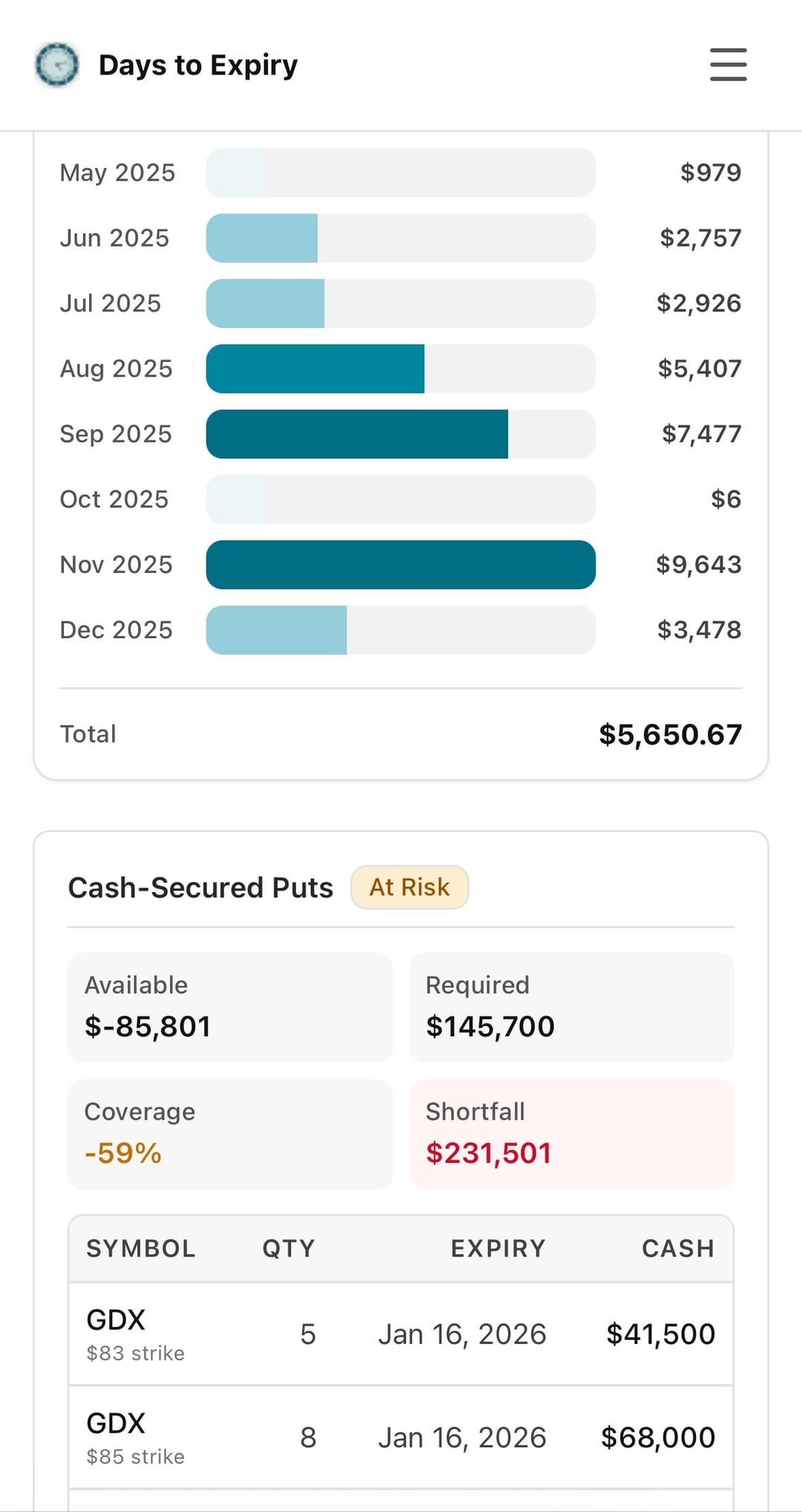

• I run the options wheel (cash-secured puts → covered calls) on liquid names in sectors I’m comfortable owning.

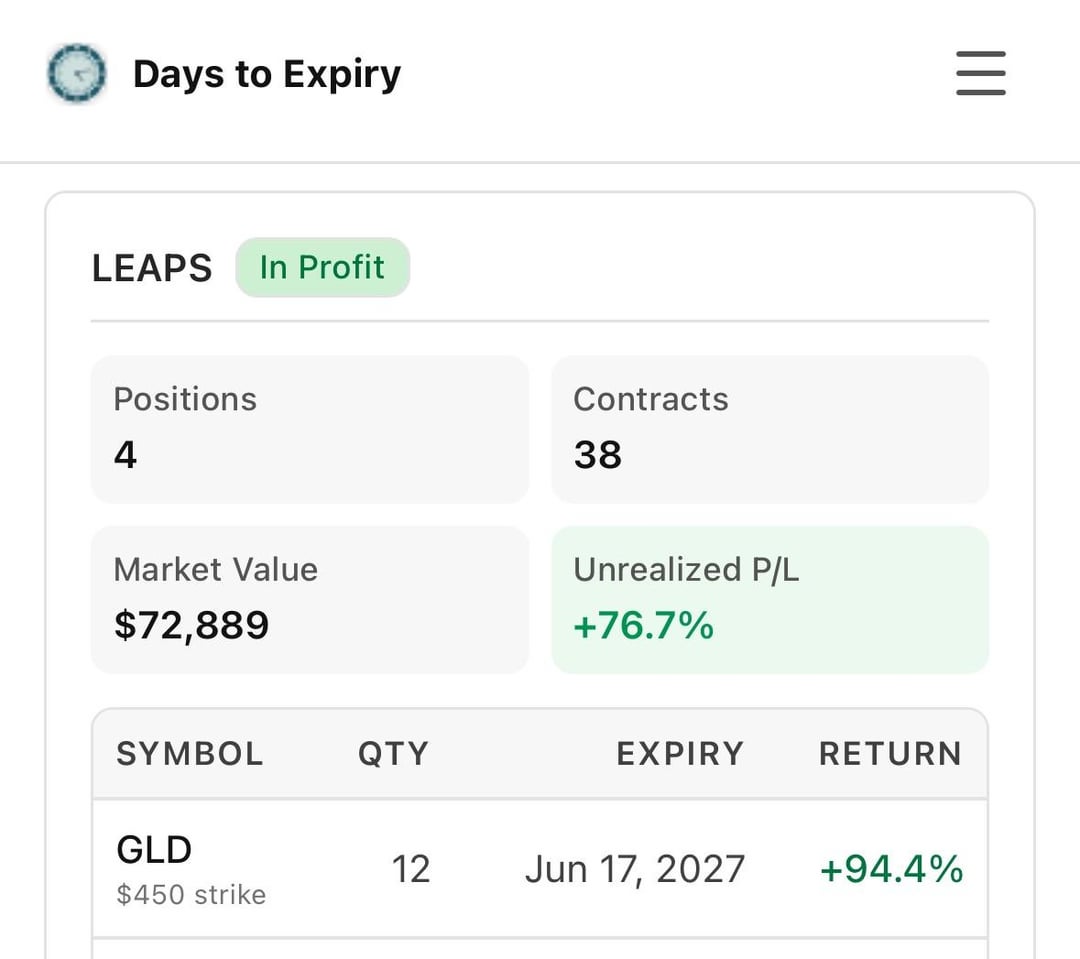

• The cashflow from that activity is used to fund LEAPS in sectors where I believe I have a structural or informational edge.

• I’m patient when markets are flat, and I let positioning add torque when trends finally show up.

Most of the time, this is fairly boring. In years where the broader market is choppy or directionless, the wheel does what it’s supposed to do: generate steady returns while I wait. In those periods, I’ve generally ended up in the ~15–20% range, mostly from premium collection and occasional assignment.

Where things change is when a real trend develops.

In this particular stretch (results attached), I was long natural resources. I’d already spent a long time waiting while positioning stayed cheap and sentiment was poor. During that phase, I was mostly just running the wheel and not pressing much on the long side.

Once the trend started to assert itself, the LEAPS began to matter more. Because they were funded gradually from option income rather than upfront capital, I was comfortable holding through volatility and adding selectively. That’s when returns accelerated — not because of frequent trading, but because the convexity finally showed up.

A few things that are probably worth emphasizing:

• This isn’t about constant action. There are long stretches of very little happening.

• The wheel is not the alpha engine; it’s the funding mechanism.

• The LEAPS only work because they’re in areas where I’m willing to be early and wrong for a while.

• Most of the performance comes in relatively short windows after long periods of waiting.

I’m very aware that this kind of approach won’t work every year, and it relies heavily on staying within sectors you actually understand and can sit with when they’re unpopular.

Happy to answer questions or hear how others are structuring similar setups — especially around managing patience (and drawdowns!!) during the flat years.

https://www.reddit.com/gallery/1q6b2z7

Posted by emotionally_rational