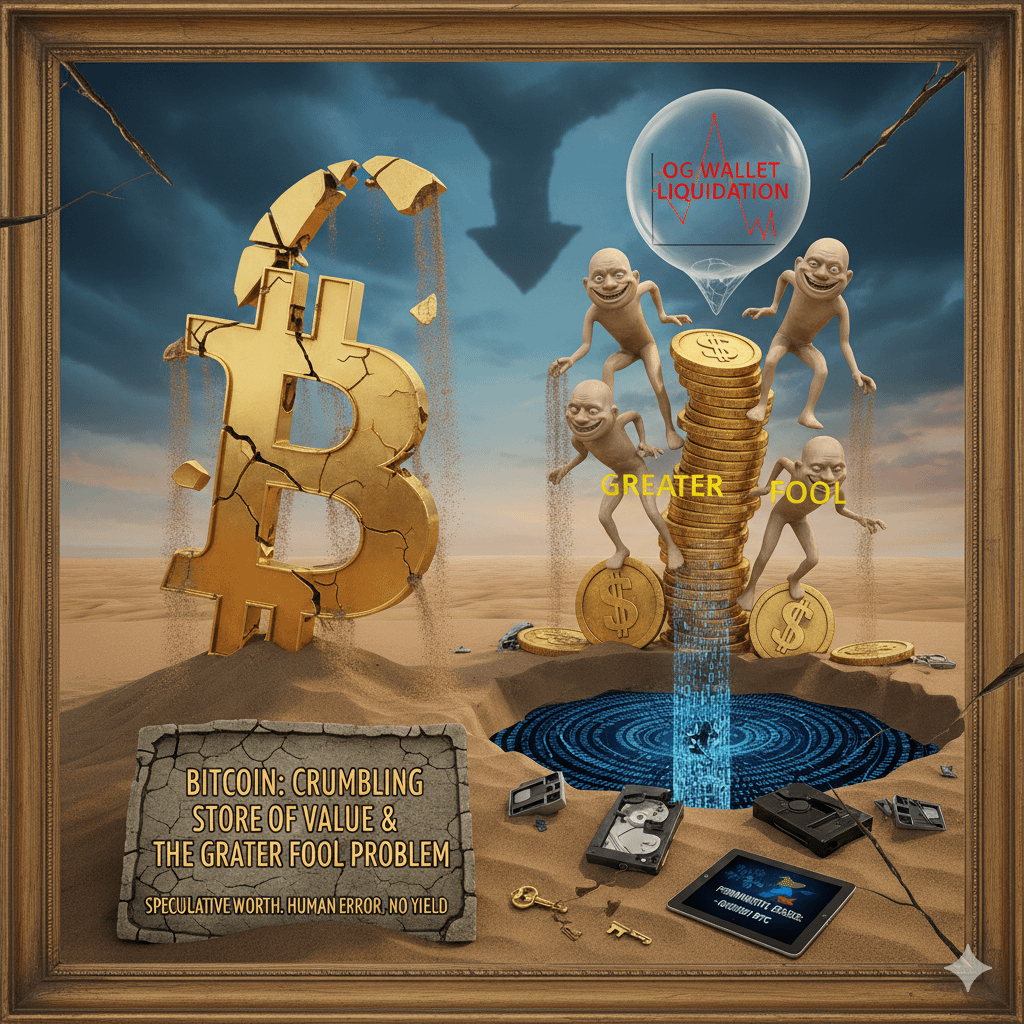

Bitcoin’s Crumbling Store of Value and the Greater Fool Problem

Bitcoin, hailed as “digital gold” for its fixed 21M supply, is a flawed store of value. Its worth is speculative, hinging on the belief a “greater fool” will pay more. Profit requires selling, leaving holders at arbitrary tops—like the recent OG wallet liquidation—exposing lack of objective valuation, psychological fragility, and dependence on endless fools. Scarcity is undermined by human error: lost keys or mistaken transactions permanently erase coins, weakening reliability. A true SoV must resist destruction, not crumble with attrition. Bitcoin’s design—slow finality, unrecoverable loss, no yield—makes it neither a practical currency nor dependable SoV.

https://i.redd.it/cw94k7xshzbg1.png

Posted by Salt_Yak_3866

1 Comment

No yield? Proves you aren’t creative bc saylor is getting yield on btc