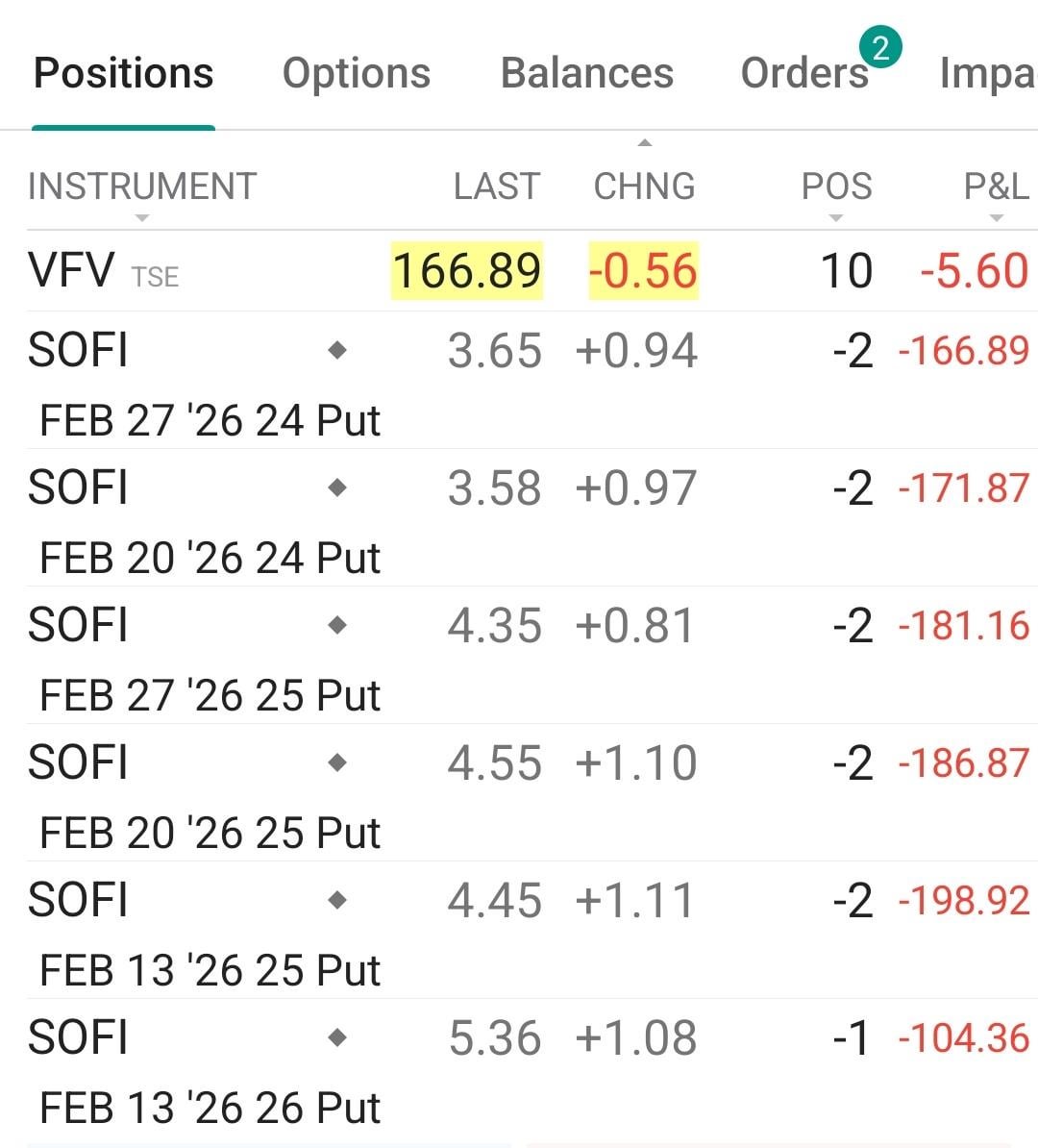

Im in a bad position with cash secured puts on sofi bought last month. Have 11 contracts averaging $25 and some are due next week , some the week after. Not sure if i should just sell and take a big loss almost $4k or wait it out till next week to see what happens knowing i might have a bigger loss. Rolling doesnt seem to yield any credit not even for $24s after 2 or 3 months. Big pickle and dont really know best strategy to get out. Any insight from the seasoned option traders would be really helpful.

https://i.redd.it/uphi99yuskhg1.jpeg

Posted by South-Specific-9897

2 Comments

Me too bro. Me too…

SOFI is a solid long term stock for me. I’m not sure how big your account is, but this is probably one of those stocks you won’t mind owning 5-10 years from now.