I understand that the level of competition is a downside. I also understand that PYPL has been strongly bearish since 2021. However, there is a lot of potential here. Here is a quick summary:

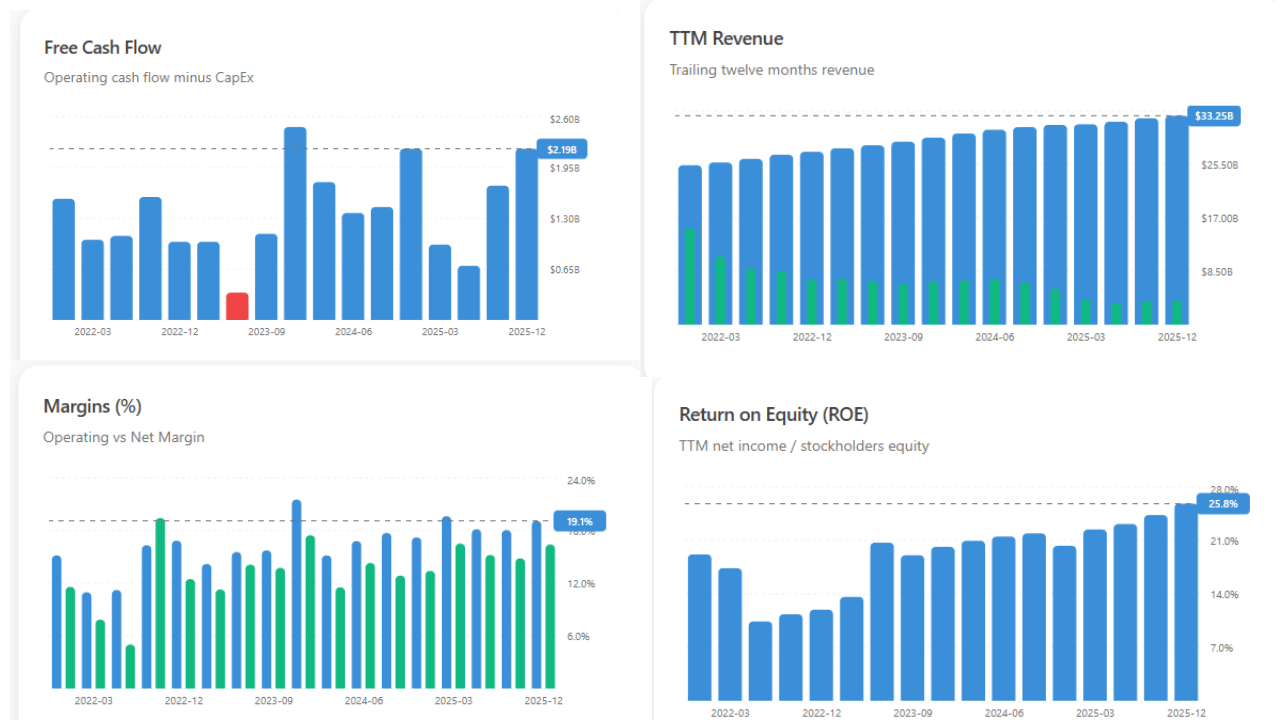

Revenue increasing YOY ✔

Gross profit increasing YOY ✔

Net profit increasing YOY ✔

Health acid-test ratio ✔

The company has plenty of cash and is not drowning in debt. It pays a regular dividend and has a global customer base.

Despite the good financials, the current CEO is stepping down as the company 'is not where it needs to be'. The new CEO, Enrique Lores, takes office on 1 March, 2026. New CEO's are a gamble. They can drive stock prices lower, but they can also turn things around.

The concern with buying PayPal is that it's a value trap, i.e. it seems like a bargain, but the company has no growth potential. It becomes stagnant, or its financials even start declining. I get it. But, is it worth $40 per share? I think so. Prices are back to where they started in 2015.

From a technical view, buying PayPal at any level since 2021 would have resulted in significant losses. The stock has fallen another 50% since the summer of 2025! So, I'm hesitant.

I'm cautious, for good reasons, but interested to see where the price goes from here. I'm interested to see if $40 is a bottom or just another level which breaks and the price moves lower.

https://i.redd.it/8ogsjq7qjekg1.png

Posted by samuel_morton_trader

15 Comments

Hell no

Gayyyy

Not while net income is declining. Not being able to guide for a certain increase in EPS for 2026 with 6bn buybacks on a 38bn market cap means they expect further declining net income and revenue going forward.

nope

It’s kind of a meme at this point

If you were here in 2021, 2022, as Paypal dropped from $300 to below $100, there would be a post every other day about how Paypal was the biggest bargain in tech and any quarter now about to head back over $100, $150, etc.

Didn’t work out so well then.

Paypal is a no brainer value buy at these levels. But it might stall in price so the best thing to do is long + short straddle at least half a year out. You make most of the money when the price is flat or slightly rising. If it falls then just accept delivery at expiration which’ll increase your stake but at even lower prices

You forgot buying back stock with all that cash

15 dec 2028 50C LEAPS… just in case

Competition is brutal in their sector, they are competing against Apple pay, google pay, zelle, etc.

Lamentablemente, los jóvenes no lo usan y en vez de haber sabido proteger su ‘most’ y aumentarlo hacia pagos nfc, wallets, pagos con móviles,…se quedó estancado y no creo que vuelva a resurgir, tarde.

Need someone with grandparent’s inheritance to buy the stock and post it on fb and reddit. Need a good narrative to create a positive sentiment.

Look at the product.. hell no

I’ve considered it three years ago but suddenly unconsidered it after losing 15% of my money in a few weeks (on shares)

I don’t have anyone in my circle using it. It’s over for paypal