So far we’ve been hearing “AI Bubble” “Software Bubble” “CapEx Bubble” fear mongering stories from the media like a clockwork along with youtubers, other content creators and everbody’s Nana (Micheal burry) parroting and exacerbating them. “Great rotation into the safety” recently came along.

As a result, Google lost 15%, Microsoft – 30%, Oracle – 60%, Meta – 25%. All while SPX and DJI sit at ATH, and chips with your boomer “defensives” are making new highs.

All that got me thinking whether these “defensives” are truly “safety” or is it another trick by larger forces to lure retail into bagholding said “defensives” while buying tech at dirt cheap prices.

Let’s compare valuation of the S&P 500 Technology sector vs every other sector excluding Financials.

|S&P 500 Sector|Forward P/E (Feb 2026)|Premium to 10-Yr Avg|Observation

|:–|:–|:–|:–

|Real Estate|32|Significant|Highly elevated, highest sector P/E

|Consumer Staples|24|Highest since 1998|Trading as Tech

|Industrials|26|+32%|Trading well above long-term norms

|Energy|19|+36%|Largest jump relative to its 10-year average

|Consumer Discretionary|28|+12%|High multiple despite potential economic cooling

|Tech|25|+5%|Surprisingly close to its historical average

Based on the raw data, tell me that the "Safety Bubble" is not real. Historically, Tech trades at a significant premium to every other sector because software scales faster than traditional businesses. As of February 2026, that relationship has completely flipped.

Waste Management trades at 33 P/E. Are we expected to produce 3x garbage than usual this year?

Costco trades at 49 P/E, Walmart at 44 P/E. Are we expected to buy 3x of only premium top-margin groceries this year?

Caterpillar trades at 33 P/E while showing four consecutive quarters of negative income growth.

McDonalds trades at 26 P/E. Have they replaced all “you rule!” retards with AGI quantum-powered cyborgs with telekinesis and teleportation abilities?

At the same time Microsoft trades at 23 P/E, Google at 26 P/E, Oracle at 20 P/E, Meta at 21 P/E. All collectively still going south.

CapEx? All regards, institutions, analysts and their Nana (Micheal burry) must be praising hyperscalers and tech for huge ever-increasing capital investments as they fuel our economic growth and GDP, it’s what creates jobs and pays for your food and everything. It’s the only thing that effectively pulled us out of recession. If not for them, the money printed by Fed would just disappear in the bankers pockets and hit everybody with much more severe inflation.

Enough rant for tonight, “defensive” trade has become extremely crowded and valuations got overstretched as your wife’s boyfriend’s dong. **The Great Tech Rotation** is the next trade.

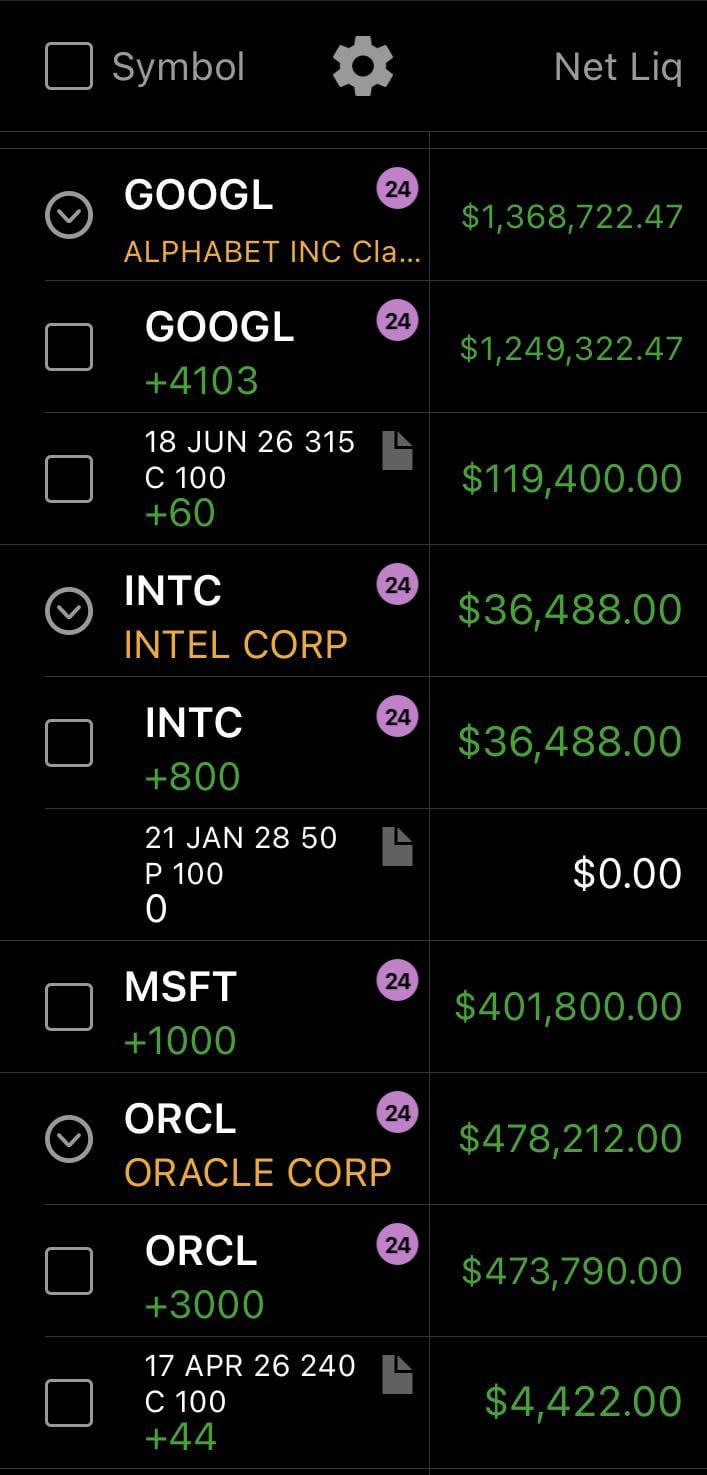

https://i.redd.it/938ncsu4rekg1.jpeg

Posted by g3tr1ghttt

8 Comments

I can’t read. Calls on MSFT/AMZN?

Wait, why are his numbers green? I thought they only come in red?

who let the bagholder out of the cage??

I don’t get why you bought oracle.

Why you so rich?

Can I invest in tech but with your monies just in case

I’m completely in agreement. This isn’t a proper sector rotation imo, it’s temporary refuge. We didn’t have big earnings misses, didn’t have major negative catalysts, etc. We had a noisy short term macro environment, a higher than expected capex shock, and a technical cascade that’s led tech giants to sit firmly in oversold territory. If SPY had dropped significantly, I’d think we were moving to a longer term defensive positioning – we’d see the money flow not just into defensive stocks but other safe haven asset classes.

It could unwind quickly from here, or it could consolidate into a drawdown – but I’m heavily betting against an equity drawdown. We’ve got NVDA earnings coming up, PCE figures, and a potential Supreme Court tariff decision. You’ve got earnings calls still to come for the likes of WMT, COST, etc – the stocks that the money has shifted to and are now very overcrowded. Earnings could give liquidity for an exit for institutions, as well as a potential “sell the news” effect regardless of results. Once that starts unwinding, and the opportunity to buy into the hyperscalers at exceptionally low P/Es (and with potential for massive growth over the next few years) starts to disappear, we could see a flood re-entering. If we get a cool PCE, it’s hard to see how this doesn’t play out.

Oracle is a bad move though. Shits fucked.

https://preview.redd.it/3e26jvmyuekg1.png?width=1080&format=png&auto=webp&s=b0d861b3739ccd55705289a3b7b4243b4e4214aa