Here's a writeup for the newbies:

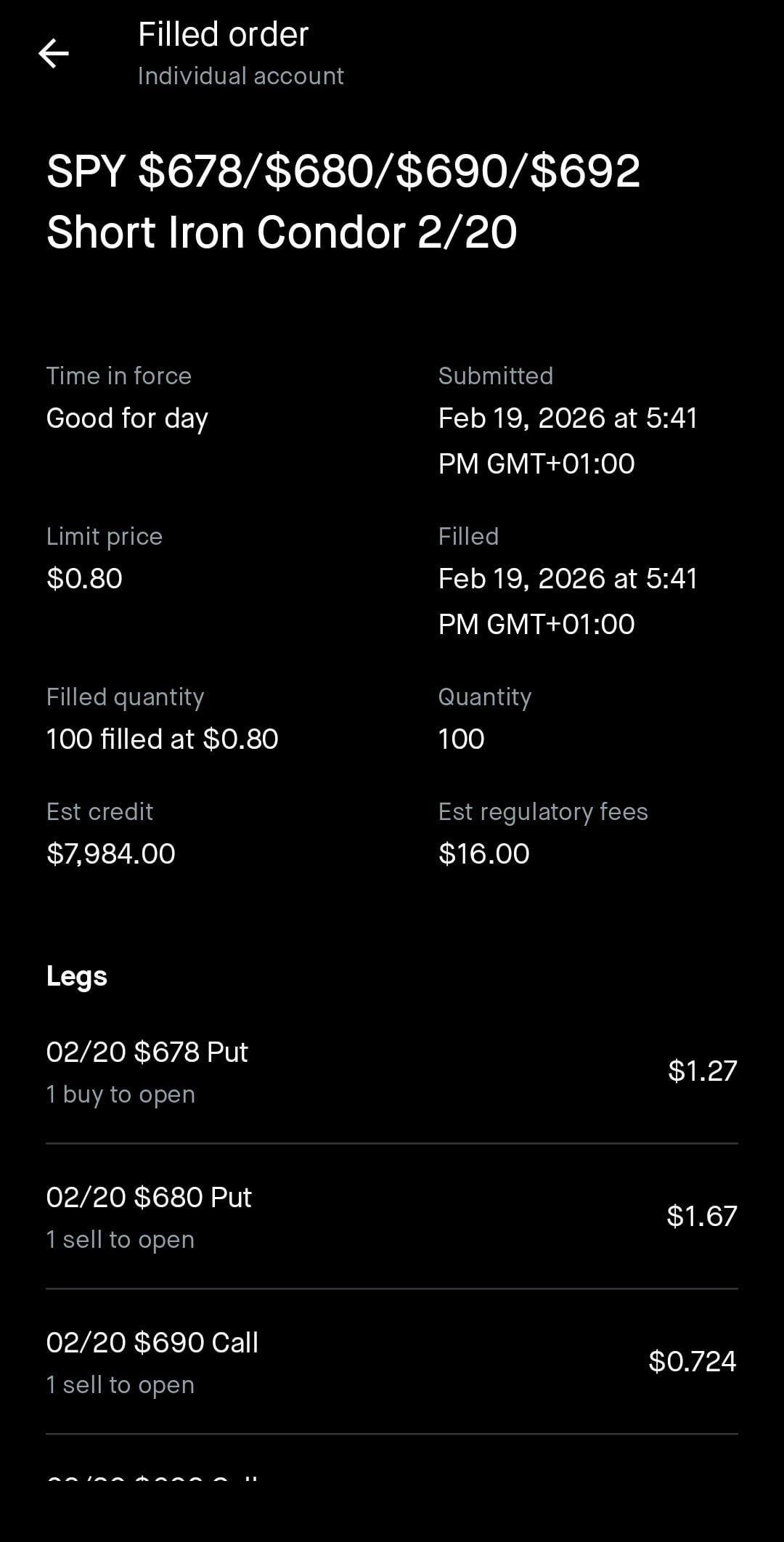

A Iron Condor is a nickname for a an options strategy that profits when a stocks price stays within a predicted range.

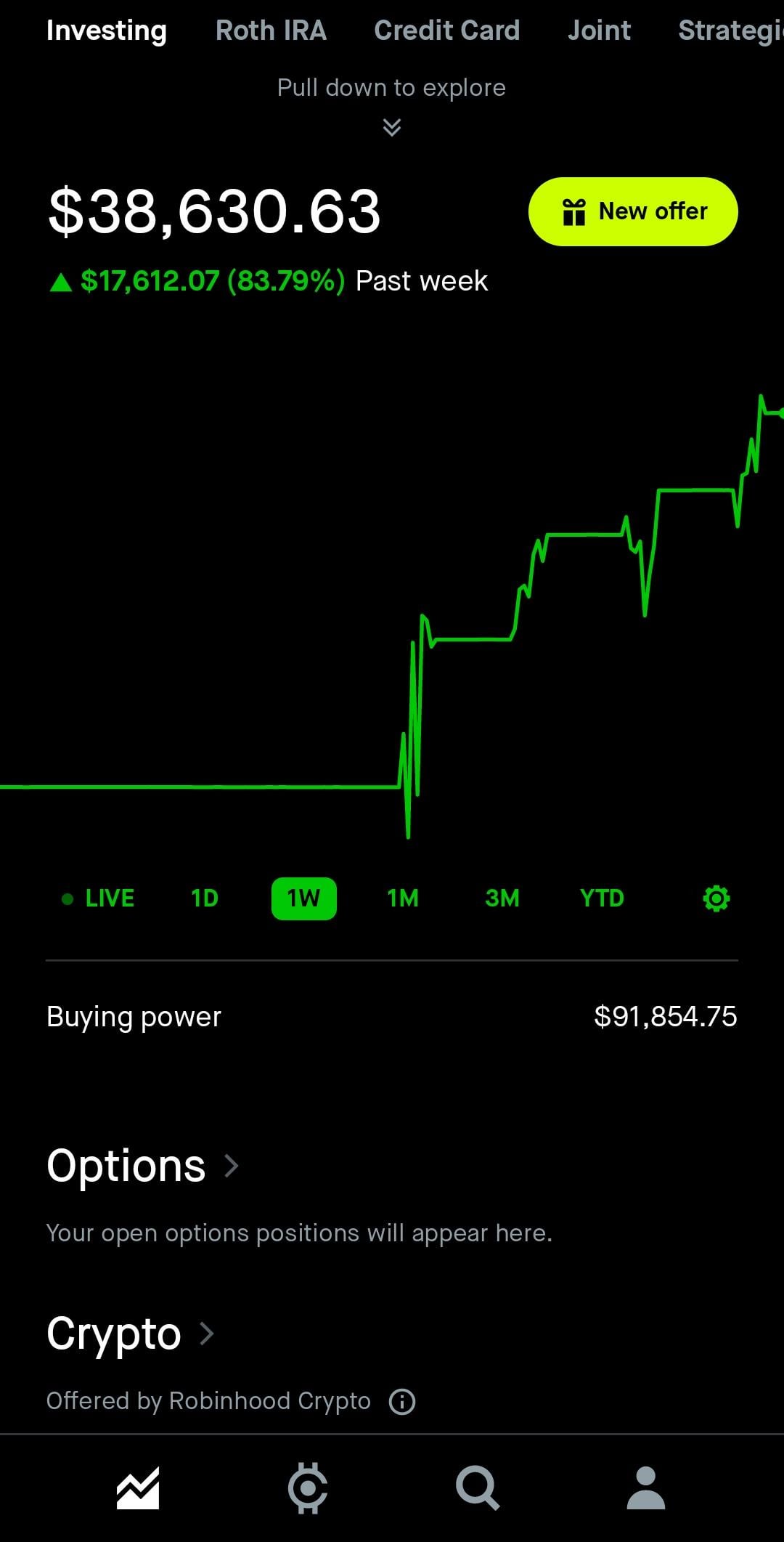

Yesterday I sold 100x iron condors for $7,984 total credit after fees, expiring today, gambling that SPY would stay between 679.20 and 690.80. If SPY went past 678 or 692, my max loss would be $12, 000.

Shared wisdom dictates that it is foolish to hold ICs until expiration. Theta decay is rapid in the first hour of the day of expiration, and buying back at 50% of the price is far smarter then letting the gamma risk from some last minute headline ruin your day.

Fortunately, I don't know what gamma is, so I let these babies ride to close. Call spread was bought back for 0.09 each, and put spread expired worthless.

My lucky week. Even with the tariff decision and Trump making noise about Iran, SPY fucked the dog and hung around 685 all week. That kind of volatility is great for scalping with short term SPY options. You toss a coin on buying puts or calls at the money, and if it goes the wrong way you double down again and again until you're back in the green, but now your profit is even higher! Works great until it doesn't and you lose it all.

https://www.reddit.com/gallery/1rado0f

Posted by smohyee

13 Comments

Strong work retard

Lame. I just bought calls everyday and sold after they increased. 133% week here.

I can’t believe you’d do this on opex lol

This made me litterally laugh out loud, I’m reading this thinking hmm this is correct advice but how did he print so much and then got to the “fortunately, I don’t know what gamma is” this is funny. You had me in the first half, do not get in the habit of printing near 100% on IC. Good work, but your girl a nice dinner and get laid because clearly you were trying to get fucked the market

https://preview.redd.it/uoy3kczb2rkg1.png?width=1170&format=png&auto=webp&s=e27319858a51c05bf4b26f033aa8d8d8751fd392

>1DTE iron condor

This is the kind of shit that I come here to see. Now it’s probably just a matter of time til we have a 0DTE iron condor etf

So you’re posting a gain for absorbing a contract’s remaining theta juice of <1%? bruh

I’m retarded someone explain how this worked

first person i seen to ever make this kind of profit on an iron condor lol

Just use spx dude

Hope everyone read to that last line 😂

Congratulations on risking 20K on a 40k account. Your daddy, if he didn’t go for a cigarette break, would be really proud of you.

This one might know what he’s doing let’s see if he loses it all next week on “is he retarded or nah”

You tellin me a spy ironed these condors?