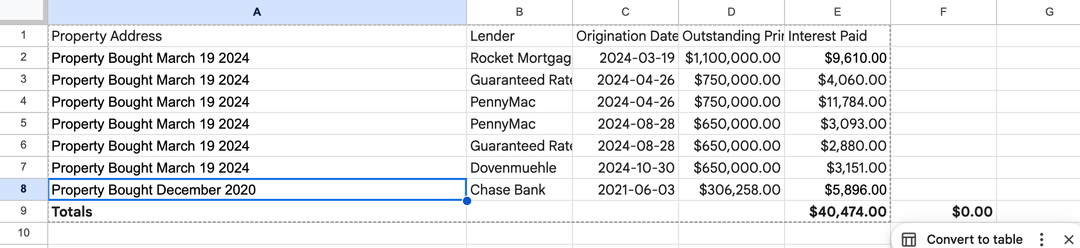

I am responding to CP28 notice regarding my 2024 Federal Tax Return. I have two qualified homes:

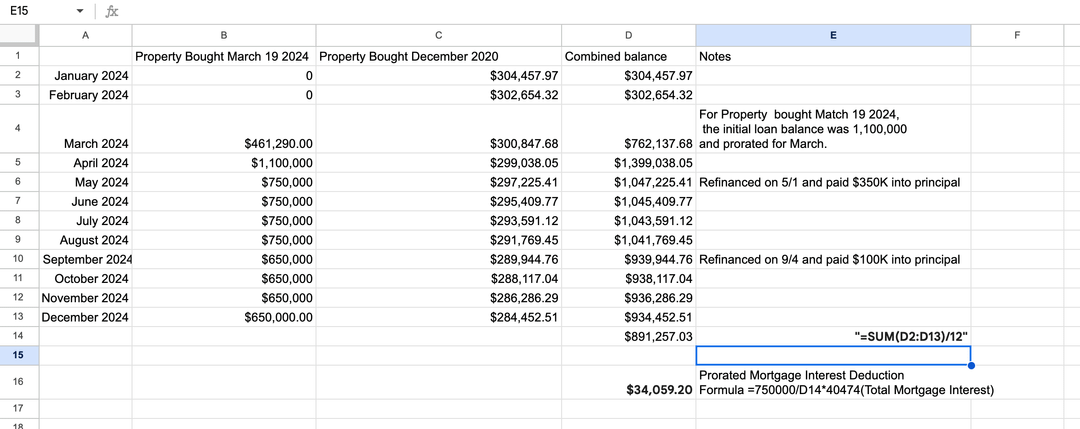

Property A(purchased December 2020) and Property B(purchased March 19, 2024). My total mortgage interest paid was $40,470, but because my combined mortgage debt exceeded $750,000, I am recalculating my deductible interest using the Average Balance Method from IRS Publication 936. I am seeking clarification on whether the average balance for Property B should be pro-rated for the partial year of ownership (starting March 19) to ensure my final deduction is accurate

Can some one help me validate my average balance calculations in the image attached?

https://www.reddit.com/gallery/1psf3cn

Posted by Ok-Seaworthiness8619

1 Comment

You can’t use the average balance method because you borrowed during the year.

**Average of first and last balance method.**

You can use this method if all the following apply.

* You didn’t borrow any new amounts on the mortgage during the year. (This doesn’t include borrowing the original mortgage amount.)

[https://www.irs.gov/publications/p936#en_US_2025_publink1000230028](https://www.irs.gov/publications/p936#en_US_2025_publink1000230028)

You need to use the “statements method” which is pretty similar, but on a month by month basis

Also in March, you use the opening balance of your mortgage as the beginning, not zero.